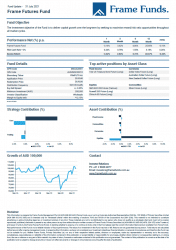

Units of the Frame Futures Fund appreciated by +2.28%. Both the core & trading strategies contributed +1.49% and +1.27% respectively.

Equity and Currency investments added approximately +2.88% and +0.18% respectively, while Commodity and Fixed Income investments were largely flat.

Global equity markets continued to rise in August. Iron ore, copper and crude oil all experienced profit-taking, while foreign exchange markets saw a bout of repositioning, as the Delta strain impacted traditional risk currencies. Fixed Income markets were largely unchanged during the month as market participants awaited further information as to the path of policy tightening.

Our event-based trading added +2.07%, with our investments in China & Hong Kong adding +1.39%. This was positive considering the poor performance seen in this region last month. We have started to see a change in the communication from the People’s Bank of China (PBOC) in recent weeks. This, in combination with restarted liquidity injections, may mean the large retracement we have seen in these markets could well be approaching a short-term bottom.

Largest contributors to the performance were our active trading strategies on the S&P/ASX 200 future contract (+1.16%), our investment in a listed blockchain technology company (+1.18%) and our active trading on the China A50 future contract (+1.38%). Our investment in Fortescue Metals Group was the largest detractor to performance (-0.80%).

In terms of fund activity, we reduced our lower conviction holdings within the core strategy which can be seen in the decreased number of Fund investments. We also actively traded in and out of the Delta impacted ‘re-opening’ businesses (as noted in prior months). We trimmed our lithium & rare earth materials holdings. In our view the euphoria seen in some of these investments at present is somewhat irrational.

At the conclusion of the month, the Fund held 28 investments.

The full report can be downloaded by clicking the image below.