Weekly Update | 2nd June 2025

1. US Core Durable Goods Orders m/m rise 0.2% vs -0.1% expected

In April 2025, U.S. core durable goods orders—excluding transportation—rose 0.2%, which surpassed expectations of a 0.1% decline. This modest increase suggests resilience in non-transport sectors amid broader economic challenges. However, overall durable goods orders fell 6.3%, driven by a 17.1% drop in transportation equipment, which highlights sector-specific volatility. The uptick in core orders indicates cautious optimism in business investment, but broader uncertainties persist.

2. Australian CPI y/y steady at 2.4%

Australia’s Consumer Price Index (CPI) remained steady at 2.4% year-on-year in April 2025, slightly above the forecasted 2.3%. Key contributors included food and non-alcoholic beverages (+3.1%), housing (+2.2%), and recreation and culture (+3.6%). The trimmed mean inflation, a core measure, rose to 2.8%, within the RBA’s target range. This stability supports the RBA’s cautious approach to monetary policy, balancing inflation control with economic growth.

3. RBNZ cuts its OCR to 3.25%

The Reserve Bank of New Zealand (RBNZ) reduced the Official Cash Rate (OCR) by 25 basis points to 3.25% in May 2025, which marked the sixth consecutive cut. This decision aims to support the economy’s recovery after a period of contraction, with elevated export commodity prices and lower interest rates bolstering overall activity. The RBNZ noted that the full effects of previous cuts are yet to materialize, which indicated a continued accommodative stance to stimulate growth is needed.

4. US GDP q/q contracts by -0.2% but beats estimates

The U.S. economy contracted by 0.2% in Q1 2025, an improvement from the initial estimate of a 0.3% decline. This marks the first quarterly contraction in three years, primarily due to a surge in imports ahead of anticipated tariffs, which widened the trade deficit and subtracted 4.9 percentage points from GDP. Despite this, business investment grew by 24.4%, and inventories contributed positively, suggesting underlying economic resilience.

5. US Core PCE Price Index m/m meets expectations of 0.1%

In April 2025, the U.S. Core Personal Consumption Expenditures (PCE) Price Index increased by 0.1% m/m, aligning with expectations. Year-on-year, the index rose 2.5%, marking the lowest level in over four years. This moderation in the Federal Reserve’s preferred inflation gauge suggests easing price pressures, potentially allowing for a more dovish monetary policy stance if the trend continues.

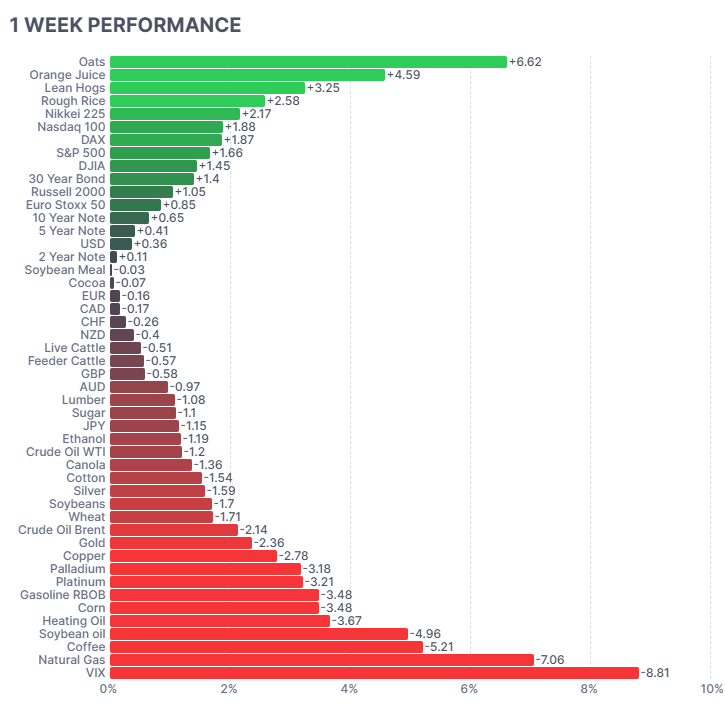

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Commodities saw divergent moves last week. Oats surged +6.6% on adverse U.S. Midwest weather threatening yields, while lean hogs (+4.6%) gained amid strong domestic demand. In contrast, energy markets slumped as OPEC discussed increasing productions by around 400k barrels per day. Natural gas dropped -7.1% due to mild weather forecasts and ample storage, and heating oil fell -3.7% on softening demand. Coffee plunged -5.2% on improved Brazilian harvest prospects. Metals like copper (-2.8%) and gold (-2.4%) declined amid a firmer U.S. dollar and fading safe-haven demand. The VIX fell -8.8%, which reflected reduced equity market volatility. Overall, price action reflected easing inflationary pressure and shifting sentiment toward risk assets over defensive commodities.

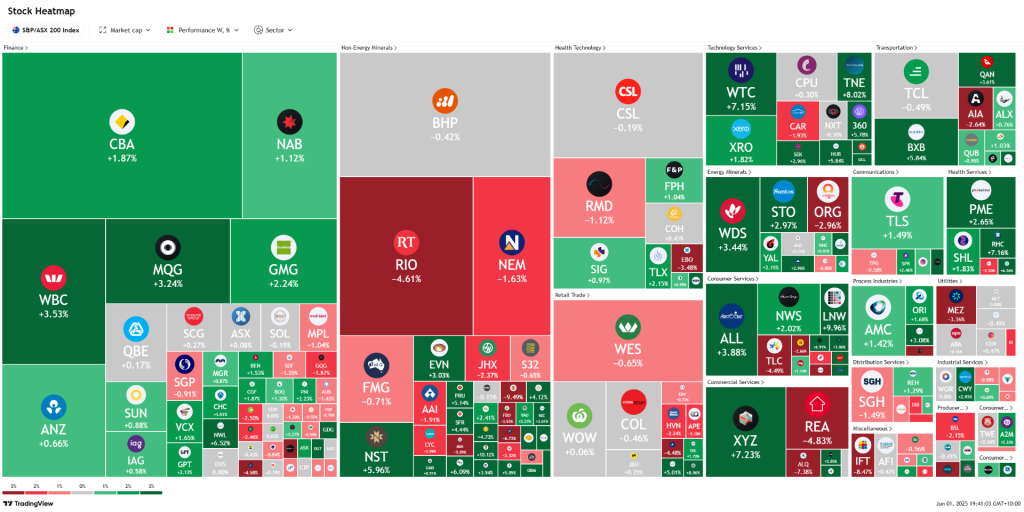

Here is the week’s heatmap for the largest companies in the ASX.

Australian equities posted a mixed week, led by strength in tech and financials. WiseTech (WTC) surged +7.15% on strong earnings guidance, and Westpac (WBC) rose +3.53% as banks benefited from stable inflation and firm loan growth. Newscorp (NWS) jumped +2.02%, buoyed by media optimism. On the downside, Rio Tinto (RIO) fell -4.61% as iron ore prices declined, while REA Group (REA) and Altium (ALU) dropped -4.83% and -7.38% respectively on tech sector volatility. Healthcare showed modest gains, with Pro Medicus (PME) up +2.65%. Overall, the ASX had a mediocre week, especially considering the S&P500 moved higher by +1.66%.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.