Weekly Update | 26th May 2025

1. Chinese Industrial Production y/y rises 6.1%

In April 2025, China’s industrial production increased by 6.1% year-on-year, surpassing expectations of 5.5% but down from March’s 7.7% growth. This deceleration suggests a moderation following a surge in activity ahead of anticipated tariffs. Notably, sectors like 3D printing devices, industrial robots, and new energy vehicles saw significant growth, indicating a shift towards high-tech manufacturing. Overall, while the industrial sector shows resilience, the mixed signals point to a cautiously optimistic outlook for China’s economy.

2. RBA cuts cash rate to 3.85%

The Reserve Bank of Australia reduced the cash rate by 25 basis points to 3.85%, marking the second cut in four months. This decision follows signs of easing inflation, with the trimmed mean falling to 2.9%, within the RBA’s target band. However, Treasurer Jim Chalmers cautioned about global uncertainties, including trade tensions and geopolitical conflicts, which could impact Australia’s economic stability. The RBA’s move aims to support domestic growth amid these external challenges.

3. British CPI y/y rises 3.5%

In April 2025, the UK’s Consumer Price Index rose to 3.5% year-on-year, up from 2.6% in March, exceeding forecasts. This increase was driven by higher costs in energy, water (up 26.1%), road tax, and airfares. Core inflation also climbed to 3.8%, indicating broader price pressures. The surge in inflation raises concerns about the cost-of-living crisis and may delay potential interest rate cuts by the Bank of England. The persistent inflationary pressures suggest a challenging economic environment ahead for the UK.

4. US Flash Manufacturing PMI rises to 52.3 vs 49.9 expected

PMI rose 52.3 in May 2025, the highest in three months, surpassing expectations of 49.9. This indicates the strongest improvement in business conditions since June 2022, with factory production returning to expansion after two months of decline. New order growth hit a 15-month high, and inventories increased at the fastest rate since the survey began in 2009. Overall, the manufacturing sector shows robust growth, but inflationary pressures remain a concern.

5. NZ retail sales q/q rise 0.8%

New Zealand’s retail sales rose by 0.8% quarter-on-quarter in Q1 2025, outperforming expectations of a 0.1% increase. This growth reflects improved consumer demand and confidence, possibly influenced by recent interest rate cuts. However, economists warn of a potential economic downturn looming, suggesting that the current retail strength may be short-lived. The data indicates a resilient consumer sector, but broader economic challenges could temper future growth.

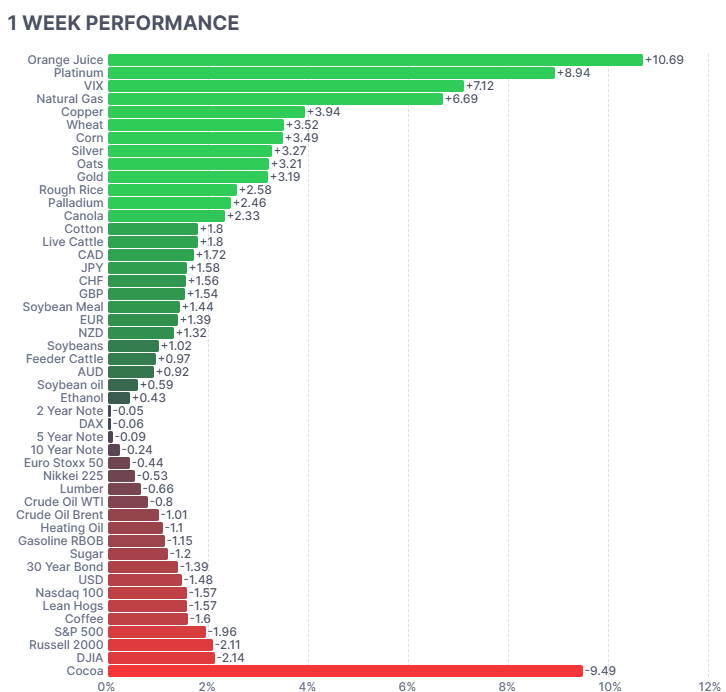

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

This week, orange juice surged +10.69% amid concerns over Florida crop yields and continued supply shortages. Platinum (+8.94%) rose on increased demand for industrial and clean energy applications. VIX (+7.12%) spiked due to geopolitical tensions and equity market volatility. Natural gas (+6.69%) climbed on stronger-than-expected summer demand forecasts. Copper (+3.94%) and other industrial metals gained on renewed Chinese stimulus hopes.

Meanwhile, cocoa (-9.49%) plunged as improving West African weather eased fears of prolonged supply disruptions. Crude oil (-1.01%) slipped on rising inventories and weaker global growth projections. The week reflected heightened commodity volatility driven by weather, geopolitics, and macro policy.

Here is the week’s heatmap for the largest companies in the ASX.

This week’s ASX200 heatmap shows strong gains in technology, gold miners, and communications, with standout performances from TNE (+17.59%), EVN (+13.67%), and TLS (+4.86%). Gold stocks surged as investors responded to geopolitical uncertainty and weaker global growth outlooks. Tech firms like WTC (+4.10%) and XRO (+1.47%) rallied on easing interest rate expectations. Meanwhile, miners such as FMG (-8.41%) and RIO (-3.50%) dropped sharply on weaker Chinese demand signals. Financials were mixed: CBA (+2.00%) rose, while WBC (-0.95%) fell. Overall, the market reflected mixed positioning and some optimism in tech and gold, offset by pressure on cyclicals and heavy industry.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.