Historically, during times of monetary policy uncertainty, we have seen gold rise. This is primarily due to its safe haven characteristics, as well as the perception that gold can be used as an inflation hedge. At present, we have an environment that is conducive to being invested in Australian gold miners, companies such as Northern Star (ASX:NST), Evolution Mining (ASX:EVN), Newcrest Mining (ASX:NCM).

There are three factors that we will assess prior to completing an investment in Australian gold miners.

- Gold

- Australian Dollar

- Monetary Policy

1. Gold

The process of analysing gold is different to analysing other commodities, considering its poor use case. Gold is primarily used in jewellery, dentistry, electrical components and as a minor component in computers.

We assess stock piles held in inventory and on exchanges, the amount of gold expected to be produced and consumed for the upcoming year as well as any technical trading formations we identify based on historical prices.

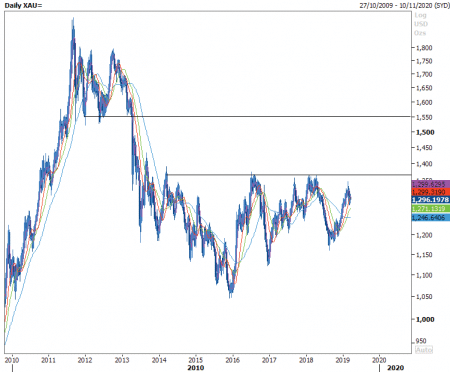

From a technical perspective, gold has recently attempted and failed to break through the important $1350usd/ oz level. Upon a break of this level, an acceleration to $1600usd/oz is projected.

2. Australian Dollar

As the businesses we are investing in are located in Australia, the consideration of the Australian Dollar relative to the US dollar is crucial. The majority of the companies mentioned above have their mines located within Australia, which means most of their operating costs are priced in Australian Dollars. If we see an appreciation in gold priced in US dollars, we will see their margins and ultimately their profitability increase, while their costs will remain relatively constant (assuming the AUD/USD remains constant). For example, NCM has an All-In Sustaining Cost (AISC) of $747aud/oz (as at HY FY18). If we see of $20/oz increase in the price of gold, NCM will produce an additional $20,000,000 in profit (assuming a production rate of 1m/oz per annum).

3. Monetary Policy

Global monetary policy is one of the largest considerations prior to an investment into gold businesses. Gold has historically been viewed as an inflation hedge due to it acting as a physical store of value. If we foresee a pickup in inflation, or global central banks target a pick-up in inflation, gold traditionally does well.

Also, we consider the recent 180-degree shift from the Federal Reserve regarding monetary policy (they moved from a tightening to an expansionary cycle within the space of 4 weeks). As a result of this 180-degree shift, gold has received more interest from investors due to the view that the Federal Reserve will do whatever it takes to support the US economy in the face of slowing global growth. By moving from a tightening cycle (increasing rates and executing balance sheet run-off), to now an expansionary cycle (rates on hold and adjustments to balance sheet run-off), investors are now investing into assets that will perform well in an environment of lower rates for longer