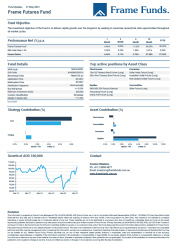

Units of the Frame Futures Fund increased by +0.04%. The core strategy detracted -0.36% to performance, whilst the trading strategy added +0.63%.

Equity investments contributed +0.17%. Currency and Fixed Income investments rose by +0.32% and +0.24% respectively, while Commodity investments were lower by -0.46%.

Global equity markets continued to move higher during the month, however domestically the S&P/ASX 200 experienced a period of volatility once again. The index advanced aggressively for the first 2 weeks, leading into options and futures rollover. This is significant, because at the end of May, the index options market saw a significant spike in open interest in short-dated out-of-the-money calls with strikes at the 7300-point level. To hedge this open interest, market makers must buy the index, which meant the market rose with broad sector participation. On expiry, the majority of the open interest was rolled to further out-of-the-money July and August expiries, meaning at some stage during July & August, we may see a repeat of this upside volatility.

Towards the end of the month, minutes from the May Federal Open Markets Committee meeting sparked a brief selloff in global equity markets as the Fed brought forward its tapering expectations. The market subsequently cooled and became rangebound for the remainder of the month.

The price of copper declined during the month which dragged on the performance of our ASX listed small to mid-cap copper investments by -0.63%. Silver also saw selling pressure as the US Dollar Index strengthened.

Largest contributors to the performance were our active trading strategies on the S&P/ASX 200 future contract (+2.14%), our investment in Aeris Resources Ltd (+0.61%) and our investments in rare earth and battery material businesses (+1.68%). The largest detractor to performance was our investments in the China A-50 future contract (-0.81%).

In terms of fund activity, we continued to take advantage of the latest Australian lockdowns due to COVID-19 and accumulated investments in ‘re-opening’ businesses, took advantage of mispricing within some junior tech companies and trimmed some global equity exposure.

At the conclusion of the month, the Fund held 30 investments.

The full report can be downloaded by clicking the image below.