Weekly Update | 22nd April 2025

1. Chinese GDP q/q rises to 5.4%

In Q1, China’s GDP grew by 5.4% y/y. This growth was driven by a 6.5% rise in industrial production, notably in equipment and high-tech manufacturing, and a 4.6% increase in retail sales. Agricultural output and animal husbandry also expanded steadily. However, challenges persisted, which included a 9.9% decline in real estate investment and ongoing trade tensions with the U.S., which have led to mutual tariff hikes. To counter these issues, China is implementing fiscal stimulus measures to bolster domestic demand. The outlook for China’s economy remains cautiously optimistic. While the strong Q1 performance indicates resilience, sustained growth will depend on effective policy responses to domestic challenges and external uncertainties, particularly trade relations with the U.S.

2. United States Retail Sales up 1.4% m/m

In March, U.S. retail sales rose by 1.4%, marking the largest monthly gain since January 2023. This surge was primarily driven by consumers accelerating purchases of big-ticket items, notably automobiles, ahead of impending tariffs imposed by the Trump administration. Motor vehicle and parts sales increased by 5.3% m/m. However, this uptick is considered temporary, as consumers aimed to avoid anticipated price hikes, and underlying consumer sentiment has been declining for four consecutive months. While the March retail sales boost reflects short-term consumer behaviour, it doesn’t indicate sustained economic growth.

3. New Zealand CPI 0.9% m/m

In the March quarter, NZ CPI rose 0.9%, with an annual increase of 2.5%. Non-tradeable inflation, reflecting domestic costs, grew by 4.0%, while tradeable inflation, influenced by global prices, increased by 0.3%. Significant contributors included higher housing costs and education fees, partially offset by declines in international airfares and petrol prices. This moderate inflation suggests the economy is stabilizing, potentially reducing the need for further interest rate hikes.

4. Australian employment change 32.2k vs 39.8k expected

Australia’s unemployment rate edged up to 4.1%, while employment increased by 32.2k jobs, which indicates a resilient labour market. However, hours worked declined by 0.3% due to weather disruptions. The participation rate rose slightly to 66.8%. Despite the solid job gains, the Reserve Bank of Australia is expected to cut interest rates in May, responding to global economic risks and a softer inflation outlook.

5. United States unemployment claims 215K vs 225K expected

US initial jobless claims fell by 9,000 to 215k, which indicates a stable labor market. However, ongoing trade tensions and tariffs are causing business uncertainty, potentially dampening hiring. While layoffs remain low, the increase in continuing claims to 1.89 million suggests some softening. This mixed data points to cautious optimism but highlights risks to sustained economic growth.

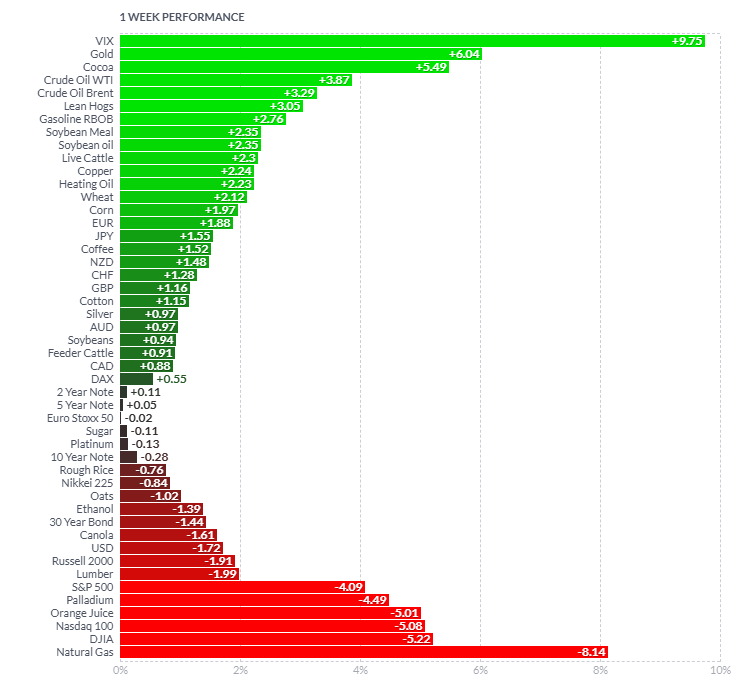

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Last week saw a surge in market volatility, with the VIX up +9.75% and the safe-haven asset of gold (+6.04%) rising, which reflects investor caution amid U.S.-China trade tensions and tariff concerns. Oil prices climbed on supply fears and trade tensions, while agricultural commodities like lean hogs and corn gained, mostly due to weather and trade impacts. Major equity indices fell sharply—Nasdaq (-5.08%), DJIA (-5.22%)—as investors reacted to slowing growth and global trade tensions. Natural gas plunged -8.14% on oversupply worries. Overall, markets shifted from risk assets to safer bets, highlighting economic uncertainty, global trade uncertainty, and inflation concerns driving investor behavior.

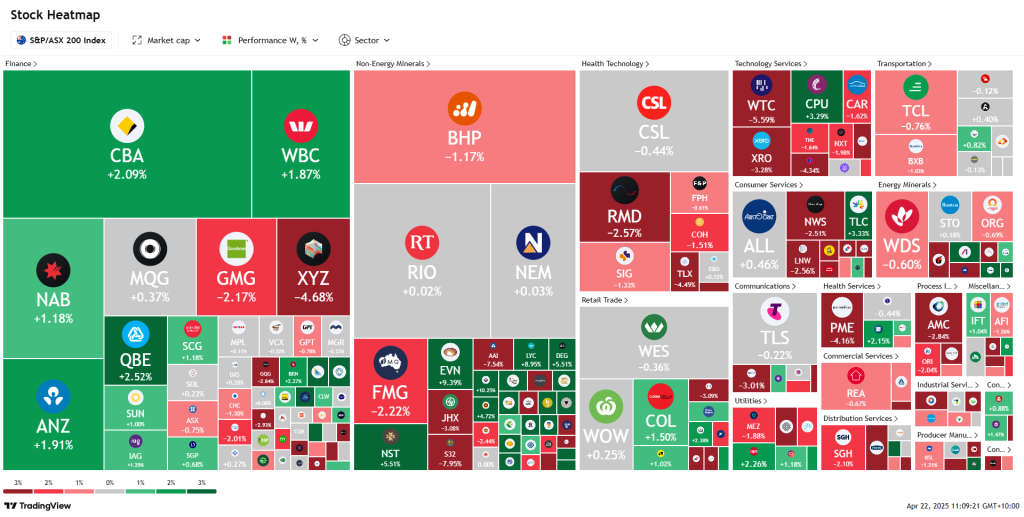

Here is the week’s heatmap for the largest companies in the ASX.

The ASX 200 showed mixed performance this week, with financials leading gains—CBA (+2.09%), ANZ (+1.91%), and QBE (+2.52%)— supported by stable employment data and interest rate cut expectations. Energy and materials lagged, with BHP (-1.17%) and FMG (-2.22%) falling amid global growth concerns. Tech stocks were hit hard—WTC (-5.59%), XRO (-3.28%)—mirroring U.S. market selloffs. Defensive sectors like consumer staples (COL +1.5%) outperformed, reflecting cautious investor sentiment.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.