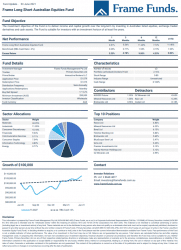

Units of the Frame Long Short Australian Equity Fund increased +3.51% in June. Comparatively, the S&P/ASX 200 rose +2.11% for the period.

June was an interesting month for global markets as most major equity markets continued to move higher, however the divergence seen between the Dow Jones Industrial Average and the Nasdaq was significant once again. Last month, money flowed through to large cap tech stocks rather than banks and industrials, the reverse of prior months. 30-year US treasury yield continued to decline, which provided support to this trade.

Top equity contributors were Mineral Resources Limited (ASX: MIN), Brickworks Limited (ASX: BKW) and Reece Limited (ASX: REH) which all appeared to benefit from investors positioning before reporting season. Their approximate contributions were +1.00%, +0.96% and +0.93% respectively. Discretionary trading activity in the ASX200 SPI futures contract contributed +1.95%.

Oz Minerals Limited (ASX: OZL) was the weakest performer, detracting -0.65%. The catalyst for this profit taking was China raising the possibility of releasing reserves to calm recent price rises. Copper was subsequently sold off. We expect this to be a temporary measure to ease short-term price concerns. We remain bullish on global long-term copper demand. Nuix Limited (ASX: NXL) continued to be sold off as governance and legal complications persisted over its IPO. It detracted approximately -0.28%. Codan Limited (ASX:CDA) also detracted approximately -0.18% after one of the Directors sold down some of their holdings.

In terms of fund activity, advances in our materials names increased our weighting in the sector to 44.25%. We continue to believe companies in this sector will perform well into the upcoming reporting season. Trading opportunities arose in Tesserent Limited (ASX: TNT) after they increased earnings guidance for the 2021 financial year. We also capitalised on broader market moves through ASX200 futures exposure.

At the conclusion of the month, the Fund held 22 investments.

The full report can be downloaded by clicking the image below.