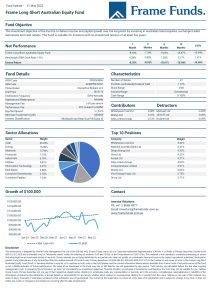

Units of the Frame Long Short Australian Equity Fund decreased -8.64% in May. Comparatively, the S&P/ASX200 declined by -3.01% for the month.

The Australian share market continued to struggle in May. The month began with the RBA increasing interest rates 25 basis points. Governor Lowe highlighted the need to return to a ‘business as usual’ monetary policy environment, given inflation and growth were running ahead of the Bank’s forecasts. Equity markets fell as investors digested the beginning of quantitative tightening and further interest rate hikes. Realised volatility remained high over the month with no sectors exhibiting strong outperformance.

Top equity contributors for the month were Whitehaven Coal Ltd (ASX: WHC), Worley Ltd (ASX: WOR) and Atlas Arteria Group (ASX: ALX). They contributed +0.30%, +0.16% and +0.12% respectively. Coal prices continued their charge higher as energy shortages persisted around the globe. Worley announced several new contracts over the course of the month which benefitted their share price. Atlas Arteria moved higher off the back of increased travel as the world continues to move past the COVID-19 pandemic.

Largest detractors for the month were Metcash Ltd (ASX: MTS), JB Hi-Fi Ltd (ASX: JBH) and Nufarm Ltd (ASX: NUF). They detracted approximately -0.42%, -0.42% and -0.39%. All three businesses suffered at the hands of a gloomy global outlook spurred on by unsustainably high prices and poor sales prospects. We have since exited our investments in Nufarm and Metcash.

As volatility remained high and the global growth outlook worsened, we began to reduce equity exposure. We exited several of our positions in the materials space while retaining our energy exposure as global supply remains tight.

At the conclusion of the month, the Fund now held approximately 39.69% in cash and had 27 investments.

The full report can be downloaded by clicking the image below.