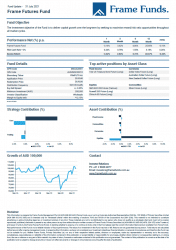

Units of the Frame Futures Fund declined by -3.16%. Both the core and trading dragged on performance, costing –2.22% and -0.72% respectively.

Commodity, Currency and Equity investments detracted -0.22%, -0.19% and -2.75% respectively. Fixed Income investments rose by +0.22%.

July saw continued strength in global equity markets. As in previous months, volatility emerged in concentrated pockets, however equity markets in general trended higher. The US S&P 500 & S&P/ASX 200 finished the month up +2.27% & +1.09% respectively. The Chinese and Hang Seng share markets on the other hand experienced huge downside volatility – the China A-50 Index and Hang Seng Index both closed down -12.60% & -9.94% respectively. This came as a result of continued government crack downs on tech businesses which also extended into the education sector last month.

Again we saw our investments in the battery material space contribute well. The basket of investments which operate across the supply chain added +2.2%. Pilbara Minerals Limited (ASX :PLS) updated the market on the results of its first spodumene concentrate auction. Lynas Rare Earths Ltd (ASX :LYC) announced they were awarded a $14.8m government grant.

Largest contributors to performance were our active trading strategies on the S&P/ASX 200 future contract (+1.84%), our investment in Lynas Rare Earths Ltd (+0.71%) and our investment in Aeris Resources Ltd (+0.49%). Our investments in the Chinese and Hong Kong share markets were the largest detractor to performance.

In terms of fund activity, we continued to accumulate ‘re-opening’ businesses and participated in a selection of private placements in the copper and gold space. Most of our activity was centred around the analysis of central bank communication and how the recent COVID-19 Delta strain may force a change in rhetoric.

At the conclusion of the month, the Fund held 35 investments.

The full report can be downloaded by clicking the image below.