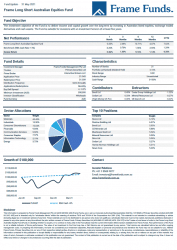

The Frame Long Short Australian Equity Fund rose +2.34% in April. Comparatively, the XJO rose +3.46% for the period.

The Australian share market started April strongly, with the ASX200 rising almost 4% in the first 2 weeks of the month. There was no follow through however and the market yet again became range bound as quarterly reporting approached. Investors became reluctant to take large positions with valuations already stretched and without a catalyst to spark a move either way, equity markets consolidated on light volume. Commodity markets and the homebuilder sector continued their hot streak, aided and abetted by the ongoing effects of stimulus and reopening economies. This assisted our investments in Mineral Resources (MIN), Reece Group (REH) and Boral Limited (BLD) which contributed +1.22%, +0.96% and +0.63% respectively.

The bottom three performers and their approximate detractions were Challenger Ltd (CGF), Harvey Norman Holdings Ltd (HVN) and Blackmores Limited (BKL). These investments detracted -0.60%, -0.46% and -0.46% respectively. Selling pressure in both Challenger and Blackmores came after disappointing quarterly reports, while Harvey Norman saw some profit taking after a significant move in March.

Fund activity over the month was light. We initiated investments in Brickworks Limited (BKW) and Codan Limited (CDA). We took part in the Seven Group Holdings Ltd (SVW) placement at a 2.5% discount. The Fund exited its investment in Vocus Group Ltd (VOC) as the takeover with Consortium of Macquarie Infrastructure and Real Assets (MIRA) and Aware Super entered the scheme implementation deed phase.

The top sector weighting remains materials at 42.88%, with industrials our next largest investment at 10.34%. We continue to believe companies oriented around the production and distribution of materials and capital goods will be the main beneficiaries of the economic recovery. This is as a result of the increased money supply in the economy created by multiple rounds of fiscal stimulus and accommodative monetary policy.

At the end of April, the Fund held 23 investments.

Download the full report by clicking the image below.