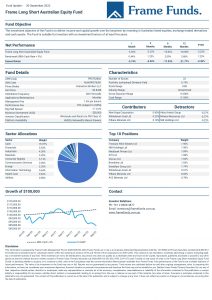

Units of the Frame Long Short Australian Equity Fund declined -3.30% in September. Comparatively, the S&P/ASX200 declined -7.34% for the period.

Aggressive selling pressure returned to global financial markets in September. Another upside CPI surprise out of the United States sparked fresh fears inflation may be more persistent than previously expected. Both equity and bond markets took a hit as investors adjusted to the idea of higher interest rates for longer. In Australia, the cash rate was increased to 2.35%, the highest level since December 2014. At the close of the month, market pricing suggested at 79% chance of a fifth consecutive 50 basis point increase to 2.85%. The implied terminal rate is now over 4%.

Alternative energy commodities were top performers once again. Our investments in New Hope Corporation Ltd (ASX: NHC) and Whitehaven Coal Ltd (ASX: WHC) contributed approximately +0.40% and +0.29% respectively. Energy market turmoil continued in Europe, aided and abetted by leaks in the Nord Stream gas pipelines. Pilbara Minerals also contributed +0.18% as spodumene concentrate prices at auction continued to exhibit significant strength. The strategy took profit in these businesses but has maintained a smaller core position in the portfolio.

Largest detractors were Atlas Arteria Group (ASX: ALX), Mineral Resources Ltd (ASX: MIN) and NIB Holdings (ASX: NHF). They detracted approximately -0.27%, -0.27% and -0.22%. Atlas Arteria fell after they announced their acquisition of a majority interest in the Chicago Skyway, a deal that required them to raise ~$3.1 billion AUD. Mineral Resources experienced a choppy month, with falling iron ore prices offset by leaked news that suggested they could list the lithium component of the business. NIB fell with the broader market.

Fund performance benefitted from tight risk management and low exposure. Our longer-term strategies remain defensive, while short-term volatility presents opportunities to trade long and short. Capital preservation remains our focus as it is our view that elevated volatility will continue for some time.

At the conclusion of the month the Fund held 76.97% in cash.

The full report can be downloaded by clicking the image below.