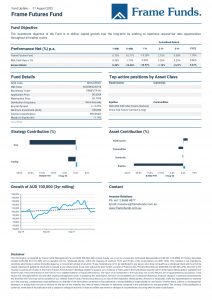

Units of the Frame Futures Fund appreciated by +0.73%. The Fund’s trading strategies added +0.66%, while the core strategy added +0.32%.

Equity and Fixed Income investments rose by +0.85% and +0.13% respectively. Commodity and Currency investments were flat.

Global equity markets continued to experience significant volatility. The S&P500, Nasdaq and Dow Jones were down -4.24%, -5.22% and -3.94% respectively. Volatility across fixed income, currency and commodity markets also continued to expand. Investors spent most of the month attempting to interpret the US Federal Reserve minutes. Initially, the market interpreted that the rate of interest rate increases was going to slow. However, after the Jackson Hole symposium, Federal Reserve Chairman Jerome Powell reiterated, that interest rates will be in restrictive territory for some time. He also continued to reiterate that price stability is the primary mandate of the US Fed, and they will not stop until this has been achieved. Investors took this reiteration negatively and resumed to offload equities and bonds in tandem.

Major commodities continued to swing between the optimism that a slow-down in the rate of interest rate increases may be around the corner, and that further restrictive monetary policy will slow-down economic growth. At the close of the month, most major commodities closed in the red. In currency markets, the one place to hide has been the US Dollar Index. It finished the month up +2.73%, which brings its year-to-date performance to +13.05%.

Largest contributors to performance were our active trading strategies on the S&P / ASX 200 future contract, and our investment in an Australian based fintech company, they contributed +0.76% and +0.14% respectively. Largest detractor was our long position on China A50 future contract which cost the core strategy -0.097%.

In terms of fund activity, exposure levels were kept low during the month which significantly reduced portfolio volatility. This move now allows the Fund to take advantage of both long and short opportunities within both the core and trading strategies.

Looking forward, we will continue to assess incoming data and make suitable investments considering the uncertain investment climate.

The full report can be downloaded by clicking the image below.