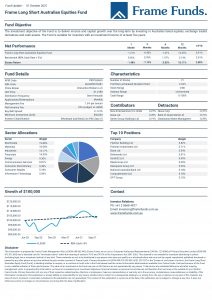

Units of the Frame Long Short Australian Equity Fund decreased -1.21% in October. Comparatively the S&P/ASX200 declined -0.12% for the month.

October was characterized as a relatively low volatility month, as the Australian share market closed fractionally lower. Investor focus was on the bond market as yields spiked due to inflationary concerns. There appeared to be a mismatch between central bank rhetoric and market pricing of interest rate expectations around the globe. It remains to be seen if central banks will succumb to market pressure or continue with the same tapering timeline. Only time will tell.

October was another busy month for the Fund, starting out with approximately 36% in cash. As the market looked to hold steady over the course of the month, the strategy began allocating into industries that look poised to benefit from higher rates in the medium term, namely financials and real estate. We opened positions in Macquarie Group (ASX: MQG), National Australia Bank (ASX: NAB), Scentre Group (ASX: SCG), GPT Group (ASX: GPT), National Storage (ASX: NSR), Waypoint REIT (ASX: WPR), Computershare (ASX: CPU) and Cleanaway Waste Management (ASX: CWY). We exited our position in Alumina Limited (ASX: AWC) as the aluminum price corrected.

Top equity contributors were Nine Entertainment Co Holdings Ltd (ASX: NEC), Boral Ltd (ASX: BLD) and Seven Group Holdings (ASX: SVW), which contributed +0.27%, +0.20% and +0.19% respectively. Boral benefitted from the completed sale of various building product lines which will add to surplus capital and reduce net debt. Both Seven Group and Nine moved higher on no specific news. Discretionary activity in the ASX200 SPI futures contract added +0.93%.

The largest detractors were NewsCorp (ASX: NSW) and Bank of Queensland (ASX: BOQ), which cost -0.37% and -0.31% respectively. NewsCorp fell after the release of their 2021 annual report, despite reporting their most profitable year on record. Bank of Queensland fell after they completed the sale of St Andrew’s Insurance for a loss. After a considerable reshuffle of the portfolio over the last two months, real estate is now our heaviest weighted sector at 19.88%.

At the conclusion of the month, the Fund held 21 investments.

The full report can be downloaded by clicking the image below.