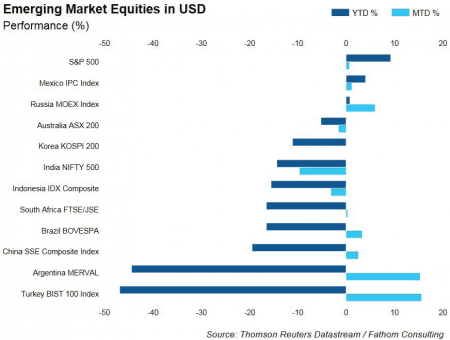

Since the start of the year, the iShares MSCI Emerging Markets ETF (EEM) has declined by 9.34%; simultaneously, the S&P 500 has risen by 9.20%.

Why have we seen such a large divergence between these two markets in returns this year?

A large part of the answer is related to three things:

- The United States Dollar (USD)

- Bilateral trade relationships with the United States and their largest trade partners

- Idiosyncratic issues of some emerging market economies

1. United States Dollar (USD)

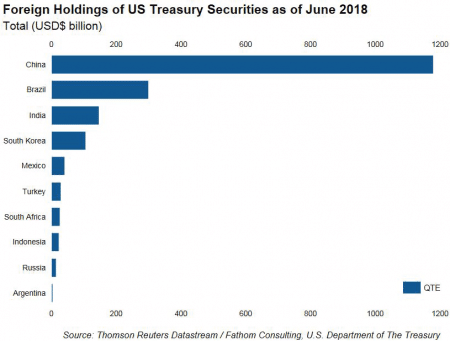

The USD is negatively impacting the largest emerging market (EM) economies due to the levels of US borrowing these economies currently have.

As the United States tighten both their monetary (by increasing interest rates) and fiscal policy (by stopping their bond purchase program), two things are occurring.

- The borrowing costs of these Emerging Market (EM) economies rise as interest rates and over night borrowing rates increase. Because of these increases, the amount they must pay back on a yearly basis also increases, which reduces the amount of fiscal spending within each economy.

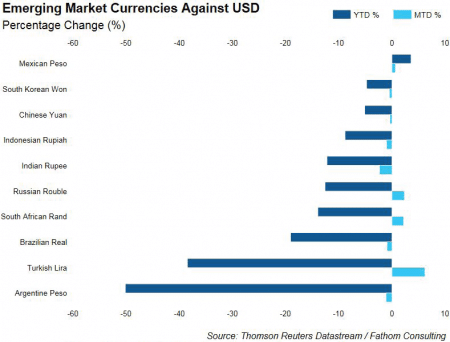

- As a result of the US economy strengthening and interest rates increasing, the USD is strengthening relative to EM currencies. This has been seen across the globe, with extreme movements in these currencies, as shown below. As the USD increases, the value of their debt also increases in local currency terms, making the liabilities of emerging market economies much higher than they may have originally planned.

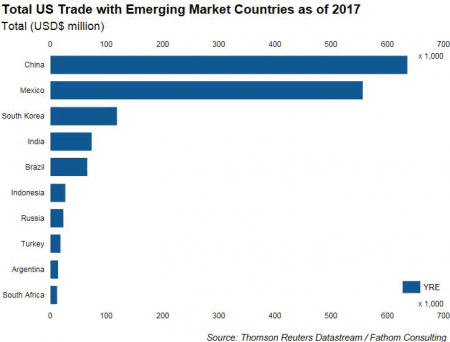

2. Bilateral trade agreements

At the forefront of investors’ minds are the on-going discussions between the United States and their largest trading partners. The negotiations with China and the United States have impacted the Chinese share market (-16.15% YTD (as at 25/09/18)) as well as any other country that trades with the United States (see Figure 1).

The reason that these share markets are experiencing such large divergences in returns can be attributed to the simple fact that these are the economies where Trump is attempting to renegotiate. The economies affected generate most of their revenue from exports and have trade surpluses with the United States. If these trade discussions are negative, the impact will be felt at a country, company and individual level. As these negotiations drag on and the uncertainty about future trade with the United States continues, investors will continue to reduce their investments from these EM economies.

3. Idiosyncratic issues

There have been numerous idiosyncratic issues within major emerging markets, that have also provided volatility to their currencies and equity markets.

In Turkey, the government seems to be dragging its feet to take the necessary policy action to ease the current debt crisis. This has seen the Turkish Lira devalue by approximately 50% this year alone. Brazil are currently in the process of electing a new president, whereby some candidates with extreme policies may be put into power. Recently, there was the stabbing of the far-right candidate Jair Bolsonaro. These events have provided huge volatility to the Brazilian Real and equity market.

Additionally, emerging markets are also having to deal with the devaluation of the South African Rand, Argentina’s investor confidence dropping, Chinese trade issues and the expansion of the India’s trade deficit. There have been multiple events over the last 6 months that have contributed to the large divergence in performance between the S&P 500 and emerging market equity markets. Attempting to project the perfect time to allocate money into these markets is nearly impossible; however, based on previous occurrences of debt crises in emerging market regions, they have typically lasted between 2 and 4 quarters. After this period, market participants slowly and gradually allocate money in these regions; however, whilst doing this, experience large degrees of volatility.