One of the major benefits of analysing commodity markets, is that we can look at the current price, inventory levels and future prices, to better understand how producers, speculators and money managers view the outlook for each commodity.

In the current environment of cost push inflation, analysing the outlook for major producer inputs, can help to provide us with a good understanding of what the outlook for inflation may be.

This update will look at current prices, inventory levels and what the forward market is indicating.

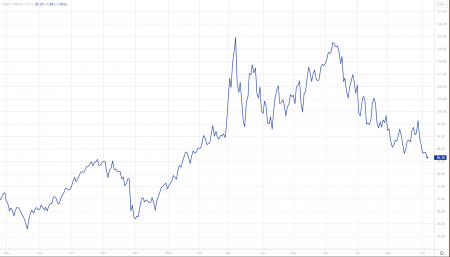

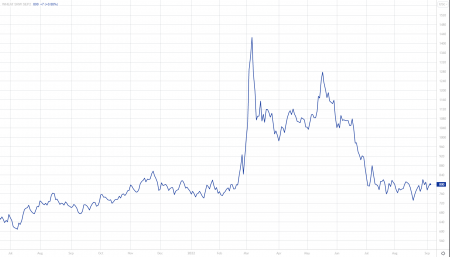

Crude Oil – used in practically everything, is down approximately -35% from highs seen in March.

Inventory levels are low, reflective of recent underinvestment.

The forward contract term structure is implying that traders have positioned for lower prices next year and beyond.

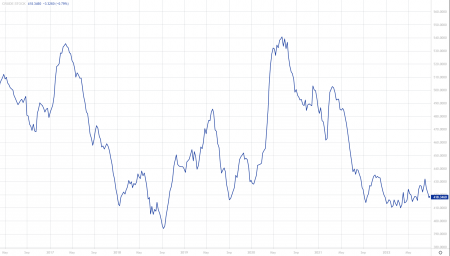

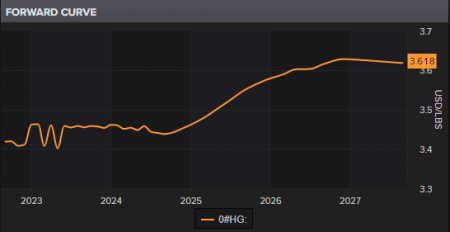

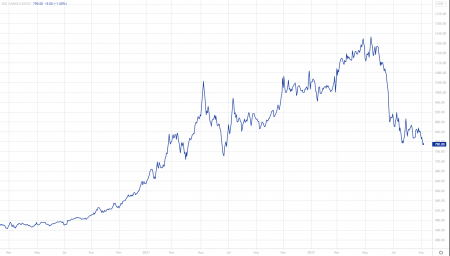

‘Dr Copper’ – generally a bell weather for economic growth is down approximately -30% from highs seen in March.

Inventory levels are at recent lows – reflective of a lack of new copper projects to add to supply.

The forward contract term structure shows that traders expect prices to be robust into the future.

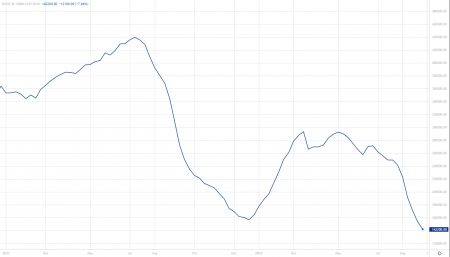

Iron Ore – a key commodity used in steel production & linked to economic activity, is down over 50% since mid-2021.

Inventory levels held at Chinese ports has started to increase. Reflective of a slowdown in the Chinese property market and reduced global demand.

Wheat – a key input of food production and consumption – down around -35% from highs seen in March.

The forward contract term structure shows that traders are expecting prices to stay elevation into 2024. Tightness is expected to reduce thereafter.

Corn – another key component of food production and consumption, down approximately -12% from the highs seen in May.

The forward contract term structure shows that traders expect tightness to reduce, and prices to fall over the next 3 years.

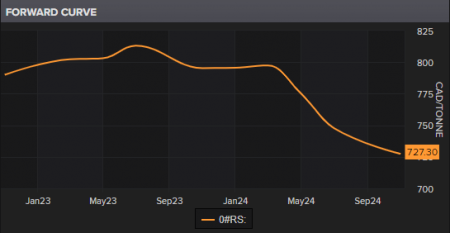

Canola – another key input in food production, down approximately -30% from highs seen in May.

The forward contract term structure shows that traders expect prices to remain sticky until mid-next year.

In summary, most of these commodities are well off from the highs seen earlier this year, when Russia caused havoc to commodity markets. We can also see that on the whole, the term structure for these commodities leads us to believe that we will see further lower prices into the future.

The structural underinvestment (Crude) and lack of new deposit discovery (Copper), provides some food for thought regarding upcoming trading opportunities for these commodities.

Within the core strategies of the Frame Futures Fund, we operate a commodity-only strategy called the ‘B20’.

This strategy trades a universe of major commodities and uses statistical anomalies for entry signals, which allows it to enter positions to capture outliers (tail events).

If you would like to find out more about this strategy, then please call our office on 02 8668 4877.