The Frame Futures Fund runs two portfolios. They are called the Core and Trading strategies. The Core strategy comprises of positions which are based on the current macro-economic environment. These positions are invested into over the medium to long term. The Trading strategy comprises of specific trading strategies on Australian equities and global futures markets. The time frame for these strategies is typically intra-day to short term.

The purpose of having multiple portfolios within the Fund is to reduce the overall volatility of the Fund, essentially cushioning the portfolios negative returns. In a perfect world, both portfolios perform positively each month, however when they do not, ideally the outperforming portfolio cushions the underperformance of the other.

Core Strategy

Generally, the Core portfolio has higher levels of volatility than the Trading portfolio. There are a number of things we do to reduce this volatility – hedge equity exposure with bond exposure, hedge our commodity exposure with currency exposure, for example. However, at times these assets do not correlate as they may have historically. When this occurs, we will adjust the position sizing based on the amount the correlation and historical volatility has deviated. For positions which are negatively correlated, we will hold two long positions. For positions that are positively correlated, we will hold a long and a short position.

Two positions which are negatively correlated:

- Long Gold futures & Long US Dollar index futures.

- Long US Equity futures & Long US Treasury futures.

Two positions which are positively correlated:

- Long Copper futures & Short AUD futures.

- Long S&P 500 futures & Short Russell 2000 futures.

By including positions in the Core portfolio that are hedged in this manner, it enables us to make an investment based on the current macro-economic environment, however, provide a form of downside protection.

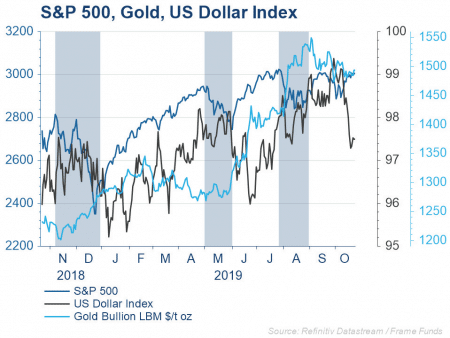

We currently have an ideal scenario, being when historically negatively correlated positions (Long Gold & US dollar futures) rise in tandem due to the current macro-economic environment but are also receiving money flow from market participants to hedge risk in times of uncertainty.

Referring to Chart 1, as the market has retraced, Gold and US Dollar futures have continued to grind higher.

Trading Strategy

Within the Trading portfolio, we implement strategies which target low levels of day to day volatility. These strategies are primarily intraday or very short term in nature. One of these strategies predominantly trades the ASX 300 and utilises intraday company announcements and changes in money flow to generate trading opportunities. Another strategy trades S&P/ASX 200 futures, again over a short to medium time frame, utilising volume supply and demand regions to determine where to enter and exit positions.

To demonstrate the short term and active nature of one of the trading strategies, a sample of a recent trade is included below.

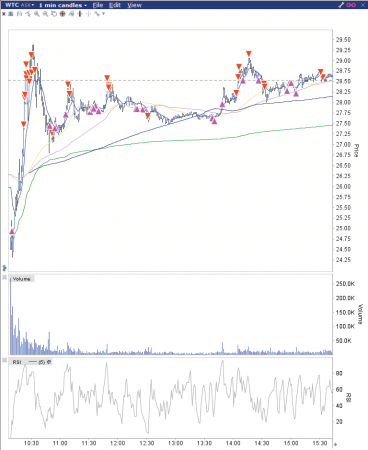

Wisetech Global Ltd (ASX:WTC)

Wisetech is a technology company that provides software to the logistics industry globally. Recently, J Capital Research came out with a short report questioning the company’s valuation and accounting methodology, amongst other things. Wisetech came to our attention shortly after, and we were able to capitalise on the trading opportunities it provided over the coming days.

On the 23rd of October after Wisetech’s response to the second short report, Wisetech opened down significantly after the opening auction. Selling was met straight away with net buying. We had felt that the gap down was overdone, and once there was an indication that sellers were not willing to sell Wisetech down at these levels, we took a position in the morning and had traded out of it by the days close. From this news catalyst, there was a significant amount of both volume and volatility, allowing us to enter positions and catch big intraday moves with size (trades below).

Summary

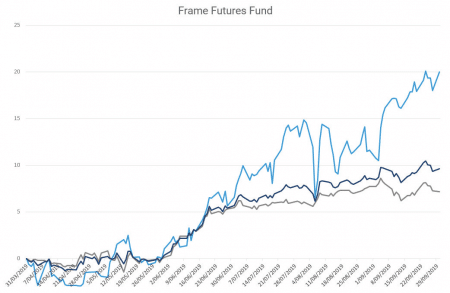

Referring to last month’s article ‘Circle of Control & Investment Strategy’, operating multiple strategies adjusts our focus to what we can control and what we can improve on, rather than relying on the market to rise on a particular day. Our focus is on how we can improve the strategies and if they have executed well in the current market climate. By implementing multiple strategies within the Fund, we expect the performance to continue with less volatility. As mentioned earlier, ideally both portfolios perform well each month, however when they do not, the outperforming portfolio may cushion the underperformance of the other, seen in Chart 3.

You will notice during periods where the Trading portfolio has underperformed (early June), the Core portfolio performed. Vice versa in early September, the Core portfolio underperformed, while the Trading portfolio outperformed, cushioning the overall performance of the Fund.