Following on from our latest article ‘2020 Investment Themes & Opportunities’, we identified a number of themes & opportunities we are monitoring for 2020 and beyond. You can find the article on our website. The third theme & opportunity was a rebound in the Hong Kong equity market. Since publishing that article, we saw the novel coronavirus cause havoc to Asian equity markets, in particular, China & Hong Kong. For January 2020, the Chinese Shenzhen 300 and the Hang Seng were down -2.26% and -6.66% respectively.

With the novel coronavirus having caused mayhem across both these markets, does this change the theme & opportunity that we identified in Hong Kong? The simple answer is yes.

This article aims to assess the impact of the novel coronavirus on this them & opportunity.

Firstly, Chinese expectations for economic growth for 2020 is currently sitting at 6%. Recently, Chinese President Xi stated he still expects to achieve this rate of growth, even in light of the novel coronavirus which has caused a drop in output for Q1. The primary causes of this drop in output are due to the closure of retail outlets & manufacturing plants, transport restrictions being put in place, and most global airlines ceasing travel to China. If China has experienced a large drop in Q1 output, then it means that the next three quarters of output are required to run at a far faster rate to meet their annual target of 6%. With the trade war and generally soft global economic conditions, our view is that the likelihood of China meeting their current economic targets (with everything remaining equal) is improbable.

In our opinion, the Chinese government is required to launch an aggressive stimulus package, similar to the Global Financial Crisis, if they want to meet their targets.

A short look at History

In November 2008, as the United States experienced a financial melt-down, the Chinese government launched an aggressive stimulus package worth RMB4 trillion or US$586bn, which equated to 13.5% of their GDP at the time. This stimulus package was designed to support the Chinese economy by increasing the amount of government spending on infrastructure (38%), earthquake reconstruction (26%), rural infrastructure (10%), housing (10%) and innovation (9%). The stimulus plan helped fuel a strong recovery of the Chinese economy and helped overcome the large drag on growth from reduced exports, amidst the global recession.

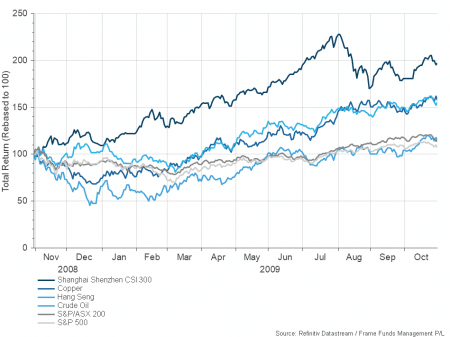

Economic growth increased to 11.9% in the first quarter of 2010, compared to 6.8% in the final quarter of 2008, and 6.1% in the first quarter of 2009. As a result of this strong rebound, the Chinese Shenzhen 300 and Hong Kong, Hang Seng markets rallied 97.18% and 55.73% between 01.11.2008 & 31.10.2009 respectively.

More importantly, most industrial metals used as key materials of these projects, experienced a strong rebound. Copper and Crude rebounded 59.84% and 13.55% respectively, over the same period.

In conclusion

Our view is that the Chinese government may be somewhat optimistic believing they will be able to meet their current GDP forecasts considering the recent soft trading conditions. Taking all of the above into consideration, we believe that if the Chinese government does a stimulus programme similar in scale to what they did in 2008, the opportunity we identified in ‘2020 Investment Themes & Opportunities’ has become more compelling than ever. However, we also believe that there may be additional opportunities within the base materials space, copper, crude, aluminium, steel and iron ore, to name a few.