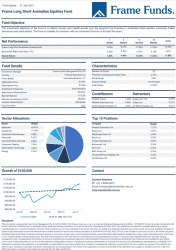

Units of the Frame Long Short Australian Equity Fund increased 2.06% in July. Comparatively the S&P/ASX 200 rose 1.09% for the period.

Global equity markets rose again last month, with the ASX200 posting it’s tenth straight month of gains. The market was rangebound for the first half of the month before the materials and industrials sectors drove the market to fresh all-time highs. Yields continued to decline as global central banks maintained their accommodative policy stances amid mixed economic data that fed the ‘peak growth’ narrative.

Mineral Resources (ASX: MIN) was the top equity contributor once again as the battery metal theme returned to centre stage. The approximate contribution was 0.94%. Seven Group Holdings (ASX: SVW) and BlueScope Steel (ASX: BSL) also contributed 0.56% and 0.55% respectively, where the latter benefitted from materials sector tailwinds and the announcement of record second half year results. Seven Group appeared to benefit from Boral’s (ASX: BLD) rejection of their takeover offer. Discretionary activity in the ASX200 SPI future contract contributed a further 1.08%.

The largest detractors were Kogan.com Limited (ASX: KGN), Codan Limited (ASX: CDA) and A2 Milk Company Limited (ASX: A2M), costing approximately 0.28%, 0.27% and 0.21% respectively. While Kogan’s July business update seemed positive on face value, continued questions around their inventory management sent the stock price lower. A2 Milk struggled to maintain its turnaround momentum after the ACCC reauthorised restrictions on the marketing of infant formula.

Our investments in materials continued to grow with the sector – they now make up 45.45% of the portfolio. We took advantage of an event driven arbitrage opportunity in Strickland Metals (ASX: STK) that arose as a result of our participation in their placement. Bellevue Gold (ASX: BGL) also presented trading opportunities after upgrading their resource at the start of the month.

We were pleased to pay our first distribution at an approximate rate of 2% per annum.

At the conclusion of the month the fund held 22 investments.

The full report can be downloaded by clicking the image below.