Weekly Update | 16th June 2025

1. Israel & Iran declare war

The declaration of war between Israel and Iran has escalated geopolitical tensions, leading to significant disruptions in global energy markets. Both nations have targeted each other’s energy infrastructure, with Iran threatening to close the Strait of Hormuz—a critical chokepoint for global oil and gas supplies. This has caused oil prices to surge, with Brent crude rising as much as 14% before settling at a 7% increase on Friday. The conflict’s potential to disrupt energy supplies poses a risk to global economic stability, potentially fueling inflation and hindering growth.

2. US Core CPI m/m expands 0.1% vs 0.3% expected

In May 2025, the U.S. Core Consumer Price Index (CPI) rose by 0.1% month-over-month, below the anticipated 0.3%. This marks a continued deceleration in inflation, with the year-over-year rate at 2.8%. The subdued inflation figures suggest that price pressures are easing, which may provide the Federal Reserve with greater flexibility in its monetary policy decisions. This trend supports a more accommodative outlook for the U.S. economy.

3. Chinese CPI y/y -0.1% vs -0.2% expected

China’s Consumer Price Index (CPI) declined by 0.1% year-over-year in April 2025, slightly better than the expected -0.2% decrease. The deflationary trend reflects ongoing challenges in domestic demand, with food prices falling by -0.2% and non-food prices remaining flat. While the slight improvement suggests some stabilization, persistent deflation could prompt Chinese authorities to implement further stimulus measures to bolster economic activity.

4. US Consumer Sentiment jumps to 60.5 vs 52.2 previous

The University of Michigan’s Consumer Sentiment Index rose to 60.5 in June 2025 from 52.2 in May, indicating improved consumer confidence. This increase reflects optimism about current economic conditions and future expectations. However, it’s important to note that inflation expectations for the year ahead surged to 7.3%, the highest since 1981, which could influence consumer behavior and spending patterns. Overall, the uptick in sentiment suggests resilience in the U.S. economy, though inflation concerns remain.

5. US Core PPI m/m expands 0.1% but much slower than forecasts of 0.3%

U.S. Core Producer Price Index (PPI) increased by 0.1% month-over-month in May 2025, below the expected 0.3%. This modest rise indicates that inflationary pressures at the producer level are easing, which could translate to lower consumer prices in the future. The data supports the view that the U.S. economy is experiencing a gradual slowdown in inflation, potentially allowing the Federal Reserve to adopt a more dovish stance

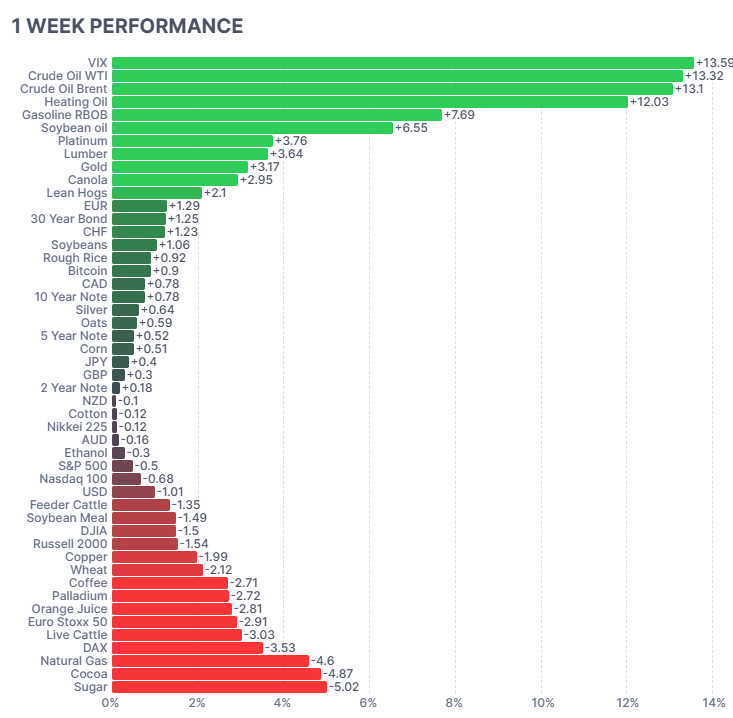

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Last week saw heightened geopolitical tensions between Israel and Iran. This conflict drove a sharp rally in energy markets. Crude oil (WTI +13.32%, Brent +13.1%) and heating oil (+12.03%) surged on supply disruption fears. The VIX spiked +13.59%, which reflected investor anxiety. Soybean oil rose +6.55% on stronger demand, while sugar (-5.02%) and cocoa (-4.87%) dropped on improved crop weather in Brazil and West Africa. Natural gas fell -4.6% despite broader energy gains, due to weak domestic demand. Precious metals like platinum (+3.76%) and gold (+3.17%) rallied on safe-haven flows. Overall, markets reflected risk aversion and strong bid into energy and defensive assets.

Here is the week’s heatmap for the largest companies in the ASX.

The ASX 200 was mixed last week amid geopolitical tensions and soft US inflation data. Energy led gains, with Woodside (WDS) surging 10.72% on spiking oil prices following the Israel-Iran conflict. Gold miners like Northern Star (NST +6.42%) and Newmont (NEM +4.22%) rose as safe-haven demand increased. Financials were subdued—CBA slipped —-0.75% and Macquarie (MQG) dropped -1.71%. Tech lagged, with TNE down -4.10% and Xero (XRO) off -0.67%. Real estate was broadly weaker, led by REA (-2.52%) and QBE (-2.96%) on bond market volatility. Overall, the index reflected defensive buying in energy and miners, with the general risk appetite cautious.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.