This article is Part Five and the final instalment of our ‘Investing – An Alternative Approach’ miniseries. The series aims to inform readers about how the Frame Long Short Australian Equity Fund generates returns for its investors.

This series has attempted to identify some issues with markets and trading, including the issues with indices (Part One) and common investor cognitive biases (Part Two). It has also sought to explain the concepts and roles of systematic strategies (Part Three) and discretionary investing techniques (Part Four).

When we launched the Frame Long Short Australian Equity Fund, we aimed to circumvent the problems identified in Parts One and Two via the application of techniques explained in Parts Three and Four. The market capitalisation weighting bias of the index is exploited by avoiding an ‘index tracking’ strategy, a common pitfall in the funds management industry. Cognitive biases are removed by running the core part of the portfolio (approximately 75%), on a purely systematic basis. The remaining 25% of the portfolio is managed in a discretionary manner, with the aim of generating additional alpha and for hedging purposes.

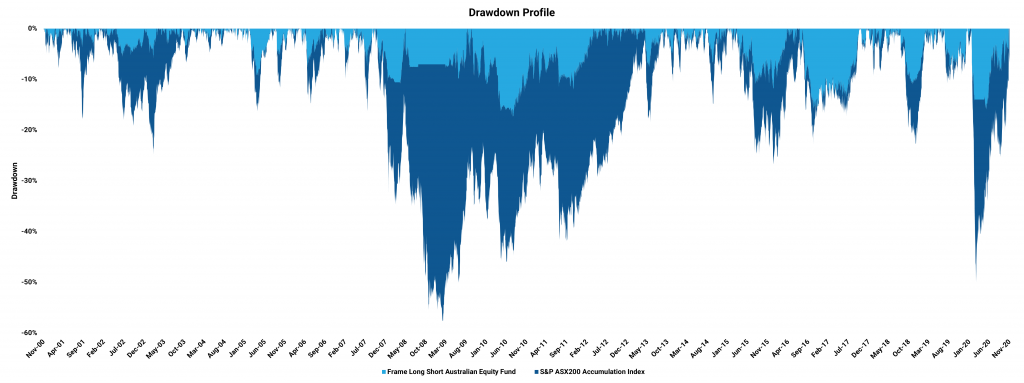

Within the systematic component of the Fund, we implement a variety of quantitative strategies that have been proven to robustly deliver outperformance over the long term. By rigorously testing our systematic strategies, we ensure we can trade them with confidence, even in times of market stress. The strategies adhere to strict risk metrics which means we attempt to significantly reduce drawdowns.

Taking our primary systematic strategy as an example, wider stops are used when there is momentum in the broader market so our winners can ‘run’. When the market begins to lose upwards momentum, the system does not initiate any new investments while employing tighter risk measures on current positions. The result is that the maximum drawdown of the S&P ASX200 Accumulation Index is almost 3 times larger and the recovery 2.5 times as long as the drawdown of our strategy.*

It is our view that long-run outperformance is delivered by taking an alternative approach to markets and not ‘index tracking’. We also believe that operating a portfolio on a 100% discretionary basis leaves you susceptible to illogical decision making because of various cognitive biases. Our unique blend of systematic and discretionary investing allow the Frame Long Short Australian Equity Fund to outperform the market in a risk adjusted manner over the medium to long term. It makes the product a superior alternative to passive investing or solely discretionary management, meaning we can meet an investor’s need for capital growth and income over the long-term.

It is our view that long-run outperformance is delivered by taking an alternative approach to markets and not ‘index tracking’. We also believe that operating a portfolio on a 100% discretionary basis leaves you susceptible to illogical decision making because of various cognitive biases. Our unique blend of systematic and discretionary investing allow the Frame Long Short Australian Equity Fund to outperform the market in a risk adjusted manner over the medium to long term. It makes the product a superior alternative to passive investing or solely discretionary management, meaning we can meet an investor’s need for capital growth and income over the long-term.

We hope you have enjoyed the ‘Investing – An Alternative Approach’ miniseries. If you have any questions about the Fund or the strategies we implement, please contact investors@framefunds.com.au.

Wholesale investors can find the Information Memorandum here: https://www.framefunds.com.au/long-short-australian-equity-fund/

Retail investors can find the Product Disclosure Statement here: https://www.framefunds.com.au/primary-investment-board-class-v/

*Strategy run in a simulated environment; past performance is not a reliable indicator of future performance.