Weekly Update | 5th May 2025

1. Labour wins in a landslide

Prime Minister Anthony Albanese’s Labor Party secured a historic victory in the 2025 federal election, winning at least 86 seats—well above the 76 needed for a majority. This marks the first time since Federation that a Labor leader has won consecutive terms with an increased majority. The decisive win provides Labor with a strong mandate to implement its policy agenda, which includes increased public spending on healthcare, education, and green energy.

2. US JOLTS job openings decline to 7.19M vs 7.49M expected

The U.S. Bureau of Labor Statistics reported that job openings fell to 7.19 million in March 2025, below the expected 7.49 million. This decline suggests a cooling in labour demand, which could be indicative of businesses becoming more cautious amid economic uncertainties.

3. Australian CPI rises to 0.9% vs 0.2% previous

Australia’s Consumer Price Index (CPI) rose by 0.9% in the March 2025 quarter, up from 0.2% in the previous quarter. The annual inflation rate remained steady at 2.4%, within the Reserve Bank of Australia’s target range. Significant contributors to the quarterly increase included education (+5.2%), housing (+1.7%), and food and non-alcoholic beverages (+1.2%). The Reserve Bank may adopt a cautious approach, monitoring for signs of sustained inflation that could necessitate policy adjustments in the medium term.

4. Chinese manufacturing PMI declines to 49.0 vs 49.7 expected

China’s official manufacturing Purchasing Managers’ Index (PMI) fell to 49.0 in April 2025, down from 50.5 in March and below the expected 49.7. The contraction in manufacturing activity points to ongoing challenges in China’s industrial sector, potentially due to weak domestic demand and global trade tensions.

5. US non-farm employment 177K vs 138K expected

The U.S. economy added 177,000 non-farm jobs in April 2025, surpassing the expected 138,000. The unemployment rate remained unchanged at 4.2%. Job gains were notable in healthcare, transportation and warehousing, financial activities, and social assistance. The stronger-than-expected job growth indicates resilience in the U.S. labor market, which could support consumer spending and economic growth in the medium term.

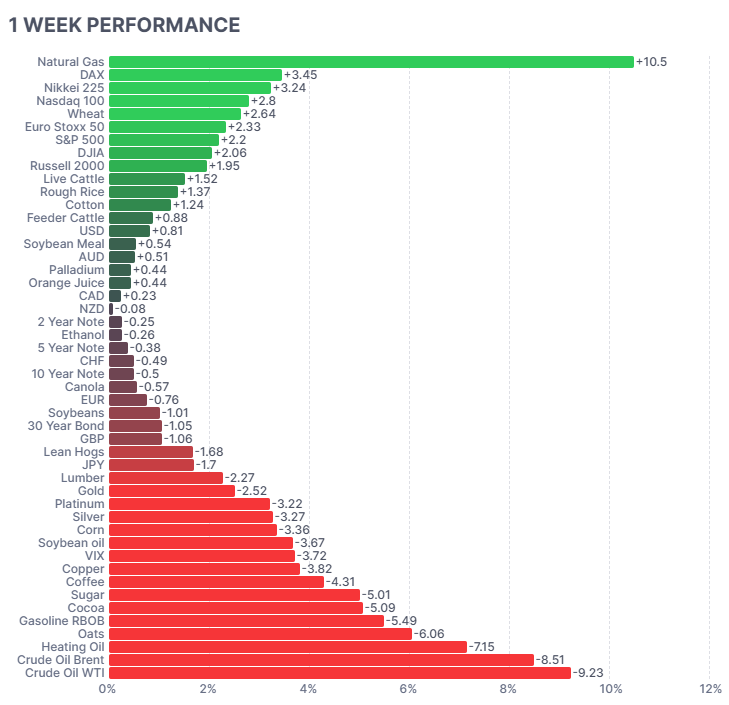

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the past week, commodity markets signaled numerous key shifts. Natural gas surged +10.5% amid tightening supply and record LNG exports, while gold cooled after its recent ascent on safe-haven flows driven by geopolitical and global trade unease. In contrast, oil slumped over -9% following OPEC+ production increases, and grains such as wheat and corn retreated on strong U.S. harvest expectations. Declines in iron ore and coal suggests weakening industrial demand. Equity markets continued to rebound, with the DAX, Nikkei 225 and NQ leading the way, as they all rose ~+3%.

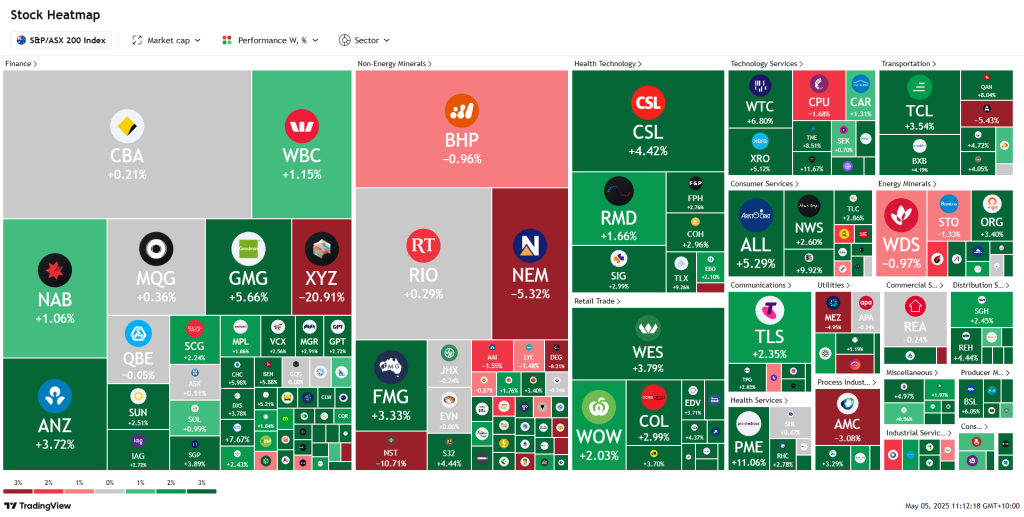

Here is the week’s heatmap for the largest companies in the ASX.

In a bullish week for the ASX 200, standout performers included Pro Medicus (+11.06%), Xero (+11.67%), and Domino’s Pizza (+9.92%), despite no fresh announcements the big leap higher was based on generally market sentiment returning to the market after positive news on trade negotiations between the US and China. On the downside, gold miners Newmont (-5.32%) and Northern Star (-10.71%) were hit by weaker gold prices, while GQG Partners (-5.88%) declined amid broader sentiment shifts in asset management. Tech and healthcare led the rally, reinforcing the appeal of growth sectors in a stabilizing rate environment. All in all it was a bullish week for the market, which BHP, XYZ and AMC the standout laggards. Energy names continued to be weak, as WDS and STO were down -0.97% and -1.33% respectively.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.