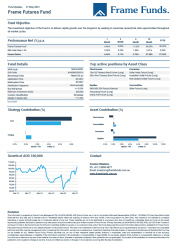

Units of the Frame Futures Fund increased by +5.86% in April. The core strategy contributed +5.16% to performance, whilst the trading strategy added +0.84%.

Our investments in listed Equities contributed +5.69%. Currency, Fixed Income and Commodity investments also rose by +0.10%, +0.22% and +0.37% respectively.

In April, major equity markets stormed higher. With Dow Jones Industrial Average and S&P 500 leading the way. After two months where fixed income markets sold off sharply, we saw a consolidation, which eased concerns that interest rates were going to increase imminently. The Australian share market also rose 3.46% during the month, however most of these gains were generated within the first two weeks of the month. Iron ore and Copper continued to move higher, whilst Gold attempted to break back above $1800. A weaker US Dollar Index supported commodity markets through-out the month.

Largest contributors to the performance were our investments in listed Cryptocurrency businesses (+1.29%), Battery Material producers & explorers (+1.94%) and situational trading opportunities (+1.63%). The largest detractor to performance was our investment in the US Dollar Index (-0.36%).

In terms of fund activity, we continued to build positions in a selection of Copper explorers. Like prior months, we also took advantage of some erratic price action in some of our small cap investments (OEL, DCC, KCC).

At the conclusion of the month, the Fund held 48 investments.

Download the full report by clicking the image below.