Weekly Update | June 02, 2023

It has been a busy week in the Frame Funds office, with strategy development as the key focus.

The following five landmark data releases were the most consequential, informing our strategy development for the week:

1. Australian CPI shows a y/y increase of 6.8%

Rising from last month’s figure of 6.3%, and ahead of expectations of 6.4%, Australia’s inflation nightmare continues. All eyes are now on the RBA as stubbornly rising prices put a spanner in the works for their plans to maintain interest rates at 3.85% until next year.

2. Canadian GDP dropped to 0%

On Wednesday, data showed that the Canadian economy ground to halt, and indicated a recession in the month of April. Although better than expectations of a -0.1% decline, the trend in the data showed a continue slow down from the prior months release of 0.1% growth.

3. German preliminary CPI m/m slumps to -0.1%

Deflation is gaining momentum in the German economy after inflation data fell below the 0.2% expectations of the market. After multi-pronged efforts to thaw inflation, it seems their efforts seem to be working for the Eurozone’s largest economy.

4. US Job openings surges to 10.1 M

The remarkable rebound of the US economy is gaining speed with 10.1 million non-Farm job openings reported for the end of April. Recession fears eased as the data beat market expectations of 9.41M, a marked improvement from the 9.75M previously reported. The resilience of the labor market is reassurance that the US economy still has some fuel in the tank.

5. Eurostat CPI flash estimate y/y falls to 6.1%

On Thursday, Eurostat announced annual inflation of 6.1%, the lowest annual inflation rate for the Eurozone since March 2022. Spearhead by the stabilization of fuel prices since the fallout of the Russia-Ukraine conflict, the data was much lower than the previous release of 7% and market consensus of 6.3%.

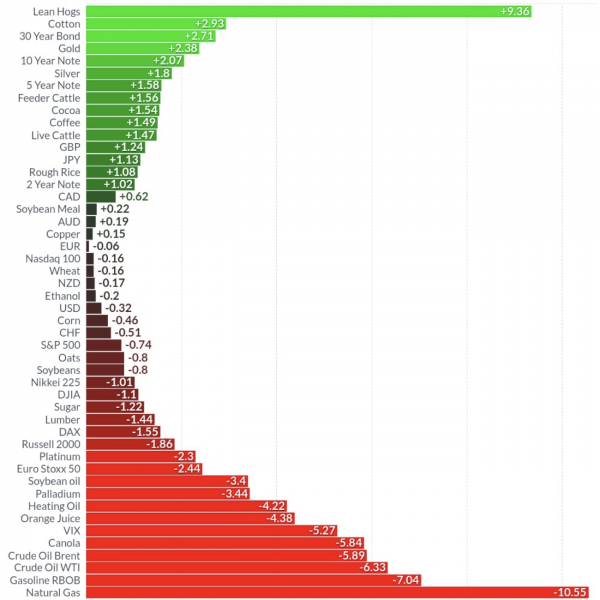

Below shows the performance of a range of futures markets that we track. Some of these are included within the universe of our multi-strategy hedge fund.

Lean hogs had a huge week. Cotton, Gold and 30 Year bonds gold reverted after last week’s underperformance. An inverse to this is Crude and Natural Gas who were leaders last week.

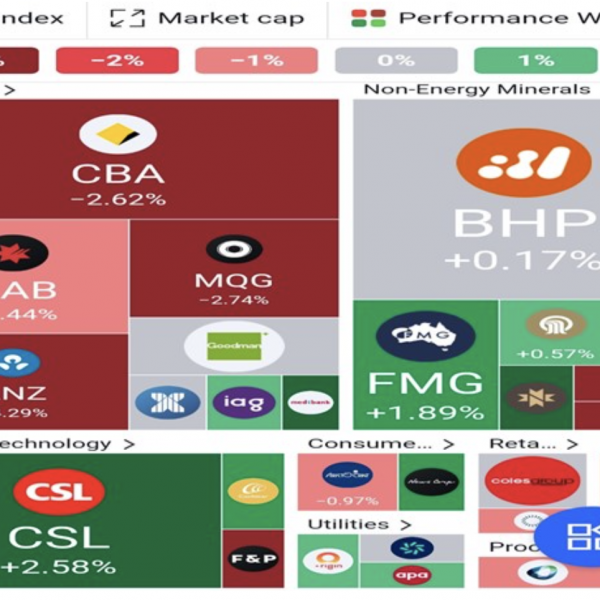

Here is this week’s heat map for the largest companies listed on the ASX.

The ASX 200 has had a mixed week with CBA, NAB and ANZ dragging the index down while CSL and FMG did most of the heavy lifting.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.