Weekly Update | December 1, 2023

Let’s hop straight into five of the biggest developments this week.

1. German preliminary CPI dipped -0.4% m/m

Disinflation in Germany is gaining momentum at a faster rate than expected and becoming entrenched in the entire Eurozone. Preliminary CPI slumped – 0.4% from the previous stagflation figure of 0.0% in November, falling below market expectations of – 0.1%. The inference is that the high interest rates are impacting the economy.

2. New Zealand held interest rates steady at 5.5%

The RBNZ sat on its hand for a fourth consecutive meeting to leave interest rates unchanged at 5 5%, in line with market expectations. While the easing of inflationary pressure in recent months has been apparent, headline inflation remains too high and far off target. This underlies the higher-for-longer stance adopted by the central bank, a decision further reinforced by relative strength in economic growth.

3. US preliminary GDP soared 5.2% q/q

The US economy grew at a much faster rate than initial estimates in the third quarter. Preliminary GDP grew 5.2%, beating expectations of 4.9%. This marked the fastest growth rate in two years, pointing to the tenacity of the US economy in the face of one of the most robust monetary tightening regimes in recent history.

4. Chinese manufacturing PMI slipped to 49.4 in October

China’s post Covid recovery suffered a fresh blow after activity in the critical manufacturing sector shrunk deeper into contraction. Manufacturing PMI fell to 49.4 from the previous 49.5 for the month of November, undershooting market expectations of 49.8. The report undermined the aggressive stimulus program by Chinese authorities, pointing to the reality that structural problems in the economy are much deeper than previously estimated.

5. US core CPE price index cooled 0.2% m/m

Inflation in the US is on a sustained downward trajectory. The CPE price index ticked lower for the month of October, reporting at 0.2% from the previous 0.3%. The data was well priced in by markets as the price of energy components continued to tumble, pushing overall prices lower. This being the Fed’s preferred inflation barometer, markets ramped up bets for an interest rate cut in the first half of 2024.

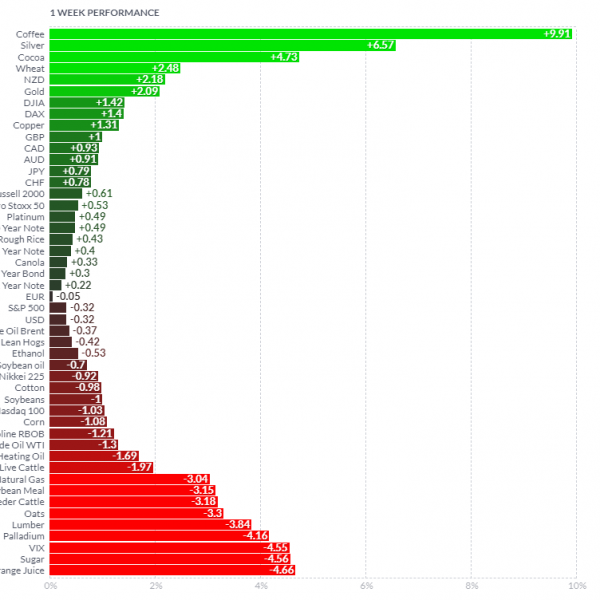

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Coffee, cocoa and heating oil were up on seasonality with predictions pointing to a colder festive season than expected. The VIX declined after upbeat data from the US, notably the PCE price index pointing to cooling inflation. Markets bet on a 70% chance the Fed would cut rates in March 2024. Consequently, investors sort alpha in risky and high return investments, propping up global indices as the dollar slid to three-month lows. Silver and gold rose on the perception that interest rates are peaking across board. Orange juice corrected from overbought levels as demand concerns emerged. Feeder cattle and lean hogs continued their sell off, they are now slowly starting to catch up with domestic meat prices which have declined significantly over the last 12 months.

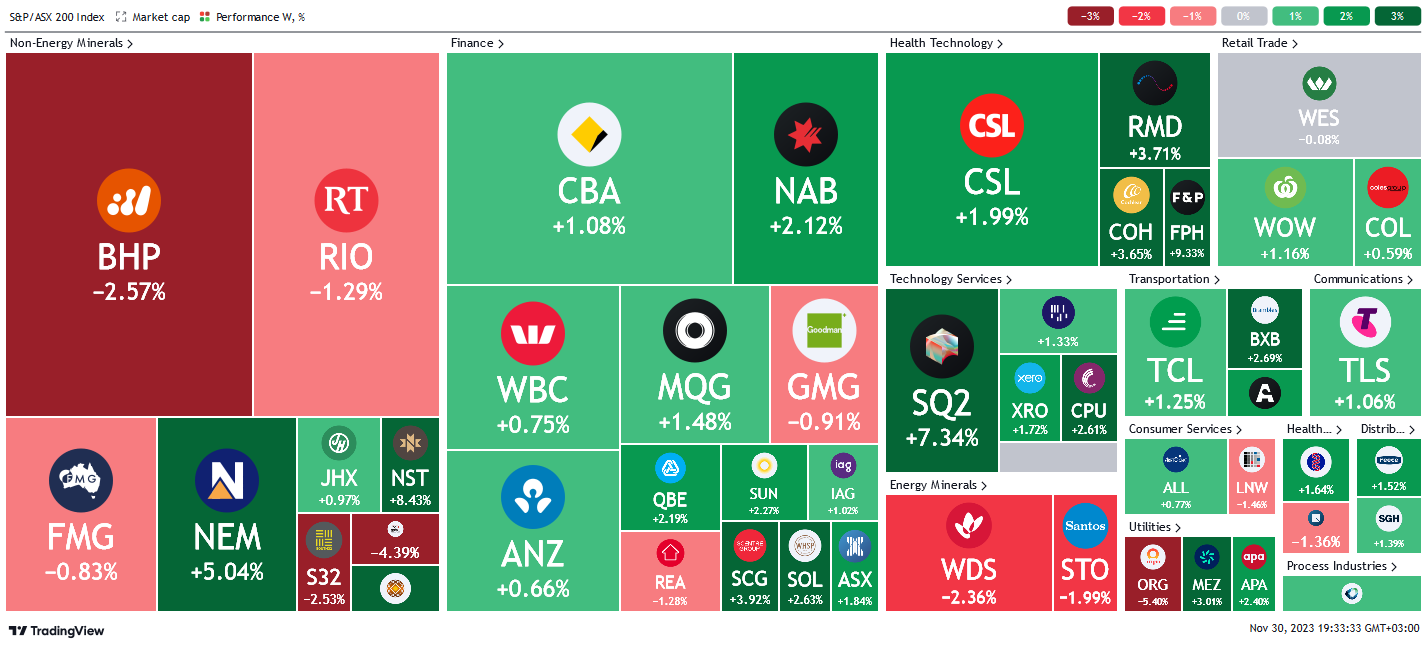

Here is the week’s heatmap for the largest companies in the ASX.

The ASX rebounded strongly from last week’s lackluster posting to end the week on a high. Financials led the rally on optimistic data from the US and reduced odds of further rate hikes. It was all green with SGP and SCG gaining more than +3.9%. REA and GMG were the only disappointment, closing on an otherwise very bullish week. Non energy miners were, however, mixed but heavy to the downside with most stocks in the red. NEM and NST, however, showed relative strength to outbuy the index, gaining +5.04% and +8.43% respectively. Energy miners were also not spared the blues with most stocks down on weak data from China. Healthcare tech, retailers, transporters, and consumer services all closed with solid gains to wrap up a positive week.

The ASX rebounded strongly from last week’s lackluster posting to end the week on a high. Financials led the rally on optimistic data from the US and reduced odds of further rate hikes. It was all green with SGP and SCG gaining more than +3.9%. REA and GMG were the only disappointment, closing on an otherwise very bullish week. Non energy miners were, however, mixed but heavy to the downside with most stocks in the red. NEM and NST, however, showed relative strength to outbuy the index, gaining +5.04% and +8.43% respectively. Energy miners were also not spared the blues with most stocks down on weak data from China. Healthcare tech, retailers, transporters, and consumer services all closed with solid gains to wrap up a positive week.

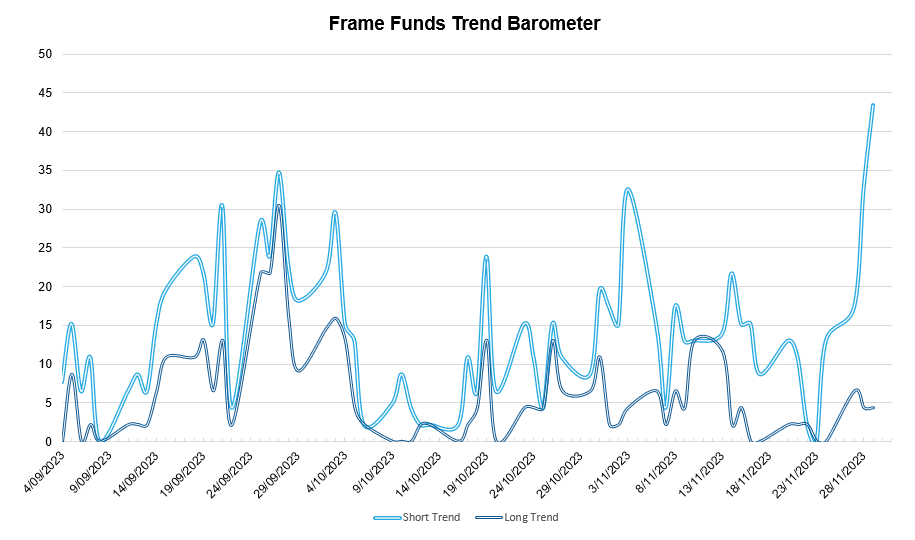

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.