Weekly Update | May 17, 2024

Let’s hop straight into five of the biggest developments this week.

1. Chinese CPI rises marginally to 0.3% y/y

China’s consumer prices rose in April for a third straight month, while producer prices extended declines, suggesting resilient domestic demand, despite a shaky economic recovery. The closely watched numbers follow official surveys which showed cooling factory and services activity. This data continues to show that the recovery in China is somewhat mixed.

2. US Core Producer Price Index rises 0.5% m/m

Wholesale prices jumped more than expected in April, putting up another potential roadblock to interest rate cuts anytime soon. The produce price index, a measure of what producers receive for the goods they produce, increased 0.5% for the month, higher than the 0.3% estimated. The data continues to suggest that inflation is bubbling below the surface and needs to be monitored.

3. Australian wage price index (WPI) rose by 0.8% m/m

The seasonally adjusted WPI rose 0.8% last quarter and 4.1% over the prior 12 months. The private sector rose 0.8% and the public sector rose 0.5%. Some of the largest contributors were Professional, scientific and technical services (0.7%), Education and training (0.8%), and Construction (0.7%). We continue to see mixed data from the labour market, which shows that businesses continue to adjust to a higher rate environment.

4. US CPI continues to show disinflation rising by 0.3% m/m

The pace of price increases in the US showed signs of slowing last month, after a streak of higher-than-expected inflation data had stoked concerns about the world’s largest economy. Consumer prices rose 3.4% in the 12 months to April, down from 3.5% for the month before. They rose 0.3% vs expectations of 0.4%. This data continues to conform with the Feds view of a soft landing.

5. Australian labour market adds 38.5k new jobs

Employment growth of 38,500 was stronger than the consensus expectation for 23,700 expected in April. Full-time jobs with their higher wages and other benefits fell by 6,100 and there was a small downward revision to the previous month’s gains. Continuing on from the wages price index earlier in the week, this demonstrates the slow down in the Australian labour market remains mixed.

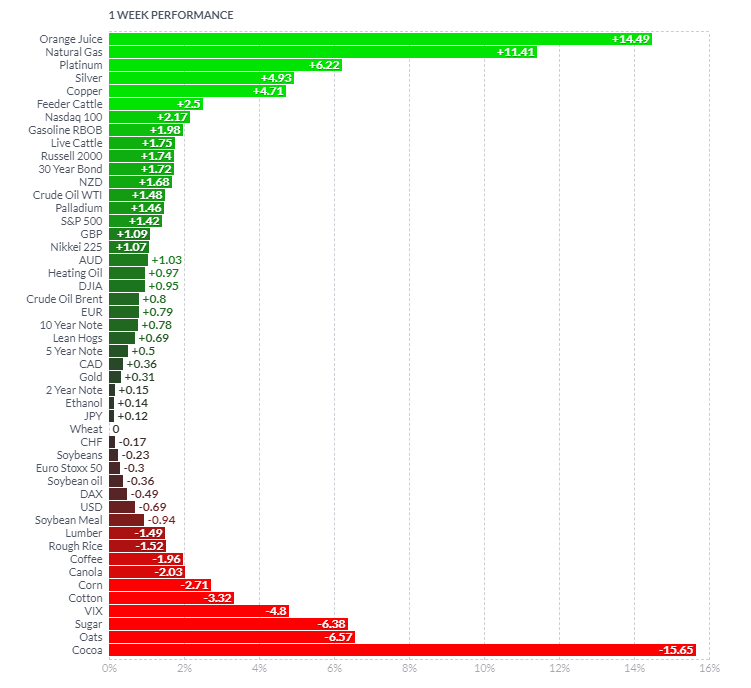

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

There has certainly been continued volatility in some markets that we track. Orange juice has had a monstrous week, rising +14.4% due to growing conditions in the US, while the continued swings in Cocoa continue. Copper, Silver and Platinum continue to rise and hit new highs. Copper hit a new 5yr high earlier this week. Softs reverted from last week’s performance as they declined broadly, the worst were Oats, Sugar and Cotton, all declining by over -3%. We can imply that the mixed performance across the board in these commodities provides additional clarity about what PPI and CPI readings may look like in the next 6 months.

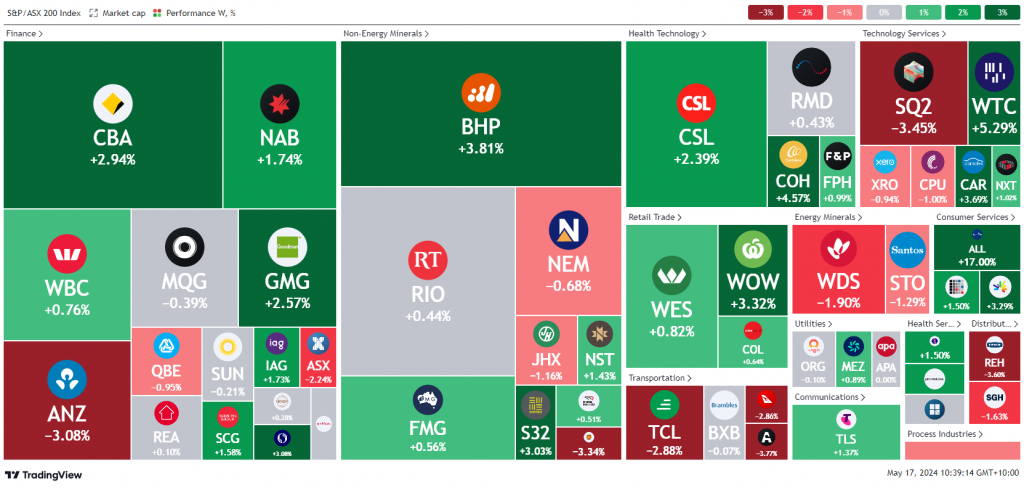

Here is the week’s heatmap for the largest companies in the ASX.

Over the course of the week, the ASX has managed to continue its rebound after the selloff in April. After weaker than expected wage growth and unemployment data, the Australian market rose swiftly as expectations of further rate hikes flew out the window. Financials and Materials did a lot of the heavy lifting, as CBA and NAB both rose by over +1.5%. ANZ dragged on the market, -3.08% after missing expectations. BHP was up +3.81% as the likelihood of the Anglo-American takeover offer being accepted reduced. WOW rose by +3.32% as generally money flow flocked into higher-yielding and stable names. The worst-performing sector of the week was energy, with WDS and STO both down over -1.25%.

Over the course of the week, the ASX has managed to continue its rebound after the selloff in April. After weaker than expected wage growth and unemployment data, the Australian market rose swiftly as expectations of further rate hikes flew out the window. Financials and Materials did a lot of the heavy lifting, as CBA and NAB both rose by over +1.5%. ANZ dragged on the market, -3.08% after missing expectations. BHP was up +3.81% as the likelihood of the Anglo-American takeover offer being accepted reduced. WOW rose by +3.32% as generally money flow flocked into higher-yielding and stable names. The worst-performing sector of the week was energy, with WDS and STO both down over -1.25%.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.