Weekly Update | February 23, 2024

Let’s hop straight into five of the biggest developments this week.

1. Canadian trimmed CPI slumped to 3.4% y/y

Inflation in Canada is thawing at a faster pace than previously thought as the deflationary momentum strengthens across board. The trimmed CPI in the year to January fell to 3.4%, a major reduction on the previous 3.7% as well as the paltry reduction to 3.6% forecasted by market participants. This marked the lowest increase since December 2021, a testament to the extent to which the current historically high interest rates have restricted price elevation in Canada.

2. Australian wage price index fell to 0.9% q/q

Australian businesses have seen the wage price index fall to the market predicted figure of 0.9%, receding on the previous 1.3% that had marked the largest rise in recent history. This comes as a much-needed reprieve for businesses that now pay record interest rates.

3. French flash services PMI rallied to 48.0

The recovery in the critical French service sector remains on course and is gaining momentum at a faster rate than expected. The flash services’ PMI marked higher to 48.0, resoundingly beating the previous 45.4 as well as the meagre 45.7 markets expected. With the strongest posting yet since June 2023, it is apparent that the French economy is impressively digesting high interest rates.

4. German flash manufacturing PMI faltered to 42.3

The all-important German manufacturing sector reversed its previous period of successive increases in productivity, which dealt a blow to its recovery efforts. The manufacturing PMI shuttered to 42.3, a massive decline from the previous upward revision of 45.5. This came as a shock to markets that had priced in on a healthy continuation in the previous trend to rise to 46.1. The inference is that German manufacturing is highly susceptible to volatility in petroleum prices.

5. US flash manufacturing PMI surged to 51.5

Growth in the US manufacturing sector remained on trend after the sector rebounded from recession to post better than expected activity in February. The flash manufacturing PMI roared to 51.5, extending on the previous festive momentum figure of 50.7 and overshooting the 50.5 market prediction. In essence, American manufacturing is unbowed by record interest rates.

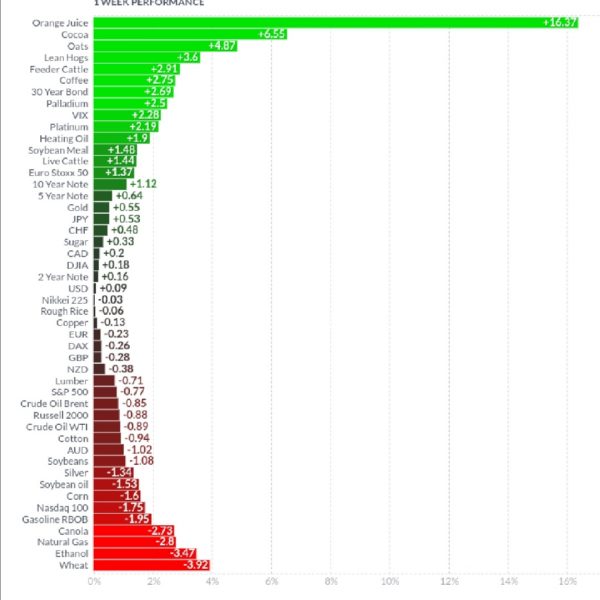

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Cocoa and natural gas were up on seasonality as colder than expected conditions persist. The VIX retraced significantly as markets revised impending geopolitical risk lower, holding to the view that the conflict in the Middle East will be a protracted stand off rather than an explosive flare up. Global indices trended higher with a number of large businesses reporting earnings. The Eurostoxx 50 netted a 2.4% gain. Lean hogs and feeder cattle rose on improving conditions in Australia as rains continue and farmers opt to retain stock. The energy complex remained hot on ongoing supply chain headwinds in the critical Red Sea route, while US strikes on Iranian pipelines kept prices on edge. Soybean, oats and corn were down on oversupply as successive bumper harvests play into a promising upcoming season of planting.

Here is the week’s heatmap for the largest companies in the ASX.

An overall mixed week for the ASX with give- and- take notable between bulls and bears across all sectors. Financials were upbeat on better business conditions after the labour cost index reported significantly lower, encouraging labour uptake. Bulls were firmly in control with most stocks recording gains. WBC and GMG were in overdrive to record +6.7% and +4.1% gains respectively. IAG and ASX were among laggards in the group to close >-3% down. Non energy miners were equally mixed with bulls largely in charge. MIN and PLS led the charge while bear activity was most notable in S32 and RIO. Healthcare stocks were also largely green with RMD being the only island of red in the sea of green, trailing – 0.72%. Transporters and consumer services were all green without exception.

An overall mixed week for the ASX with give- and- take notable between bulls and bears across all sectors. Financials were upbeat on better business conditions after the labour cost index reported significantly lower, encouraging labour uptake. Bulls were firmly in control with most stocks recording gains. WBC and GMG were in overdrive to record +6.7% and +4.1% gains respectively. IAG and ASX were among laggards in the group to close >-3% down. Non energy miners were equally mixed with bulls largely in charge. MIN and PLS led the charge while bear activity was most notable in S32 and RIO. Healthcare stocks were also largely green with RMD being the only island of red in the sea of green, trailing – 0.72%. Transporters and consumer services were all green without exception.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.