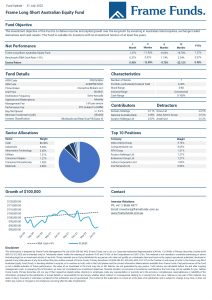

Units of the Frame Long Short Australian Equity Fund increased 1.27% in July. Comparatively, the S&P/ASX200 advanced 5.74% for the period.

Equity markets rebounded in July, making a strong start to the new financial year. The market took negative surprises in United States GDP and inflation well – investors seemed to believe deteriorating economic conditions mean the Federal Reserve will soon pivot to be more accommodating. In Australia, the Reserve Bank lifted interest rates by another 50 basis points. Both the market and economists expect the same again for the Bank’s August meeting as inflation lifted to 6.1% year-on-year. This would take the cash rate to 1.85%, the highest level since April 2016.

Top equity contributors came from both long and short strategies. On the long side, National Australia Bank Ltd (ASX: NAB) and Aurizon Holdings Ltd (ASX: AZJ) added +0.09% and +0.07% respectively. NAB benefitted from the recovery in the broader financial sector, while Aurizon completed their acquisition of One Rail Australia. Short trades in Domain Holdings Australia Ltd (ASX: DHG) and Life360 Inc (ASX: 360) contributed 0.11% and 0.06% respectively. Our discretionary active trading strategy also contributed +1.43%.

Largest detractors for the month were long positions in Orora Ltd (ASX: ORA) and Atlas Arteria Group (ASX: ALX), which cost -0.21% and -0.15% respectively. We exited our investment in Orora as it lost momentum, while Atlas Arteria fell after IFM Group failed to make a bid for the company.

We remain cautious moving forward. We are prepared to invest in strong businesses that have withstood market pressure if the current rally is sustained. It is our view that current conditions are conducive to market mispricing that will present both long and short opportunities going forward.

At the conclusion of the month, the Fund held 86.90% in cash.

The full report can be downloaded by clicking the image below.