Weekly Update | November 17, 2023

Let’s hop straight into five of the biggest developments this week.

1. US CPI fell to 3.2% y/y

Inflation in the US cooled off at a faster rate than expected in the twelve months to October. The inflation figure came in at 3.2%, a big drop from the previous 3.7% as well as the 3.3% priced in by market participants. The incessant slide in petroleum prices in recent weeks accounted for the overall thawing of inflationary pressure.

2. Chinese industrial production rose to 4.6% y/y

China’s industrial production grew faster than economic forecasts in the year to October. Industrial output grew by 4.6%, a marginal uptick from the previous reading of 4.5%. This beat market expectations which anticipated flat annual growth. The inference is that stimulus programs to prop up economic activity by Chinese authorities are slowly beginning to work their way into the economy.

3. UK CPI declined to 4.6% y/y

Inflation in the UK cooled drastically in the twelve months to October. Annual inflation reported at 4.6%, the lowest reading since November 2021. The report was far lower than the prior reading of 6.7% and slightly below market expectations of 4.7%. A reduction in oil prices, as well as cheaper imports from China were notable underlying factors.

4. US retail sales fell – 0.1% m/m in October

Retail sales in the US dropped in October by -0.1%, however they beat pessimistic expectations of -0.3%. This was a decline from the prior month’s reading of 0.9%. Overall sales volume was up 2.5% from a year ago. The inference is that American consumers are continuing to spend, however at a slightly reduced rate.

5. Australia’s unemployment rate edged up to 3.7%

More Australians entered the job market and are actively seeking employment. Unemployment rose to 3.7% in October, higher than the previous reading of 3.6%. The implication of high interest rates is restricting employee uptake, while pushing more people into the labour market, as the cost of living continues to bite.

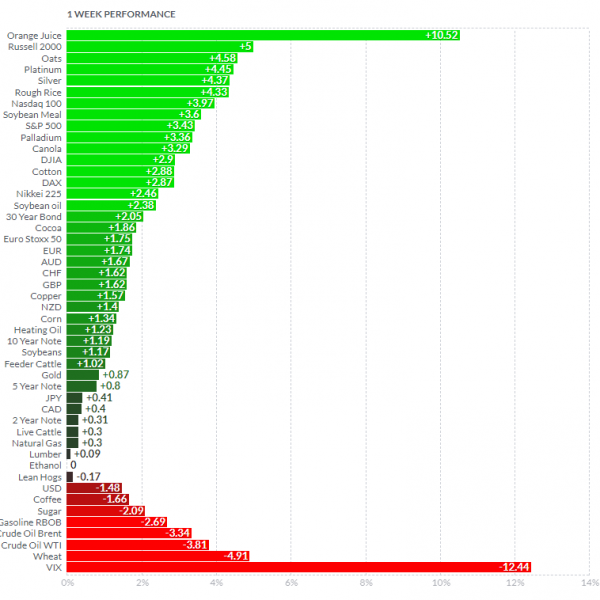

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

A big rally in commodities over the course of the week, as investors piled into most risk-on markets after the reduced inflation reading reported from the US. The VIX declined as equity markets had a very positive week. Global indices gained significantly with the Russell shooting up +4.93%. Orange juice rose on wetter than expected conditions. Wheat fell on oversupply as the harvesting season comes to an end. Petroleum products drifted further down on weak demand and oversupply. The price action in Oil and Gas contradicts the price performance seen in other risk-on markets. The demand seen in Oil, is normally a leading indicator of overall economic growth. Risk-on currencies rose with the EUR and AUD being the strongest, rising over 1.5%.

Here is the week’s heatmap for the largest companies in the ASX.

Another mixed week for the ASX but generally a much better week. Financials were mixed as inconclusive labour statistics left the door open for medium term interest rates hikes. ANZ was the biggest loser in the sector closing – 6.3%, NAB and QBE also declined over -2.5%. MQG and GMG had a solid rebound after a few weeks of poor performance. Materials rebounded well as iron ore prices continued to rise. FMG led the way rising 7.78%, while BHP and RIO also climbed over 3.5%. Energy names continued to drag on the sector due to very weak crude prices. Defensive names such as WES and WOW also rose, as investment money looked for a home to generate returns above the cash rate.

Another mixed week for the ASX but generally a much better week. Financials were mixed as inconclusive labour statistics left the door open for medium term interest rates hikes. ANZ was the biggest loser in the sector closing – 6.3%, NAB and QBE also declined over -2.5%. MQG and GMG had a solid rebound after a few weeks of poor performance. Materials rebounded well as iron ore prices continued to rise. FMG led the way rising 7.78%, while BHP and RIO also climbed over 3.5%. Energy names continued to drag on the sector due to very weak crude prices. Defensive names such as WES and WOW also rose, as investment money looked for a home to generate returns above the cash rate.

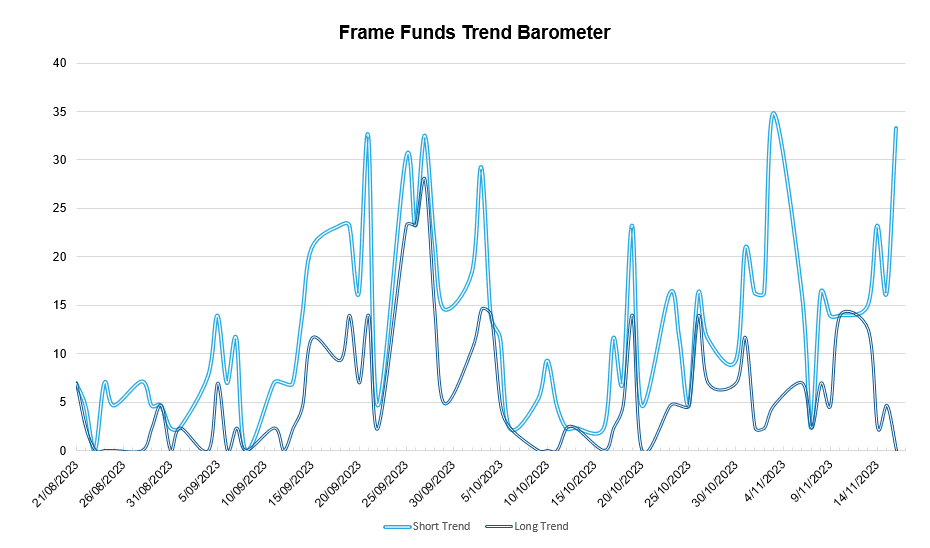

Again, as per usual shows our proprietary trend following barometer which captures the number of futures contracts within our universe making new short and long-term trends.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.