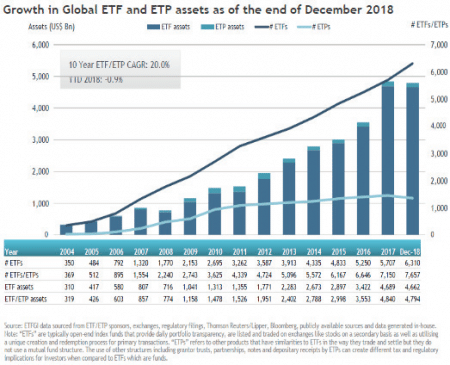

With the founding father of index investing passing away recently, we reflect on the legacy left behind by John Bogle. He will be remembered for pioneering the index fund for individual investors, a revelation that has gained significant traction since its inception. As the following figure shows, Exchange Traded Fund (ETF) and Exchange Traded Product (ETP) numbers have grown at a 10-year compounded annual growth rate of 20%.

There is no doubt that Bogle did a great service to the individual investor by providing the low-fee index tracking product, an alternative to the fund manager attempting to beat an index.

We focus on some lesser known understandings and by-products of index investing.

Diversification

Index funds provide exposure to specific diversified portfolios, which can include portfolios of domestic & international stocks, bonds, commodities, currency and other securities that would otherwise be difficult and costly to construct and monitor for an individual investor. The investor has the ability to allocate money in a hassle-free way by utilising an ETF.

Indicators

For some time, policymakers have used indices as indicators of future economic conditions, as they believe the health of the economy is priced into the index (thus providing a forward-looking indicator). Recently, we analysed this utilisation and found that the majority of equity market declines occur prior to an official recession being declared. Having assessed the performance of the S&P 500 for the last 5 recessions (where GDP contracts for 2 consecutive quarters), we found the average performance for the 12 months before a recession was declared recorded an average decline of -7.86% vs -1.53% after a recession was officially confirmed. Intuitively, this makes sense, as GDP data is backward-looking. The utilisation of index tracking products for analysis of the economic environment is common and expected to continue moving forward.

Constant re-adjustments

Dependent on the ETF methodology, adjustments may occur on a daily basis. As the weighting of assets under management within an ETF is relative to its respective market, the percentage of an individual stock/holding within the ETF fluctuates. For example, if the market capitalisation of the S&P 500 is $10 trillion, and the ETF’s funds under management is $1 trillion, the ETF needs to match the weighting of the underlying companies at a ratio of 10%. They will make these adjustments without regard to the price they pay on market which may drive prices higher or lower.

Change in performance characteristics

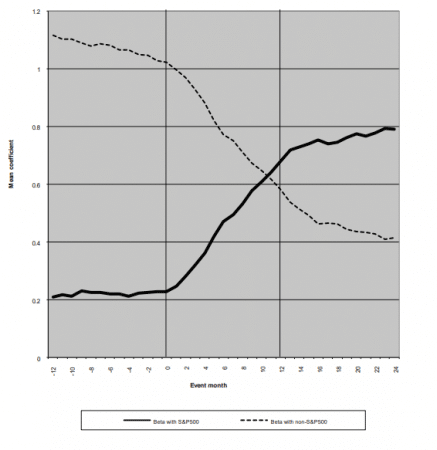

Companies are included within an Index when they meet the methodology of that index. Upon addition to an index, the co-movement between the stock and the index changes dramatically over a short period of time. A stock effectively loses its individuality, or unsystematic risk, and gains systematic risk. This is in part due to the arbitrage between futures contracts and ETF adjustments (as mentioned above) which occurs on the underlying stocks. What we essentially see, is the movement of individual companies start to match the performance of the index rather than maintain its individual price action.

The following figure demonstrates changes in co-movement patterns of stocks added to the S&P 500 Index between 1988 and 2000. As you can see below, when a company is added to the index, within 24 months, the beta of the underlying position moves from ~0.2 to ~0.80 (if the position closely tracked the index, it would show a reading of 1.0).

Money flow

The velocity of trading by index-matching funds can create self-enforced feedback loops of buying and selling pressure. Some have blamed ETFs for causing the 2010 Flash Crash and the lesser known 2011, 20-minute 7% rally in the Russell 2000. Arbitrage between futures contracts and ETFs magnifies such moves, as the underlying stocks may be shorted while futures contracts are purchased, or vice versa. Although some indices may only be re-balanced every three months, the manager must constantly track and adjust a particular stocks weight to pre-empt such changes or they will be forced to pay the price at re-balance date. Coupled with market characteristics, like the leverage effect, selling pressure on a particular stock may be far greater than it what would have been before its inclusion on the index.

Other factors

Not all ETF/ETP methodologies are the same. Investors should be aware of the weighting methodology of stocks within an index. Index weighting methodology changes depending on the index provider. For example, the Dow Jones Industrial Average weights its constituents based on the price of the stock, whereas the S&P 500 will weight its constituents on market capitalisation (we note that these are not the only weighting methodologies).

With the number of ETFs and ETPs on the rise, investors must be cautious of what product they think they are investing in and what they are actually investing in. There are misconceptions around certain products, that have diverged from the original index-tracking idea. For example, leveraged ETFs have expenses built into them that guarantee the investor will never truly reach the intended geared gain of the index, and will usually face more of a loss if it underperforms. E.g. a 3x leveraged ETF will never truly reach 3x any gain of the index, however it will often see a loss greater than 3x due to the expenses built into them.

The popularity of an index-matching fund has increased rapidly since the global financial crisis (GFC). The role of the active manager has consistently been questioned regarding underperformance relative to a particular index or benchmark. Post GFC, global markets have experienced a low-volatile, grinding bull market – the perfect environment for passive investing to outperform the active manager. The strategies of some active managers rely somewhat on heightened levels of volatility, where downside can be protected through derivatives and short exposure. With market volatility on the rise, we expect to see out-performance of the active manager whose mandate allows the use of products and strategies to capitalise on sideways to downward price movement.