Prior to the Russian invasion of Ukraine, the focus for investors was the future path of inflation and interest rates. Investors had begun to reposition into sectors that would be shielded from inflation and that would benefit from a higher interest rate environment. Post invasion, western nations imposed harsh sanctions on Russia, which sparked concerns surrounding the supply of energy, agriculture, and construction commodities. Already tight supply chains became even tighter, and equity markets sold off aggressively. After the sell-off however, the pockets of the stock market related to affected commodities exhibited significant strength.

This market insight will cover how the Frame Long Short Australian Equity Fund was positioned prior to the Russia-Ukraine war, and how the strategy is positioned now.

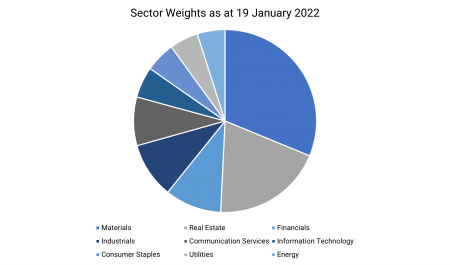

Where was the strategy positioned before the invasion?

The strategy was last fully invested on January 19, more than a month prior to the invasion. At that time, the top three sector investments were materials (31.09%), real estate (19.46%) and financials (9.96%). Combined, industrials and utilities investments accounted for a further 14.86% of the portfolio. The materials component of the portfolio was dominated by investments in construction materials businesses. The strategy had also allocated into banks (ASX: NAB and ASX: MQG) to capture expected margin expansion as interest rates rise.

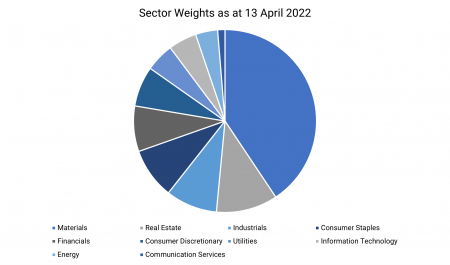

Where is the strategy invested now?

After spending some time with decreased exposure through January, February, and March, the strategy re-entered the market and became fully invested during March. The highest weighted sector is still materials, but the allocation has increased to 40.42% from 31.09%. The nature of the businesses held in the materials space also changed, with direct materials names now accounting for 20.07% of the portfolio. The strategy is now exposed to key resources which cover lithium, iron ore, coal, gold, nickel, and aluminum. Real estate exposure was cut to 10.81% from 19.46%, with industrials, consumer staples, and financials all holding allocations between 8.01% and 9.06%.

Why the shift in positioning?

The strategy has clearly responded to the change in equity market flows post-invasion. With agriculture and raw material products unable to be exported from Ukraine and Russian energy commodities shunned, prices have risen significantly. Clear beneficiaries of higher prices are external producers and exporters. Generally, they will experience increased profitability as a result of improved margins. They will also benefit from a diversion of demand away from geopolitically unstable regions.

Take nickel as an example – in 2020, the ASX hosted 3 of the top 10 largest nickel producing companies in the world: BHP Group (ASX: BHP), South32 Ltd (ASX: S32) and IGO Ltd (ASX: IGO). The strategy identified considerable strength in these businesses post-invasion and has since initiated positions in all three.

Energy operators and producers are another sectors that should benefit from higher energy prices by way of margin expansion. The strategy has identified this strength and is now invested in Ampol Ltd (ASX: ALD), Worley Ltd (ASX: WOR), Origin Energy (ASX: ORG), and APA Group (ASX: APA).

Investments in the food and agriculture space were also initiated after the invasion. New investments include agribusinesses Elders Ltd (ASX: ELD) and Nufarm Ltd (ASX: NUF). With Russia and Ukraine exporting more than a quarter of the world’s wheat (2019), other wheat exporting nations should see an increase in demand. These countries include the United States, Canada, France, and Australia.

What have we learned?

If 2022 so far has taught us anything, it is that areas of focus for equity markets can shift rapidly and in a significant way. The start of the year was dominated by inflation and interest rate news which caused significant concern to markets. Post the Russian invasion, however, key commodity shortages are front and centre in the mind of equity investors.

Our key takeaway is to follow a robust strategy, with strong risk management practices. This should ensure we survive drawdowns and put the Fund in a position to capitalise on emerging investment themes which may persist for the foreseeable future.