Weekly Update | June 09, 2023

It has been another busy week in the Frame Funds offices, with idea generation as the key focus.

Let’s hop straight into five of the biggest developments this week.

1. Reserve Bank of Australia raises the cash rate to 4.1%

On Tuesday, the RBA escalated its offensive on Australia’s runaway inflation by raising interest rates 25 basis points, surpassing market expectations that it would hold rates at 3.85%. The release demonstrates the central bank’s determination to go out of its way to meet its inflation targets.

2. Australian GDP q/q growth slows down to 0.2%

The Australian economy continues to slow. It has continued to lose steam over the last 6 months. The report came in much lower than the previous release of 0.6% as well as the market consensus of 0.3%. Key observations were the continued decline in household consumption, and a reduced savings rate of 3.7% from the prior 4.4%.

3. Canada raised overnight rate by 25bps

The BOC fired a warning shot of a possible interest rate hike in June, as they raised the overnight rate to 4.75%, beating market expectations of a hold at 4.5%. Once again it shows a commitment from the BOC to take further action to curtail rampant inflation.

4. US ISM services PMI falls to 50.3

The American services PMI reignited concerns about the health of the US economy after falling short of the market expectations of 52.6, and the previous release of 51.9. Outside of COVID and the random December reading, this is the lowest release in 14 years. Such a poor number has raised further concerns of a US recession.

5. US unemployment rises to 261k

Worse than expected unemployment claim figures attracted fresh scrutiny into the outlook of the US economy. From the previous 233k, the data exceeded the 236k market consensus. The labour market has stood out as the buttress against a lacklustre economy. This increase presents further complications to policy makers; however markets may view this as a positive that the effect of rising rates is slowly working their way through the economy.

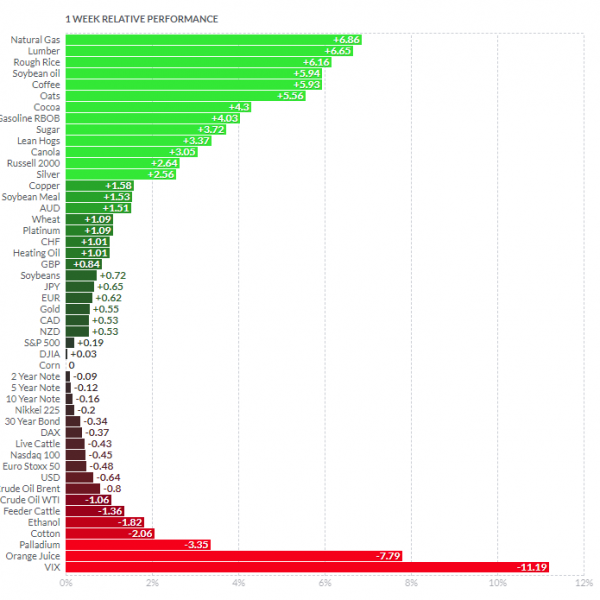

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the week, Natural Gas and Gasoline prices spiked. Rough rice, Coffee, and Oats all have rebounded after a mediocre growing season in the US. Orange Juice reversed some of its recent stellar performance, while Palladium hit lows not seen since 2020.

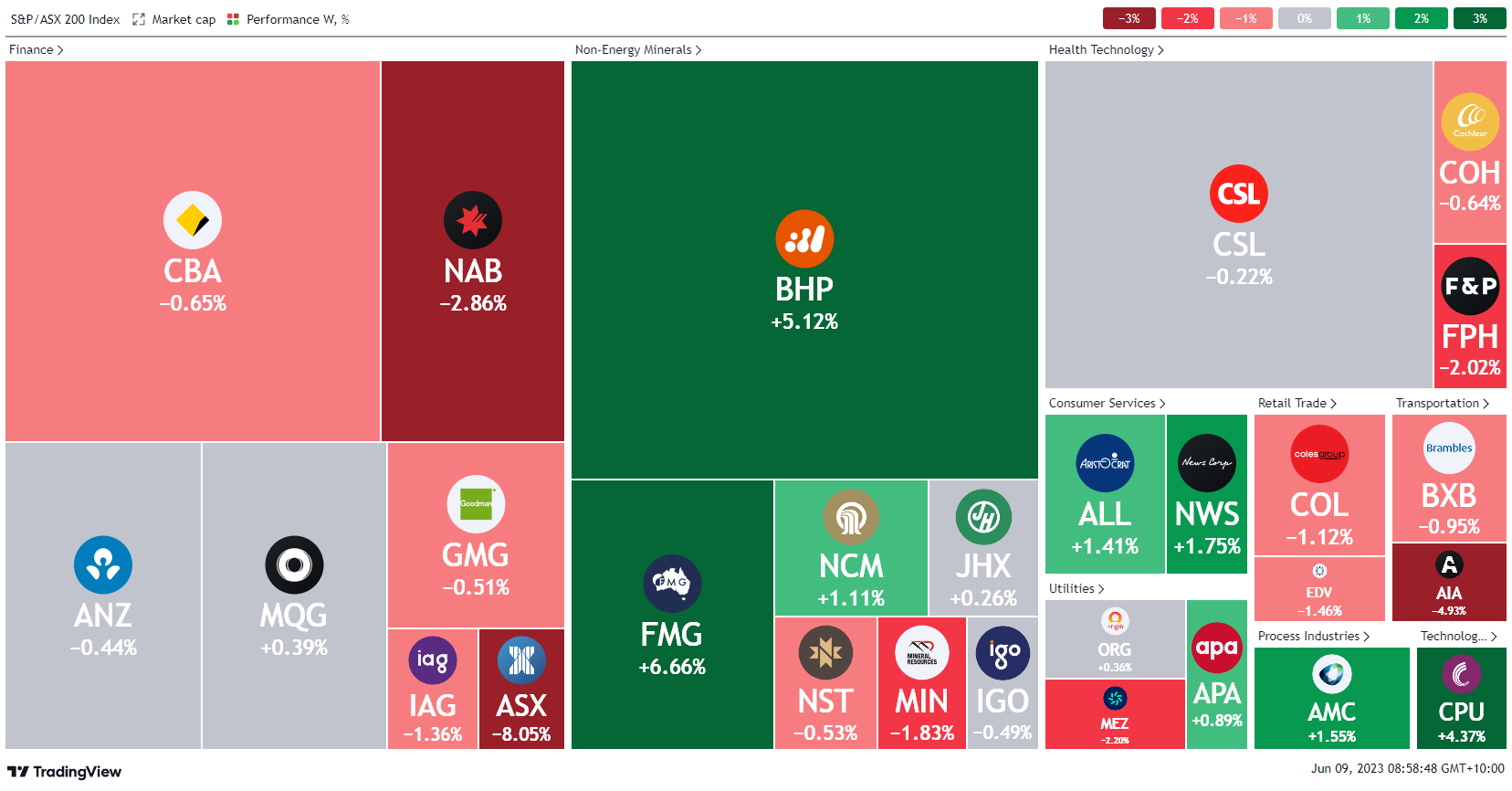

Here is the week’s heatmap for the largest companies in the ASX.

The ASX has had another mixed weak, the banks struggled as rates rose to 4.1%. Materials cushioned the selling in the financials, helped by an iron ore rebound. BHP, FMG, and RIO all had a solid week.

The ASX has had another mixed weak, the banks struggled as rates rose to 4.1%. Materials cushioned the selling in the financials, helped by an iron ore rebound. BHP, FMG, and RIO all had a solid week.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.