Weekly Update | May 26, 2023

It has been a busy week in the Frame Funds office, with strategy development the key focus.

Let’s hop straight into five of the biggest developments this week.

1. German flash manufacturing PMI falls to 42.9

The German flash PMI surprised market commentators by far missing the 44.9 forecast to pandemic lows, the biggest slump in manufacturing since May 2020. Decline in manufacturing is underpinned by a sharp decline in new orders.

2. Reserve Bank of New Zealand raised official cash rate to 5.5%

On Wednesday, the central bank of New Zealand raised interest rates by 25 basis points to mark the most aggressive hiking rate in modern history over 14 years. The RBNZ hinted at holding the current rates through to mid 2024.

3. British CPI Y/Y beat forecast at 8.7%

Despite coming higher than the 8.2% expected, the data showed a marked slowdown in inflation. The British economy is showing minor signs of recovery from the impact of the war between Russia and Ukraine as the monetary policies of the Bank of England begin to have impact.

4. US unemployment claims rise to 229K

The US unemployment claims rose marginally from the previous 225K claimants but we’ll below the 249K market projection. The US economy seems to be weathering multipronged headwinds with tenacity, chief of them being the unproductive debt sealing negotiations.

5. US preliminary GDP Q/Q rises by 1.3%

The Thursday release beat the expected spectator consensus of 1.1%. Given the many issues and concerns, the year-on-year comparative rise in GDP went a long way to reinforce the relative strength in the US economy.

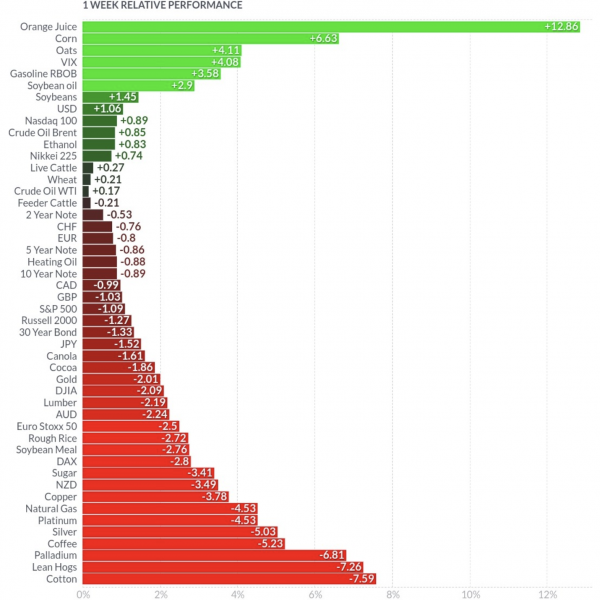

Here is a heatmap of the various commodities for the week.

We saw positive moves for soybean oil. Orange juice, corn, the VIX and oats remain strong from recent week. There’s mean reversion in cotton while palladium, lean hogs and natural gas have remained weak.

Here is the week’s heatmap for the largest companies in the ASX.

The ASX performed poorly for the week with most stocks in the red while CSL demonstrated relative strength.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.