Weekly Update | July 14, 2023

It has been another busy week in the Frame Funds offices, with strategy optimization as the focus.

Let’s hop straight into five of the biggest developments this week.

1. New Zealand holds interest rates steady at 5.5%

After one of the most aggressive monetary policy tightening cycles in recent history, the RBNZ finally put a hold on further interest rate increases. The pause was in line with market expectations. As it stands, markets are speculating as to whether this marks the end of the current tightening cycle.

2. US CPI y/y fell to 3%

Inflation in the US is ebbing with increasing momentum as interest rate increases continue to work their way into the economy. The annual CPI reading for the month of June fell to 3% from the previous reading of 4.0%, narrowly beating the market forecast of 3.1%. Price stability in energy prices is the most consequential driver for the report, which marked the lowest inflation rate since March of 2021.

3. Canada raised interest rates by 25 basis points to 5%

The BOC played its hand in its effort to mitigate runaway inflation in Canada by raising interest rates to 5%. Despite marginal signs of thawing inflation across the board, the central bank took another stab at what is considered an attempt to narrow down the timeline for achieving its 2% inflation target. The hike was in line with market expectations but leaves doubts as to the future direction of the BOC’s monetary policy.

4. UK GDP m/m fell -0.1% in May

The UK economy went into recession in the month of May, shrinking by -0.1% from the 2% growth in April. Markets had priced in a much grimmer outlook, expecting the economy to shrink by -0.3%. The sharp decline in production as well as constrained output in the construction sector were the main contributors to the overall slump in economic productivity. Turbulence in the service sector persisted, as rampant inflation stifled consumers, and the sector recorded no growth.

5. US unemployment claims drop to 237K

All doubts on the unwavering resilience of the US labour market were definitively allayed on Friday with a massive dip in unemployment claims, reporting at a rip-roaring 237K. This was far below the previous figure of 249K, as well as the market consensus of 251K. The dynamism in the labour market at the current high interest rates makes the case for a soft landing still a possibility.

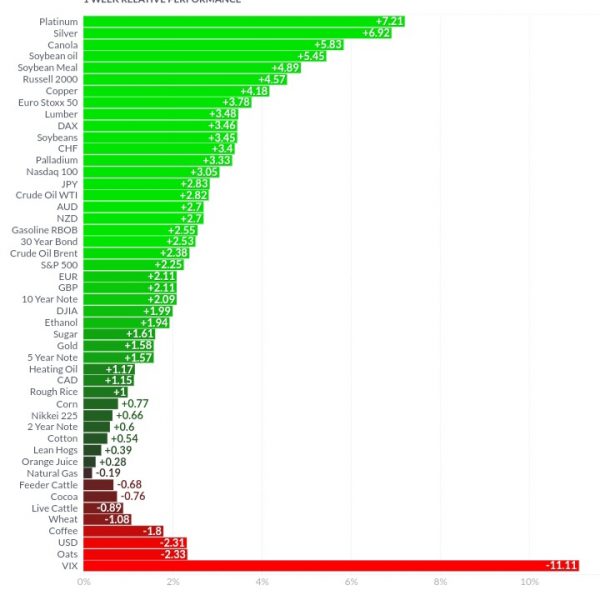

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

As CPI and PPI data cooled over the course of the week, the VIX sold off aggressively. Most of the trends seen over the last few weeks, both long and short, have continued to be volatile. The soybean complex has continued to swing up and day as weather reports out of the US hit the wires. Strong trends have been seen in Canola, hitting a new one-year highs, and Coffee hitting fresh lows. Interesting a rebound in crude oil, copper and iron ore prices all lead the argument that traders expect an uptick in economic activity in the coming months.

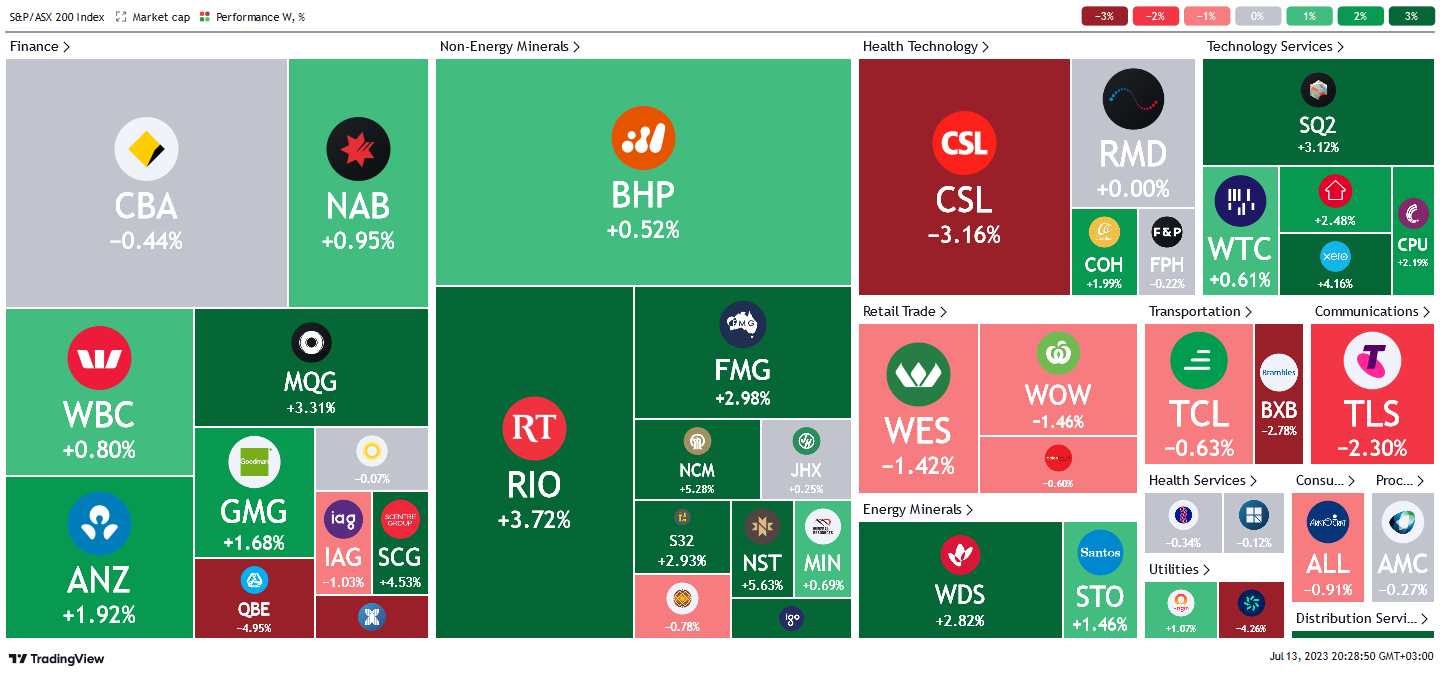

Here is the week’s heatmap for the largest companies in the ASX.

An overall positive week for the ASX across the board. The general theme is a rotation from value and defensive across to more cyclical investments. Financials led the buying clamour with ANZ, NAB and WBC leading the fray. Interesting to note the underperformance of CBA over the course of the week. The relatively consistent selling in the miners finally came to an end over the week, as the CPI data and a rebound in commodity prices helped. RIO and FMG both rose around 3%. Staples dragged as the pivot from defensives to cyclicals played out. WES and WOW both dropped by around -1.5%.

An overall positive week for the ASX across the board. The general theme is a rotation from value and defensive across to more cyclical investments. Financials led the buying clamour with ANZ, NAB and WBC leading the fray. Interesting to note the underperformance of CBA over the course of the week. The relatively consistent selling in the miners finally came to an end over the week, as the CPI data and a rebound in commodity prices helped. RIO and FMG both rose around 3%. Staples dragged as the pivot from defensives to cyclicals played out. WES and WOW both dropped by around -1.5%.

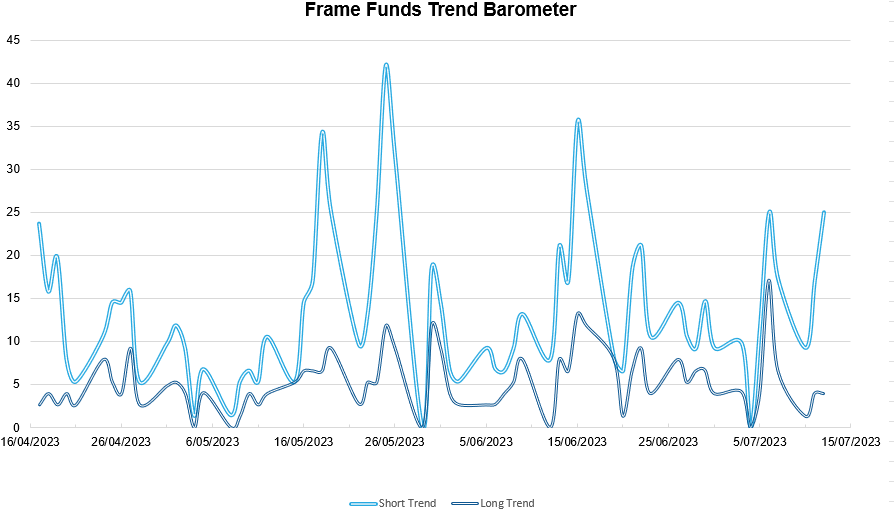

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.