Following on from our market insight regarding the rise of the USD, we have identified several key sectors on the ASX which may benefit this theme.

Firms listed on the ASX that generate a significant portion of their earnings in the United States, will see their balance sheets grow in AUD terms. Domestic exporters to the US will also benefit as their goods and services become more affordable in USD terms. Australian commodity producers who have their underlying assets quoted in USD will also be favoured by a stronger USD.

This issue of stocks in play will focus on the latter of the identified sectors.

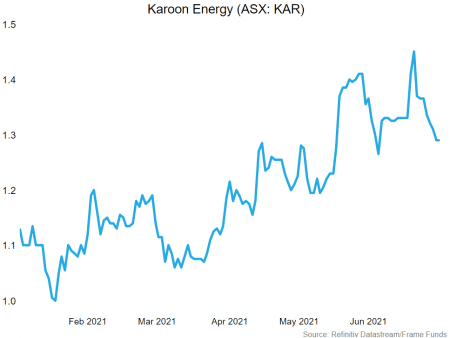

As the price of oil and gas is denominated in USD, local businesses that sell internationally will generally benefit from a rising USD. A stand-out in the oil and gas sector has been Karoon Energy Limited (ASX:KAR).

Karoon has performed strongly over recent months and has shown historically higher correlation to oil and gas prices compared to other ASX listed competitors. Since March 2020, KAR has been in a strong uptrend, which has seen seen their share price rise from lows of $0.34 to $1.33 on the 30th June.

On the 8th of July Karoon changed its report currency to USD. Since KAR has an Australian dollar-denominated cost base, a stronger USD will boost the value of assets in AUD terms and decrease costs for reporting purposes, thus expanding their margins. This could be a catalyst that continues to assist the share price.

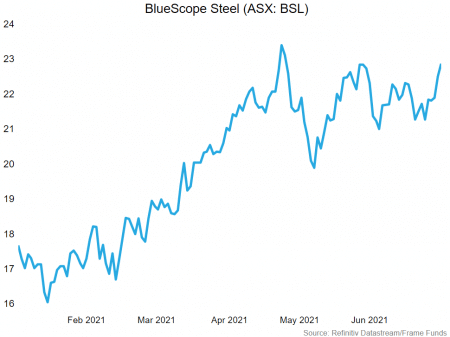

Another possible stand-out that may benefit from a strengthening USD is Bluescope Steel (ASX:BSL). Bluescope has seen a strong resurgence post the COVID-19 crash. It has risen approximately 150% since April 2020. As a big component of their business is exporting to the United States, a continued strengthening of the USD should benefit BlueScope for upcoming reporting seasons.

In their recent company update, (released April 27th 2021) earnings guidance for BSL was increased for the 2H of FY2021 from $1b to $1.08b. This increase saw their price touch $24. We expect as the USD continues to rise, the earnings of BSL will expand in AUD terms, which may act as a catalyst to drive its share price higher.

As we move out of the previous financial year and into the reporting season, the market will be flooded with financial data. With the USD continuing to strengthen, we expect to see many companies with a presence in the United States market benefit.

Download the full report by clicking the image below.