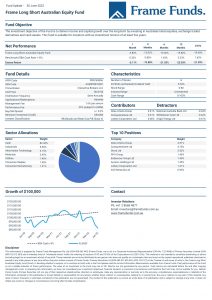

Units of the Frame Long Short Australian Equity Fund decreased -4.80% in June. Comparatively, the S&P/ASX200 declined by -8.92% over the same period.

Australian equities suffered their worst month of performance since March 2020 as investors came to grips with a more hawkish Reserve Bank and a deteriorating global economy. A shock 50 basis point increase to the cash rate kicked off a fortnight of selling, as investors rapidly priced in a more aggressive monetary policy tightening cycle. Commodity prices also fell over the month, as slower global growth led to reduced demand for raw materials. This caused additional downside pressure on the Australian market, with the materials sector falling -12.44% in June.

Top equity contributors for the month were Atlas Arteria Group (ASX: ALX), Computershare Ltd (ASX: CPU) and Lottery Corporation Ltd (ASX: TLC). They added +0.41%, +0.21% and +0.06% respectively. Atlas Arteria became a possible takeover target as IFM Investors revealed a 14.96% stake in the firm, acquired at a 14% premium. Lottery Corporation Ltd completed a successful split from Tabcorp Holdings Ltd (ASX: TAH). Media speculation around Lottery Corporation being a prime private equity takeover target drove its share price higher.

Largest detractors for the month were National Australia Bank (ASX: NAB), Whitehaven Coal (ASX: WHC) and Origin Energy (ASX: ORG). They detracted -0.44%, -0.42% and -0.41% respectively. NAB fell in line with the broader financial sector, as higher interest rates raised concerns around loan defaults. Whitehaven and Origin depreciated as energy commodity prices reversed. We are no longer invested in these businesses.

Overall, our risk management practices worked well in June. We entered the month with a substantial cash holding and continued to exit positions that lacked momentum. In previous months the market has rallied off lows after initial selling, however sellers followed through in June. We have maintained tight stops on our long-term holdings and continue to seek out shorter term opportunities when companies enter extreme overbought or oversold conditions.

The fund is currently holding approximately 82.43% cash.

The full report can be downloaded by clicking the image below.