Weekly Update | May 24, 2024

Let’s hop straight into five of the biggest developments this week.

1. Canadian CPI y/y declines to 2.6%

Canadian CPI rose 2.6% on a year-over-year basis in April, down from a 2.9% gain in March. Broad-based deceleration in the headline CPI was led by food prices, services and durable goods. The deceleration in the CPI was moderated by gasoline prices, which rose at a faster pace in April (+6.1%) than in March (+4.5%). We continue to see evidence that the impact of higher interest rates is having its desired effect.

2. RBNZ holdings the OCR steady at 5.5%

The RBNZ held rates steady at 5.5% earlier this week with restrictive monetary policy reducing capacity pressures in the New Zealand economy. Annual consumer price inflation is expected to return to within the Committee’s 1 to 3 percent target range by the end of 2024. The welcome decline in inflation in part reflects lower inflation for goods and services imported into New Zealand.

3. European Manufacturing PMI data broadly higher

Business activity rose throughout Europe for the second month running and at a faster rate in May. Alongside stronger growth in the service sector, manufacturing output moved closer to stabilisation. There was also a pick-up in hiring activity as firms reported stronger demand and greater optimism towards the outlook.

4. US unemployment claims decline to 215k

The number of Americans filing new claims for unemployment benefits fell last week, pointing to underlying strength in the labour market that should continue to support the economy. Initial claims for state unemployment benefits dropped 8,000 to a seasonally adjusted 215,000 for the week ended May 18. Such a solid labour figure made market participants doubt the likelihood of rate cuts this year.

5. US new home sales decline 634k vs 677k expected

Sales of new single‐family houses in April 2024 were at a seasonally adjusted annual rate of 634K according to estimates released today which was below the estimate of 677k. Higher interest rates have continued to impact new sales, which have continued to miss expectations broadly over the last 6 months.

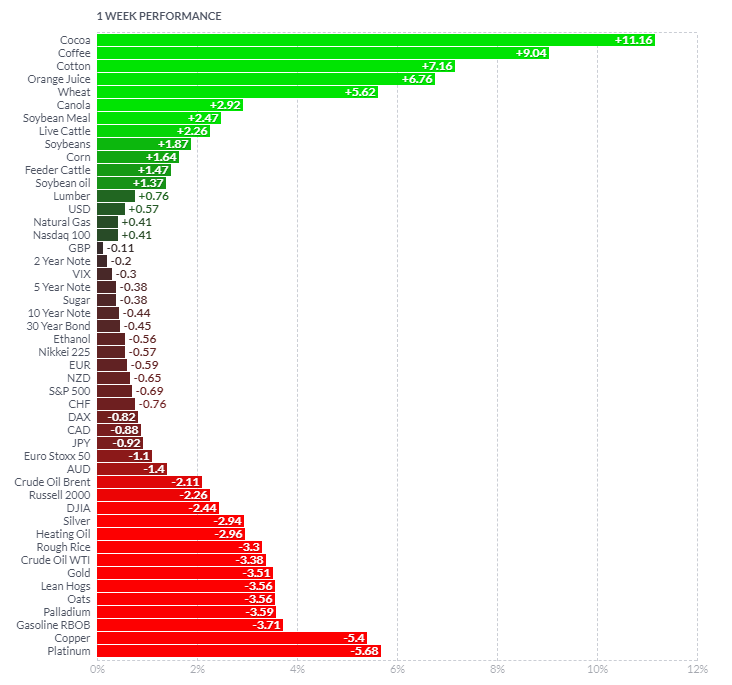

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Cocoa rebounded aggressively this week after a couple of weeks of significant volatility, primarily caused by CTA repositioning. Coffee, wheat, cotton and orange juice all had periods of momentum higher, as increased consumer demand drove prices higher. Precious metals sold off after experiencing solid trends in recent weeks, however with economic data out over the course of the week, we saw investors repositioning out of derivatives that would benefit from quantitative easing. Equities were mixed over the week, with the Nasdaq the best performer, lead higher by the results of NVIDIA beating expectations.

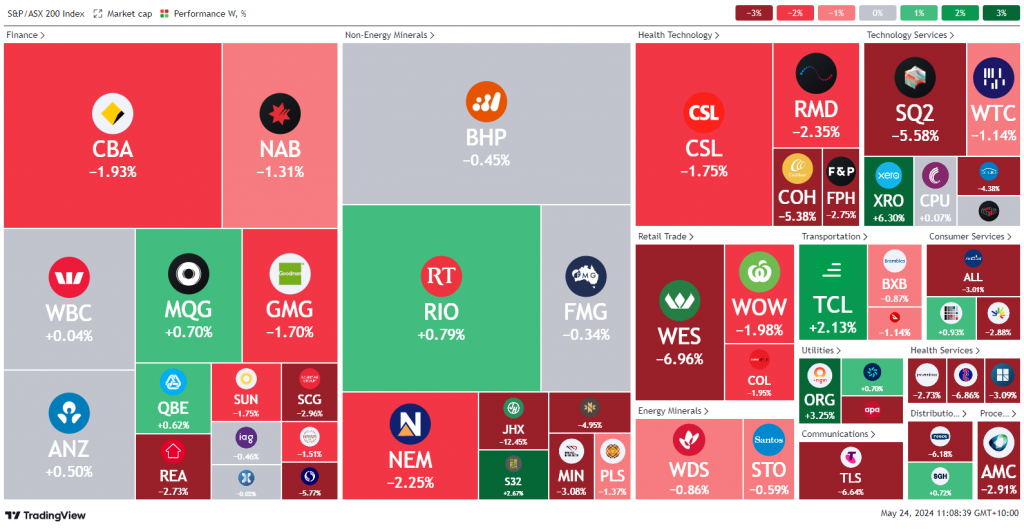

Here is the week’s heatmap for the largest companies in the ASX.

The last week for the Australian share market has been bruising, with the majority of large cap companies experiencing consistent selling pressure. Financials, outside of MQG and ANZ were sold over the course of the week. BHP, RIO and FMG were all mixed, as iron ore prices rose, while other materials prices saw profit taking. WES was the worst mega cap, as investors took profit after a stellar run. JHX sold off ~12% after they reported their full year results. All in all, the Australian market has been mixed to lower as traders continue to assess the BHP takeover of Anglo America and what the path of interest rates will look like this year.

The last week for the Australian share market has been bruising, with the majority of large cap companies experiencing consistent selling pressure. Financials, outside of MQG and ANZ were sold over the course of the week. BHP, RIO and FMG were all mixed, as iron ore prices rose, while other materials prices saw profit taking. WES was the worst mega cap, as investors took profit after a stellar run. JHX sold off ~12% after they reported their full year results. All in all, the Australian market has been mixed to lower as traders continue to assess the BHP takeover of Anglo America and what the path of interest rates will look like this year.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.