Following on from the article we wrote in December 2018, ‘Outlook 2019’, we outlined four key themes for 2019. The US interest rate path, implications of US-Sino trade negotiations, the European economic situation and Emerging market performance.

The focus of this wire is on the US interest rate path – where have expectations been, where are they now and where they are expected to go.

Where have expectations been?

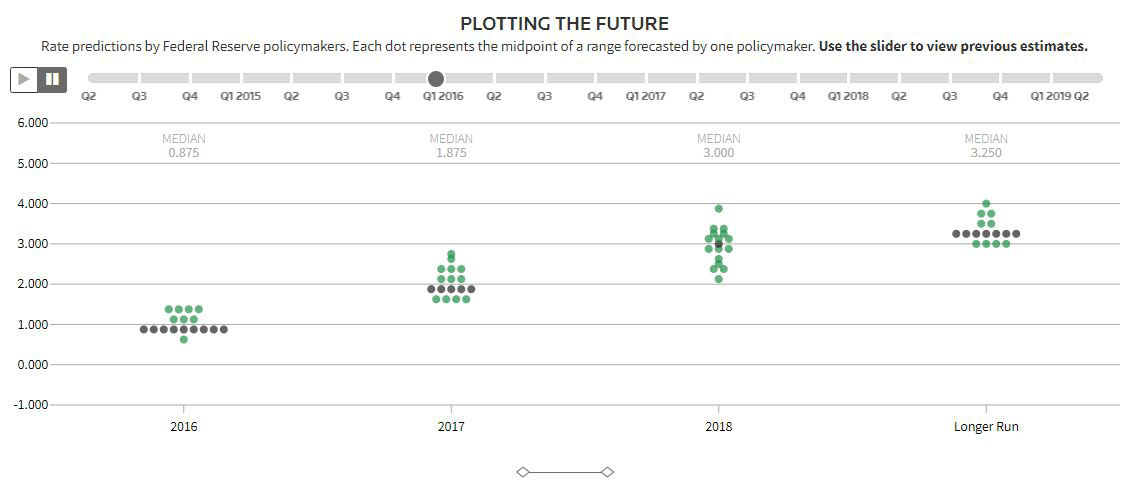

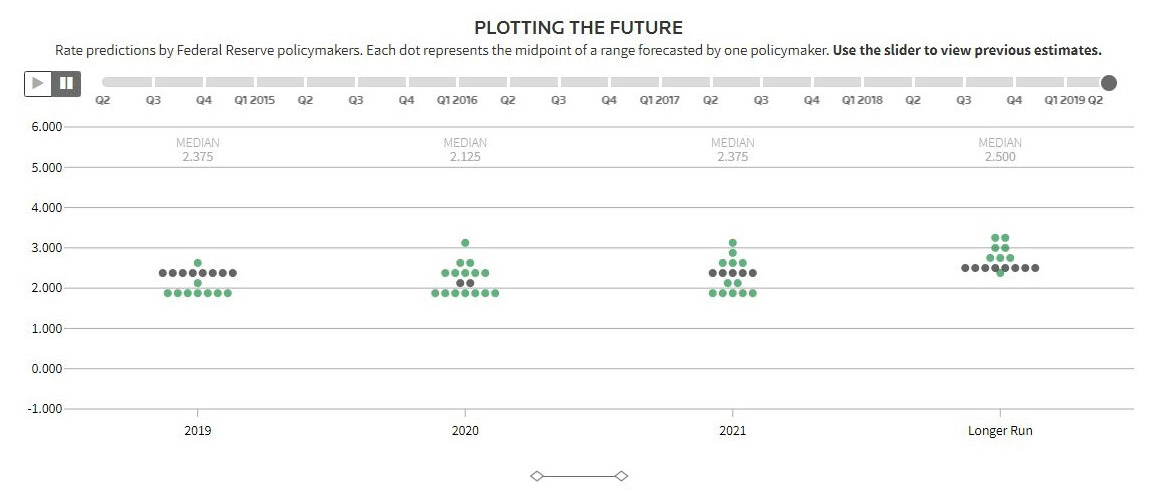

At the start of 2016, the US Federal Reserve (Fed) expected to raise the Federal Funds Rate to 3.00% by the end of 2018 (refer to Chart 1).

Chart 1. Sources: Federal Reserve, Reuters. REUTERS GRAPHICS

However, in December 2018, the US Federal Funds Rate was sitting at 2.25-2.50%. This mismatch of expectations versus reality is consistent over history, where the Fed states they will raise rates more aggressively than what they inevitably deliver.

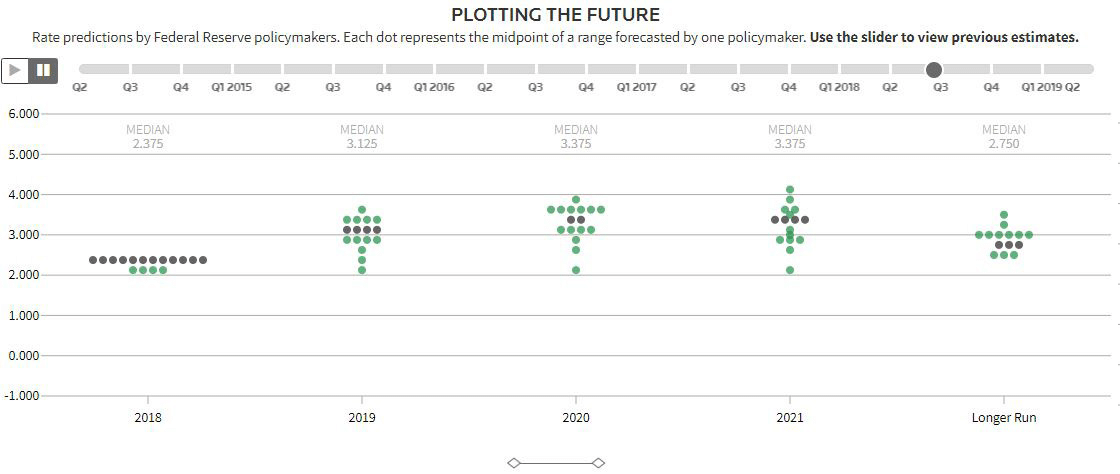

At the start of December 2018, rates were forecasted to increase three times in 2019, which would have brought the US interest rate to 3.00-3.25% (refer to Chart 2).

Chart 2. Sources: Federal Reserve, Reuters. REUTERS GRAPHICS

At that point in time, our view was that projections for three rate rises during 2019 were far too aggressive and that the Fed would have to revise their projections downwards. The justification for this view, was that ongoing US-Sino trade negotiations would impact global economic growth, which would cause the Fed to become more accommodative in their projections.

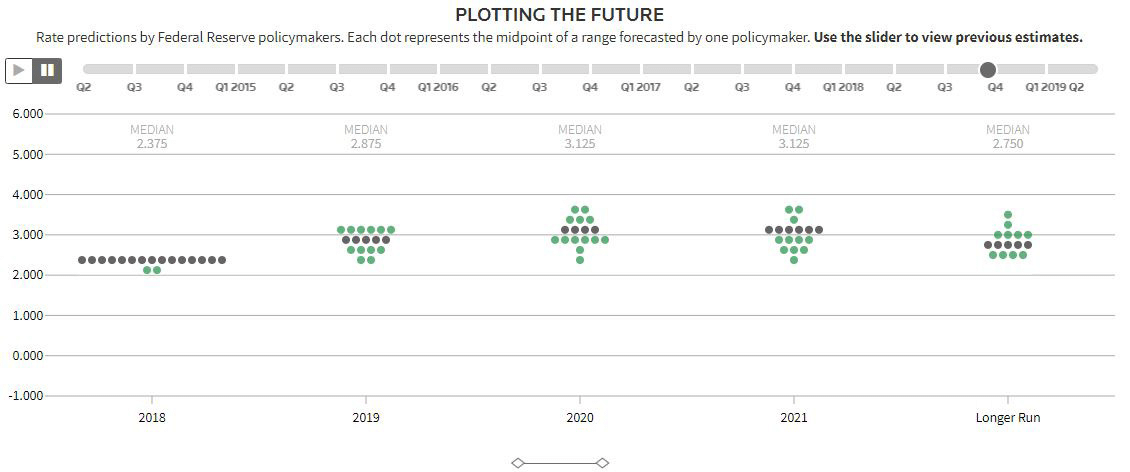

Since December 2018, projections for further rate rises throughout 2019 have continued to decline. At the end of Q4 2018, projections had dropped to two additional rates rises during 2019 (refer to Chart 3).

Chart 3. Sources: Federal Reserve, Reuters. REUTERS GRAPHICS

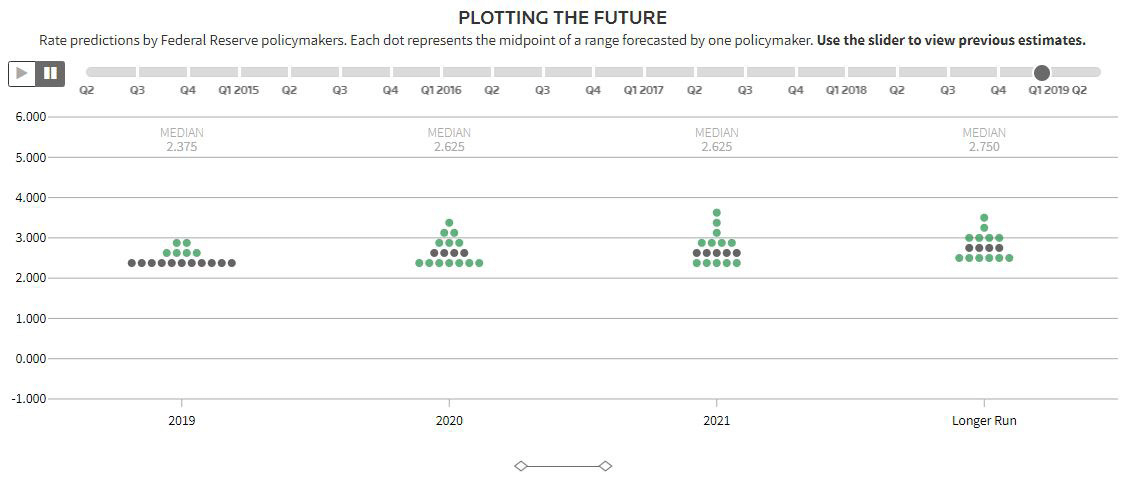

At the conclusion of Q1 2019, expectations had moved to rates staying constant during 2019 (refer to Chart 4). Notably, from Q4 2018 to Q1 2019, projections for the Federal Funds Rate at the conclusion of 2020 had dropped from 3.00-3.25% to 2.50-2.75%.

Chart 4. Sources: Federal Reserve, Reuters. REUTERS GRAPHICS

Where are projections now and where are they expected to go?

Currently the US Federal Funds Rate is 2.00-2.25%. The Fed cut rates at the start of this month, the first cut since December 2008. At the conclusion of Q2 2019, the Fed’s projections for the Federal Funds Rate at the end of 2020 had plummeted to 2.00-2.25% versus their Q4 2018 projection of 3.00-3.25% (refer to Chart 5).

Chart 5. Sources: Federal Reserve, Reuters. REUTERS GRAPHICS

We expect the next update of plot projections for 2019, due for release at the end of this quarter, to be ~50bps below their current projection. Our view is that projections for the Federal Funds Rate at the conclusion of 2020 are still far too optimistic and need to adjust more in line with where interest rate futures are projecting.

At the time of writing, interest rate futures are projecting an interest rate between 1.50-1.75% which indicates are 50 bps cut, while December 2020 interest rate futures are pricing in Federal Fund Rate of 1.00-1.25%.

Conclusion

Recent communication from the Fed has stated that they will adjust the Federal Funds Rate based on economic data, rather than based on a predetermined path. That being said, we note the recent contraction in the Flash Manufacturing PMI data (49.9 actual vs 50.5 expectations, above 50 demonstrates expansion, below 50 demonstrates contraction), the first in approximately a decade, showing that the economic situation in the United States is deteriorating faster than they may had anticipated.