This market insight will provide readers with an update in charts on some of the key components we are monitoring for an easing of inflation.

Natural Gas prices have declined approximately ~25%

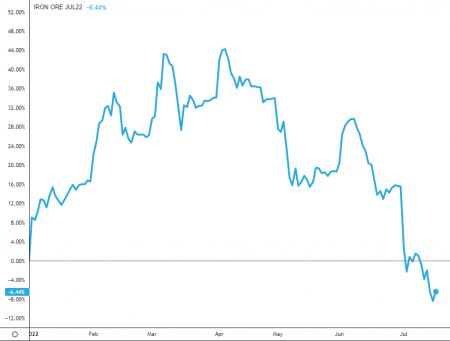

Iron ore prices have dropped ~40%

Copper prices are down ~30%

Crude Oil prices are down ~15%

Wheat prices are down ~35%

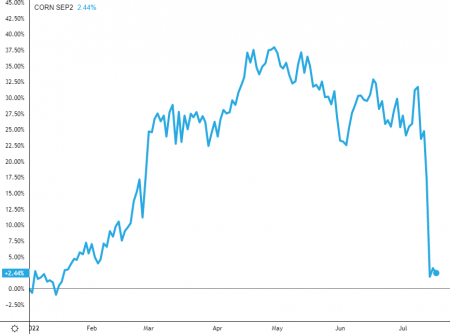

Corn prices are down ~15%

We interpret the declines seen in most of these commodities as a direct repositioning, as investors adjust to the expected decline in global growth rates over the next 12 months and beyond, however importantly, these are also key inputs into the goods that have blown inflation readings out of the water.

Although these inputs will take some time to properly flow through to consumer inflation, it does show that key producer inputs have declined from recent highs, which may, over the upcoming 6 months, provide some respite to cost-push inflation.

This respite may ease future inflation expectations, however, in our view, investor focus will at some point pivot to the deflating global economy.