Weekly Update | October 20, 2023

It has been a busy week in the Frame Funds offices, the total focus has been on the launch of our new mid-frequency strategy which trades the S&P/ASX futures market.

Let’s hop straight into five of the biggest developments this week.

1. Canadian trimmed CPI y/y fell to 3.7% in September

Inflation cooled in Canada after the annual trimmed inflation fell to 3.7% vs the prior reading of 3.9%. Market expectations were at 3.8%. Inflationary pressure eased at a faster rate than expected. The inference is that the historically high interest rates are having a significant effect in affecting price stability, thereby reducing the odds of a further hike in next week’s BOC meeting.

2. Chinese industrial production y/y stagnated at 4.5%

The Chinese economy continued to face critical demand challenges that saw annual industrial production stagnate at 4.5% in the year to September. Despite beating a gloomier market forecast of 4.4%, the inability to stimulate internal demand as well as external headwinds continue to plague the post-Covid recovery. Policies like interest rate cuts, increased government spending, and home purchase incentives have so far done little to boost industrial output.

3. US retail sales m/m outperformed at 0.7%

The US consumer market fired on all cylinders with a better-than-expected growth in September. The 0.7% retail sales figure resoundingly beat the 0.3% market forecast despite marginally trailing from the 0.8% upward revised figure in August. The American consumer is buoyed by growing wages and resurgent job growth.

4. UK CPI y/y remained static at 6.7% in September

Price elevation in the UK remained higher than expected in the twelve months to September. The inflation data maintained the August rate of 6.7% against the market expectation of 6.6%. Energy and petroleum prices were the biggest upward contributors to the figure, offsetting food and non-alcoholic beverages.

5. Australia’s unemployment rate inched lower to 3.6%

Unemployment in Australia fell to 3.6%, down from the previous from the previous 3.7%, which markets had priced in to retain. The devil was, however, in detail, with an overview showing the relative weakening of labour conditions. The labour participation rate dwindled significantly, lowering the unemployment rate as a consequence.

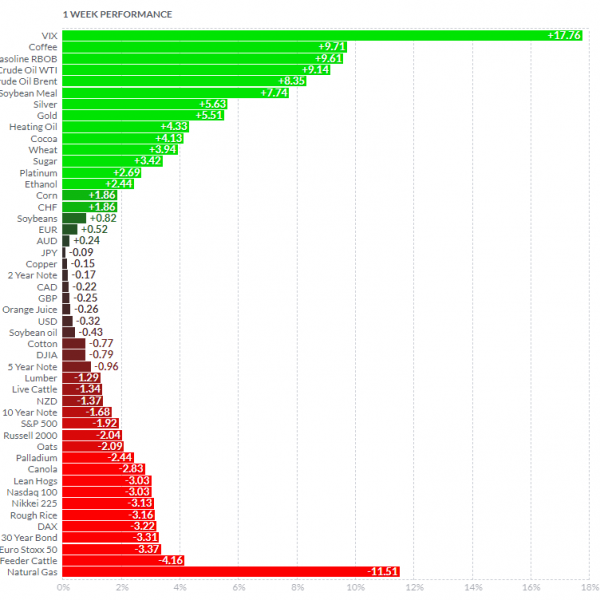

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Ethanol, cocoa, and coffee were up on seasonality-driven demand with cold conditions taking hold. Sugar, cotton, palladium, gas and petroleum products however corrected on oversupply. The VIX rose aggressively on better-than-expected data from the US. Equities and bonds fell. The Nikkei, Euro Stoxx, Nasdaq, and Dax were all down over 3%. US 30-year bond futures were down 3.31%, which provided the catalyst for further downside in equities.

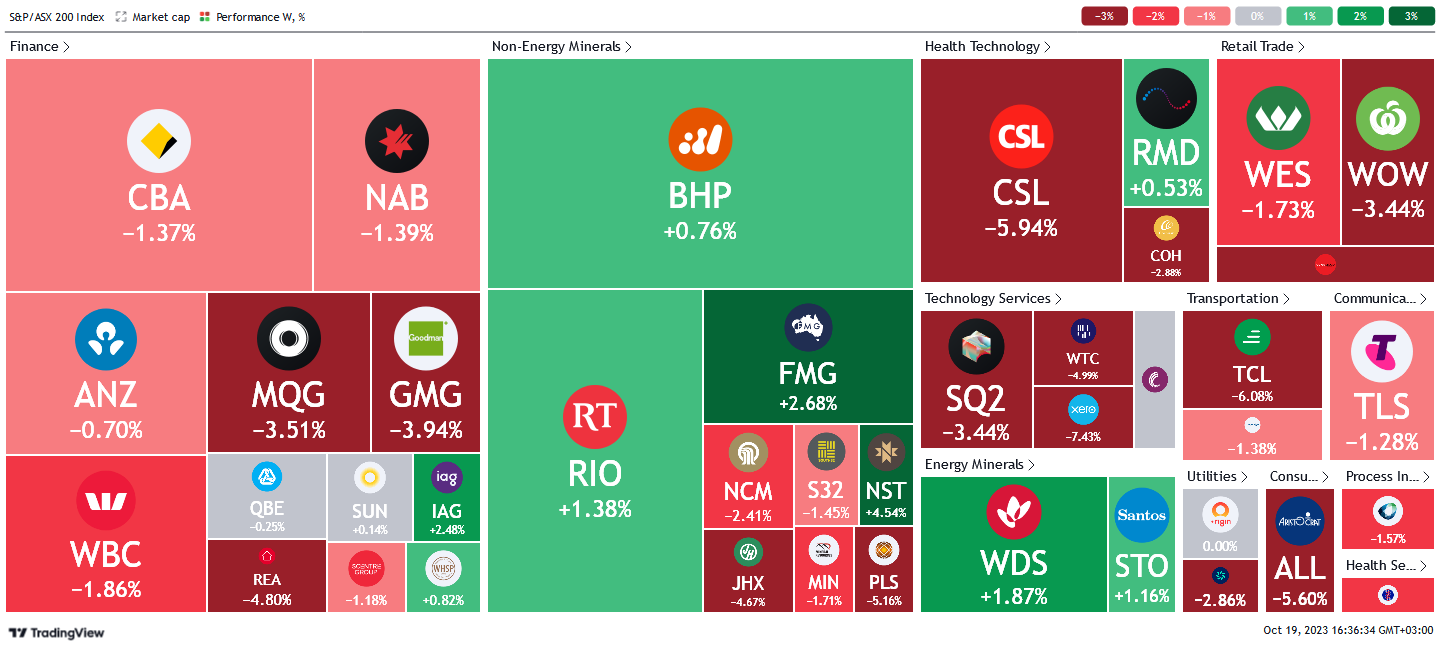

Here is the week’s heatmap for the largest companies in the ASX.

An overall mixed week for the ASX. The financial sector was the biggest loser, giving up most gains from the prior week, to close with most stocks in the red. MQG and GMG were the biggest losers while IAG and SOL were the only notable positive stocks to prop the sector. Non-energy miners were however in a much stronger position with most stocks in the green, this was primarily due to the recent positive price action in Iron Ore. NST and FMG were the best performers, rising +4.54% and +2.68%. Healthcare stocks, retailers, transporters, utilities and tech services all closed in the red. Notably, CSL closed at a 4-year low.

An overall mixed week for the ASX. The financial sector was the biggest loser, giving up most gains from the prior week, to close with most stocks in the red. MQG and GMG were the biggest losers while IAG and SOL were the only notable positive stocks to prop the sector. Non-energy miners were however in a much stronger position with most stocks in the green, this was primarily due to the recent positive price action in Iron Ore. NST and FMG were the best performers, rising +4.54% and +2.68%. Healthcare stocks, retailers, transporters, utilities and tech services all closed in the red. Notably, CSL closed at a 4-year low.

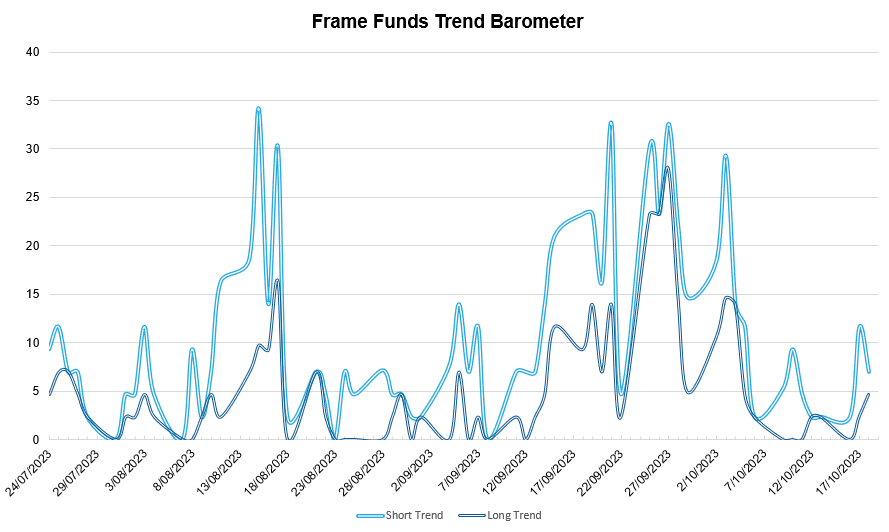

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.