Weekly Update | 29th April 2025

1. Euro area manufacturing PMI’s continue to contract

A raft of Eurozone PMI data continued to show a contraction, with all of the readings sub 50. There weren’t really any bright spots on this data release, as the vast majority were between 48-49 (contractions). Also based on the prior figures, they were all static on a m/m basis, which possibly confirms the current wait and see stance from the ECB.

2. US Global PMI Composite Output Index fell to 51.2 vs previous reading of 53.5

The fall in the index signaled a deceleration of activity growth. It hit a 16-month low, quite the opposite to what was seen last month, which was a three-month high. This data release demonstrates that there was a direct impact to confidence and output as the Tariff news accelerated.

3. US New Home sales rise to 724K vs 684K expected

In March 2025, sales of new single-family homes rose to a seasonally adjusted annual rate of 724,000, up 7.4% from February and 6.0% higher than a year ago. This growth signals continued strength in the housing market, which suggests consumer confidence remains solid and supportive of a positive outlook for the broader U.S. economy.

4. US Unemployment Claims steady at 222K

For the week ending April 19, initial jobless claims rose by 6K to 222K, with the prior week revised up to 216K. The four-week moving average dipped slightly to 220.2K. Despite small fluctuations, claims remain low by historical standards, which indicates a resilient labour market, which supports a steady, if cautious, outlook for continued U.S. economic growth.

5. Tariff news continues to contradict

At the start of the week, there was optimism as a trade deal between the US and China was being discussed between the two nations. News then broke that these conversations had never been had. This back and forth over the course of week continued, with markets becoming more and more insensitive to any news regarding Tariffs. Tariff fatigue. Equity markets had a very solid week, which tells you all you need to know.

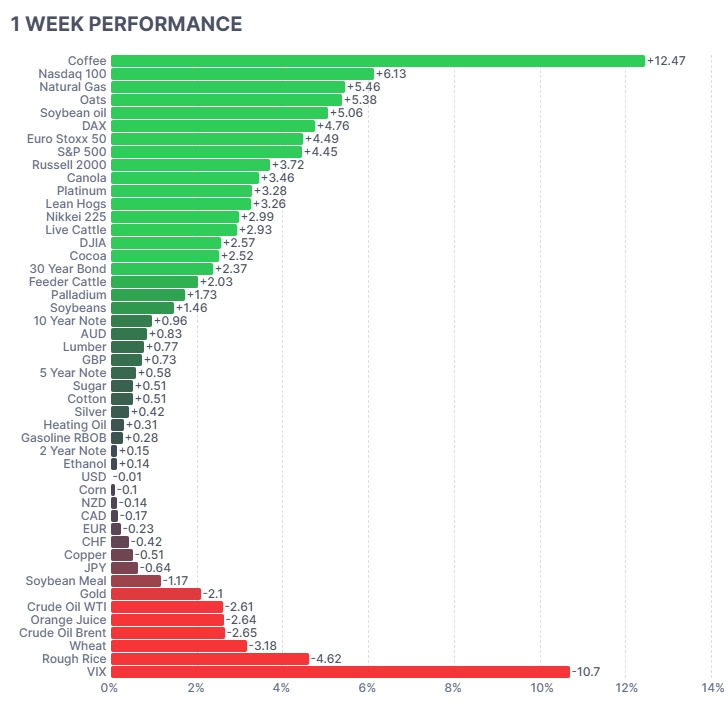

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Global financial markets continue to swing around due to news related to Tariffs, and the back and forth between the US and China. Last weeks performance in equity markets reflect this, with the Nasdaq, Euro Stoxx 50 and the S&P 500 all up over >+4%. In turn we saw the VIX sell off, it dropped by -10.7%. In commodity markets, any market that was previously sold off due to Tariff news, has reverted to the mean. Coffee in particular, which I have written about previously, was sold off aggressively as the Tariff news broke, but has since recaptured a new high. It was up +12.47% for the week. Oats, Soybean Oil and Canola also rose due to the softening trade Tariff rhetoric. The oil complex sold off as expectations for reduced demand hit the market.

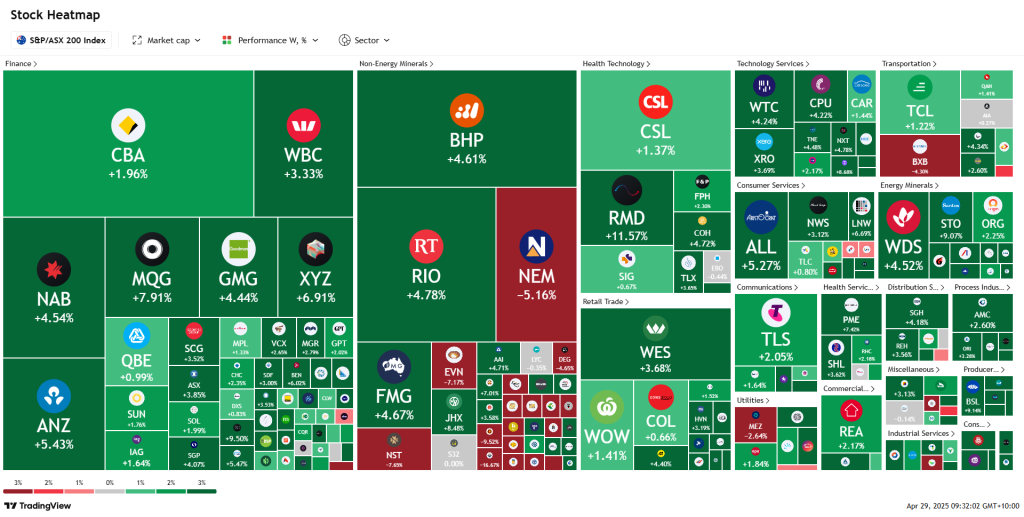

Here is the week’s heatmap for the largest companies in the ASX.

The ASX has rebounded aggressively over the last week. It was lead aggressively higher by the Financial sector, with NAB, ANZ, MQG and WBC all rising by over +3% for the week. Materials also joined in as the big three, RIO, BHP and FMG all rose over +4%. Gold miners reverted to the mean, as some profit taking occurred in these names. In general, it was a broad-based rebound for the XJO, with the vast majority of sectors and large cap bouncing.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.