Over the last few weeks investors have been fixated on rising yields in fixed income markets. The benchmark US 10-year Treasury Note yield rose from 1.08% to 1.40% during February as financial markets begin to price in the current economic recovery, in combination with the unprecedented level of monetary and fiscal stimulus which was unleashed to combat the COVID-19 induced recession in 2020.

We detailed the extent of this stimulus in our previous article “Investment Themes 2021 revisited – Part 1.”. We noted the goal of Governments and Central Banks alike was to reflate their economies to a healthy level. To do this they implemented supportive monetary policy, in conjunction with fiscal stimulus packages.

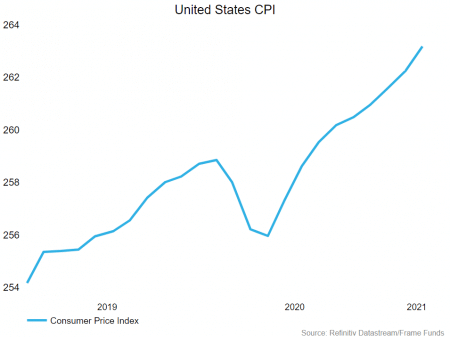

Since the release of our “Investment Themes 2021 revisited – Part 1. “, the US House of Representatives is set to pass the final version of a $1.9 trillion relief plan which would see another round of stimulus cheques sent out to Americans earning less than $80,000 per year. With US Federal Reserve Chair Jerome Powell continuing to signal support for low interest rates for the foreseeable future, expectations that we may see a rise in inflation can be seen in the bond market. Real yields also seem to be signalling approaching inflation. Real yields are calculated by subtracting the rate of inflation from the nominal (regular) yield. Increasing real yields imply the economy is recovering to a healthy state, however a rapid increase in real yields is a warning the cost of capital may be rising too fast – in other words inflation. The US 10-year US Treasury Real Yield is up to -0.66% from -1.08% at the beginning of the year.

Given these developments in the market, the remainder of this piece will be spent discussing assets that have historically performed well in an inflationary environment.

Commodities

Commodities tend to perform well as inflation increases. This is because as the demand for goods and services increases above available supply, the price of the goods and services rise as the market seeks to maintain equilibrium between supply and demand. This effect flows down the supply chain causing the price of the commodities used in the production process to also rise.

Crude Oil

Oil is a major input in the economy and is used in many critical activities such as electricity production, steel production, fuel for cars, construction of roads and heating, among others. With the current global roll-out of the vaccines produced by Pfizer and AstraZeneca, in combination with the aggressive stimulus efforts noted above, the global economy should continue to recover from COVID-19. As global economies recover, more people will begin to travel overseas , businesses will continue to reopen and there will be an increase in economic productivity. Oil will therefore be a key input in almost all economic activity associated with the global economy reopening. If prices begin to increase further up the supply chain, we expect to see the price of oil appreciate in response.

Copper

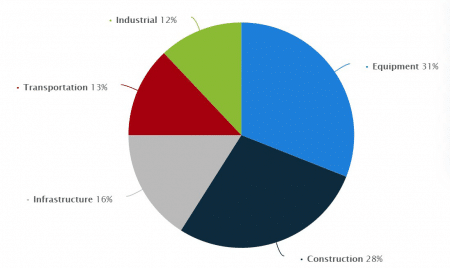

Similarly, to oil, copper is a commonly used commodity in economic reopening activities, especially for infrastructure projects where it is used for wiring, roofing, plumbing and other industrial machinery. In fact, 29% of all copper usage is used in construction, 16% in infrastructure, 13% in transport and 11% in industrial activity (including renewables). These are sectors that could be set to see the most significant increase in prices as the most recent waves of government support hit the economy. Copper is therefore naturally positioned to positively adjust to inflation induced price increases.

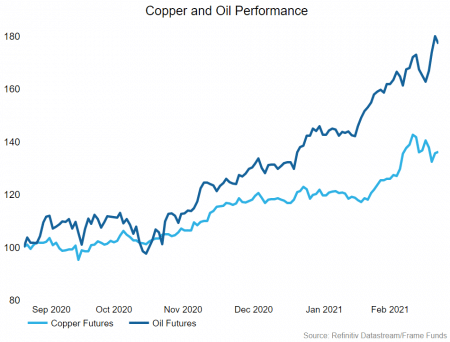

Both copper and oil have performed exceedingly well over the last 6 months. There have been sustained production cuts by OPEC, which has supported the oil price. An increased level of enthusiasm for copper is also in play due to its application in the renewables and electric vehicle market. These factors in combination with the ‘reflation trade’ mentioned in our most recent article have driven both the oil and copper markets to new yearly highs. While both commodities have been extraordinarily strong, we expect them to continue to be market leaders as inflation becomes more of a concern for investors.

Real Estate

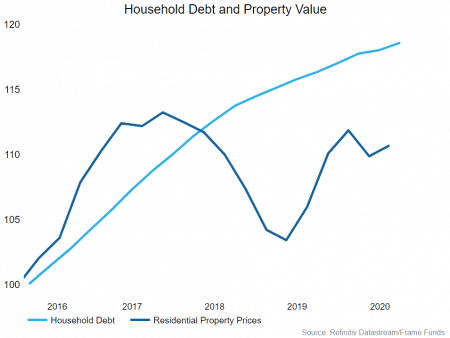

Real Estate is another asset that is known to perform well during periods of rising inflation. As inflation increases, the resale value of property has historically kept pace. In addition, commercial lease payments tend to be positively tied to inflation, meaning that annual price increases adjust upwards depending on the level of CPI. These characteristics make property an attractive investment in times of price increases. The current low interest rates also have a significant impact on house prices, as the cost of borrowing decreases making mortgages more affordable. Lower rates discourage saving as return on investment in a bank account is low – people either seek higher returns elsewhere (for example in the share market) or spend more of their income. Both of these increase demand in the market and therefore prices.

Additionally, supportive rhetoric around sustaining the current monetary policy stance will further encourage leverage. This is due to interest payments on mortgage loans being more affordable. Recent RBA analysis suggested residential property prices could increase as much as 30% in the coming years if borrowers believe the cut to interest rates is permanent.

While the future of commercial property is uncertain as it goes through a transformative period due to new work from home practices, an economic restart should support retail centres and commercial property in central business districts as more people return to work. We would expect this upward trend in prices to continue as inflation becomes a more present threat.

*time of writing 08/03/21