With multiple companies making progress in the vaccine space, we have begun to envisage a post COVID-19 investment world. This article will aim to discuss:

- The current state of the vaccine race

- What are some of the likely economic impacts of a vaccine becoming readily available

- Given point 2, what are some investment themes that could arise?

Vaccine Update

There are currently more than 170* vaccine candidates in pre-clinical and clinical trials, with 29* of those performing trials on humans. Many wealthier countries are negotiating their own deal with vaccine researchers. Australia for example has negotiated 33.8 million doses of the Oxford University/AstraZeneca vaccine and 51 million doses of the University of Queensland CSL vaccine, worth $1.7 billion in total. There are also 172 countries engaged in the COVAX facility, in which wealthier ‘self-funded’ nations subsidise ‘funded’ countries access to a basket of promising vaccines. There are currently nine* candidate vaccines included with a further nine* under evaluation. If one of these vaccines is successful, member nations have the option to purchase vaccine doses for up to 50% of the population.

Once a vaccine has passed all relevant trials, it still must be approved by regulatory agencies as safe, a process that can take years. After that, large scale production and distribution of the vaccine can begin. The fastest release of a vaccine to date is the vaccine for mumps, which took 4 years to be developed, approved, and released.

Possible Economic outcomes

Revenge spending

If a vaccine is released and people are inoculated in a timely fashion, restrictions on public gatherings will be eased and economies will gradually begin to reopen.

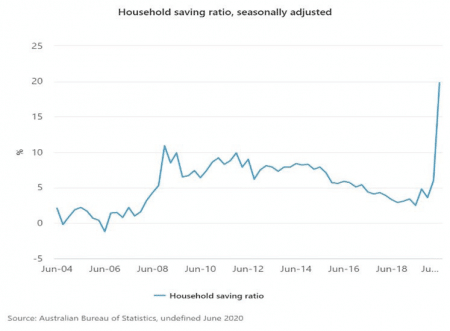

Gross household savings in the June quarter rose by $25.1 billion to $76.8 billion, with gross disposable income increasing 2.2%.

The economic certainty a vaccine provides allows consumers to be more comfortable relaxing their savings levels. We can therefore expect a glut of ‘revenge spending’ when a vaccine arrives and people begin to return to a new ‘normal’ life.

Rising asset prices

As previously discussed in our article ‘Interest Rates & Equity Valuations’, declining interest rates leave investors facing some tough decisions as they seek higher returns on investments. Low interest rates mean investors have little incentive to hold cash in bank accounts or term deposits. They therefore must take on more risk to generate higher rates of return. This process causes cash holdings and term deposits to fall, with equity and property investments increasing. We would expect the increase in demand for these asset classes to drive prices higher in the medium term.

Inflation

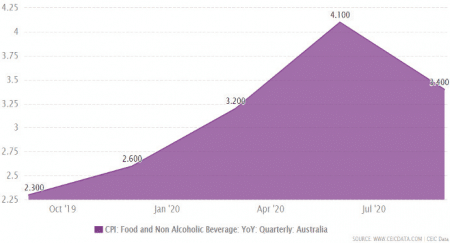

Small businesses (restaurants in particular) have already raised prices to remain viable, as operating costs increased as a result of reduced service space (imposed by restrictions) and higher food prices (food inflation up 1.5% from January 2020 – June 2020).

Given the increase in disposable income, demand-pull inflation seems almost inevitable as consumers ‘revenge spend’ their pandemic savings, leaving business output struggling to keep up.

If the aforementioned inflation comes to pass, we expect to see central banks around the world adjust their quantitative easing (QE) programmes to counteract this spike in inflation. Although global central banks have attempted to generate inflation over the last 10 years (and have thus far failed), the levels of quantitative easing seen due to COVID has been unprecedented. Due to the speed and scale of these global QE programmes, we believe a key risk and trade theme will be around inflation.

Conclusion

With pharmaceutical developers moving closer to distributing a COVID-19 vaccine, we anticipate consumers to launch a wave of ‘revenge buying’. As interest rates are at historically low levels, investors are being forced to take on more risk in order to maintain a reasonable rate of return. We expect this increase in risk taking to support equity and property prices over the medium term. If we do end up seeing inflation due to this surge in spending, a major focus will be around the response from global central banks.

*as at 15.10.2020