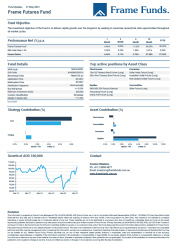

Units of the Frame Futures Fund increased by +6.96% in May 2021. The core strategy contributed +6.17% to performance, whilst the trading strategy added +0.94%.

Our Equity investments contributed +6.07%. Currency and Commodity investments rose by +0.33% and +0.63% respectively, while Fixed Income investments were marginally higher.

May saw equity markets continue to move higher. As mentioned last month, fixed income markets have consolidated at current levels, which allowed investors to focus on how well the global economy was rebounding, rather than focussing on the risk of near-term interest rate rises. The Australian share market had a positive month, however once again, was well supported by our sector weightings in the big four banks, which continued to perform well. There seemed to be a constructive rotation into listed gold companies during the month. This rotation was supported by a weaker US Dollar Index.

Our exposure to gold and silver added +2.72% to performance. Largest contributors to the performance were our investments in China A-50 equity market (+1.72%), investment in Aeris Resources Ltd (+1.61%) and S&P/ASX 200 Future trading (+1.40%). The largest detractor to performance were our investments in listed cryptocurrency businesses (-1.18%).

In terms of fund activity, we have spent significant energy reviewing our investments which are held within the core strategy. Last month we reduced some holdings based on current market conditions and our outlook for the next 12 months. We removed our investments in ASX-listed cannabis companies, reduced some small-cap copper exposure on euphoric price action. We also continued to add exposure to emerging and frontier equity markets.

At the conclusion of the month, the Fund held 38 investments.

The full report can be downloaded by clicking the image below.