Weekly Update | 14th April 2025

1. Trump backflips and tariffs then backflips on a backflip

The tit for tat global trade war continued over the week, with the US imposing tariffs on China, China retaliated, the US retaliated further, then China retaliated further once again. Trump then announced a delay to the implementation, which drove markets higher. Over the weekend, there was news out some components would be excluded, but then this morning Trump came out and said that not everything would be. So all in all, a messy week of binary news headlines.

2. RBNZ cuts the Official Cash Rate to 3.50%

The Reserve Bank’s Monetary Policy Committee reduced the OCR by 0.25%, taking it to 3.5%. Inflation remains well-anchored near the 2% midpoint of the 1–3% target band, and both market expectations and core inflation indicators suggest stability ahead. Economic activity is broadly in line with February forecasts, which will mean the RBNZ can continue with a measured and supportive stance moving forward.

3. Chinese CPI declines by -0.1% vs 0.0% expected

Consumer prices in China slid -0.1% year on year in March, which remains in deflationary territory. Economists polled by Reuters had expected a flat reading compared to the same period last year. This data continues to suggest that we will see mixed data points, as they attempt to support their economy.

4. US CPI rises 0.1% m/m however misses expectations of 0.3%

Core US CPI rose 0.1% on a m/m basis, however the broader reading declined by -0.1%. Energy fell -2.4%, while gasoline dropped -6.3%. On the other hand, electricity and natural gas prices rose to offset these declines. Markets viewed this data somewhat neutrally. The risk of deflation is evident, and markets continue to focus on the likelihood that US growth may slow over the upcoming months.

5. US Core PPI m/m contracts by -0.1% m/m

Input prices in the US declined by -0.1% m/m, around 70% of this decline was due to final price demand. Although positive to see input costs come down in the US, most participants are worried that these declines may flow through to stagflation or deflation, however the Trump tariff news has added question marks around this as tariffs would generally be inflationary.

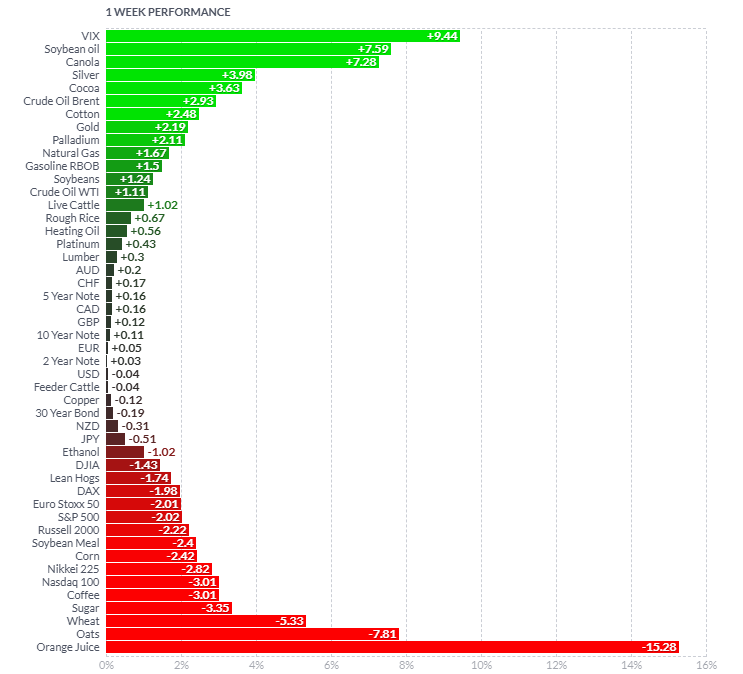

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Last week continued to be volatile as most markets reversed after Trump delayed the implementation of some tariffs. There was constant news flow which continued to be very contradictory at times. Commodities generally rebounded after the initial shock of the tariff news. Orange Juice, Copper, Gold and Silver were the best performers rising +23.07%, +9.14%, +8.97% and +8.28% respectively. Equity markets rebounded well, with the Nasdaq the best performer, they rose +8.58%. On the downside, 30 year US bonds declined by -3.88%, which some thought was a catalyst for some of the downside volatility seen in equity markets.

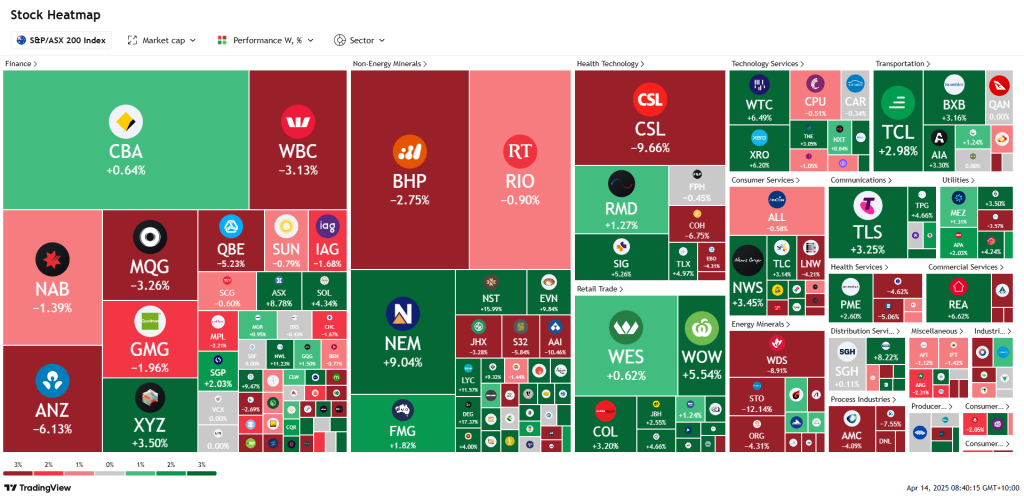

Here is the week’s heatmap for the largest companies in the ASX.

The Australian market has continued to swing all over the place with pockets doing exceptionally well, while others dragging. Financials had a mixed week, with WBC, NAB and ANZ the laggards. ANZ the worst, as they declined by -6.13%. Materials continued to be very mixed. FMG had a reasonable week +1.82%, while RIO and BHP dragged as they dropped -0.90% and -2.75%. CSL continued to underperform, as the US launched tariffs on non-US pharma companies, they declined by -9.66%. Australian tech rebounded slightly, with WTC +6.49% and XRO +6.20%, bouncing back. Other than that it was a volatile week as tariff headlines remain the focus.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.