What I saw in March 2022

March started with a continuation of the trend seen earlier in the year, where investors extracted money out of global equity markets and reduced holdings within the bond market. If I wrote this commentary at the end of the first week of the month, global equity markets were significantly in the red, the Nasdaq entered a technical correction (a decline of > 20%) and bond market experiencing the worst start to the year in more than 40 years. However, by the end of the month, global equity market finished in the green, after Jerome Powell from the FOMC increased interest rates by 25bps and stated that they think a recession is very unlikely in the near term. The Australian equity market was one of the best performers globally, as it rose +6.39%. Commodity markets continued to swing around, natural gas, oil, wheat and nickel, still experiencing the effects of the Russia-Ukraine war.

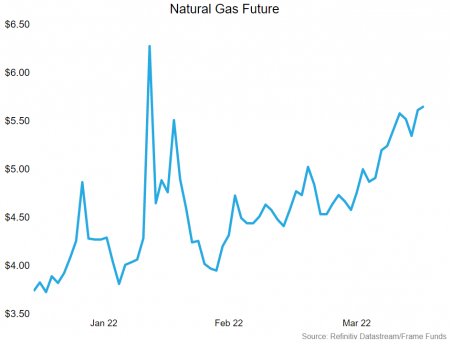

Natural gas volatility

Natural gas prices surged to the highest level in more than 13 years as the war between Russia and Ukraine causes a global energy crunch, at the same time as some forecasts call for cooler spring temperatures. The move during April meant prices have risen by over X% YTD. Europe is scrambling to move their dependence on Russian energy, however most European countries continue to buy the vast majority from Russia. Germany for example still import approximately 30% of their gas from Russia.

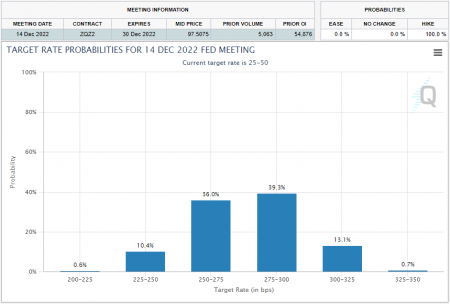

Interest rate expectations

During March we saw the first increase in interest rates in the US. Jerome Powell from the US FOMC rose rates by 25bps and stated that the risk of a recession in the near term is unlikely. He also stated that the path of interest rate increases would be gradual. By the end of this year, interest rate markets still have a 75% probability that rates will be between 2.50%-3.00% (currently 0.25%-0.50%). So, although the US Federal Reserve has stated that rate rises would be gradual, markets are saying that they do need to be more aggressive than they are projecting to the market.

New Head of Distribution

We have recently expanded our growing team by hiring Timothy Wilson as Head of Distribution. Tim will be heading up our Distribution team, where his primary focus will be on distributing the Frame Futures Fund and the Frame Long Short Australian Equity Fund products. You can contact Tim on 0418 188 146 or at timothy.wilson@framefunds.com.au

Portfolio performance

During March, both strategies had adapted to the environment of increased volatility, which was seen during February. The Long Short Australian Equity strategy rose by +1.20%, while our global macro strategy appreciated by +8.15%.

The Frame Long Short Australian Equity Fund (FLSAEF) rose by +1.20%. Top equity contributors were AVZ Minerals Limited (ASX: AVZ), Brickworks Limited (ASX: BKW) and National Australia Bank Limited (ASX: NAB). Largest detractors were Whitehaven Coal (ASX: WHC), Incitec Pivot Limited (ASX: IPL) and Atlas Arteria Group (ASX: ALX).

The Frame Futures Fund (FFF) appreciated by +8.15%. Equity, Fixed Income and Currency investments all rose by +5.56%, +2.25% and +1.30% respectively. Commodity investments declined by -0.88%.

Outlook

April will be a hesitant month for equity markets, as we have a break in the FOMC meeting schedule. Economic data will continue to provide colour to market participants as to the rate of expected interest rate increases, however with meetings scheduled during April, we expect markets to continue to find their footing.

If you would like to discuss any of these points, please email me at hue@framefunds.com.au or call our office on 02 8668 4877.

Download the full report by clicking the image below.