Inflation and rising inflationary expectations can be a minefield for investors to navigate. There is a fine line between having a good amount of inflation in the economy and suddenly having too much. The market should in theory like inflation reverting to normalised levels post-Covid, as it signals a broader economic recovery. However, as we have seen over the last couple of weeks, it is not the increase of inflationary expectations that has worried the market, but how quickly these expectations have changed.

With rising inflationary expectations, high growth names tend to be the ones hit the hardest, this is primarily due to the belief that interest rates will need to rise to curb expected inflation. Growth companies often have capital-intensive business models, so rising interest rates increase their cost of capital. Our preferred way to protect against inflation in our portfolios is to own defensive companies with strong free cash flow and pricing power. As noted in our inflation update, copper, oil, and base metals also tend to perform well in inflationary environments, this is especially true when the moves are being fuelled by expansionary monetary and fiscal stimulus.

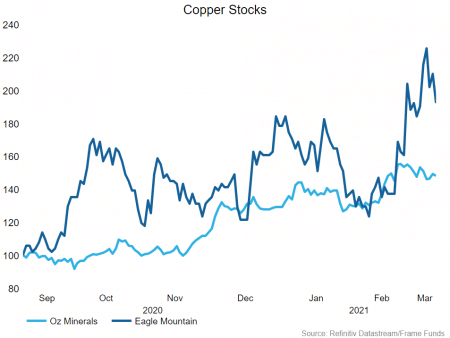

Copper stocks in play

We discussed a couple of copper stocks in last month’s newsletter (ASX:EM2 and ASX:OZL), another one that is worth monitoring is Copper Mountain (ASX:C6C). C6C is a dual-listed ASX/TSX entity with its flagship Copper Mountain mine located in Canada. Mining commenced in 2011 with the project 75% owned by C6C and the remainder owned by Mitsubishi Metals corporation. For the full 2020 calendar year, C6C produced over 77.6 million pounds of Copper, which was ahead of the company’s original guidance of 75 million pounds. The beat in production guidance was primarily due to an increase in feeder grades, which improved overall copper recoveries. With full-year all-in sustaining costs (AISC) of US$1.69 per pound, a sustained copper price above $4.00 a pound will mean strong cash flows for C6C. Management has recently guided to higher CY2021 production (between 85-95 million pounds of copper). If management continues to beat these expectations in conjunction with a strong copper price, we would expect shareholders to be rewarded.

One copper stock in play that we discussed in last month’s newsletter was Eagle Mountain Copper (ASX:EM2). Since our commentary last month, it has seen a gain of over 50%. To recap, EM2’s key focus is on its Oracle Ridge & Silver Mountain project in Arizona. Its primary aim is to become a low-cost, sustainable supplier of copper to the green energy sector. Oracle Ridge already has an existing underground mine as well as an existing high-grade copper/silver resource, however, their current focus is on expanding this resource.

The recent surge can be attributed to a number of things. Firstly, EM2 raised $11mn at 35c (22/02), and encouragingly the managing director, Charlie Bass, contributed $2mn of his own capital. Secondly, drilling results released on the 25th of February reported some excellent copper hits including 12m at 3.47% copper. Lastly, two well-known funds, Regal Funds Management & Paradise Investment Management have notified the market that they are now substantial holders of the company. Despite the substantial rise in the share price, we still like EM2 as we believe that management will continue to deliver on their exploration and goal of becoming a world-leading producer of environmentally sustainable copper.

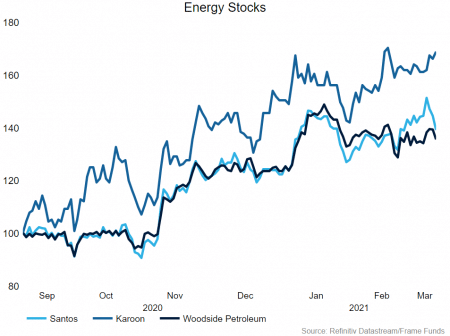

Crude oil stocks in play

Oil has been on an excellent run over the last 6 months and in the last couple of weeks, the WTI Crude oil price touched levels not seen since 2018. The recent price rises can be attributed to the cold weather in the US, particularly in Texas where the ‘Texas freeze’ caused the largest ever US oil production decline. Also, OPEC came out last week putting further supply cuts on the table.

Oil prices have commonly been a leading indicator of rising inflation as oil has many applications. We expect that if inflationary expectations persist, crude will continue to perform. There are several ASX listed Oil producers and explorers on the ASX, ranging from large-cap producers to junior explorers and developers. One large-cap oil producer we are following is Santos Ltd (ASX:STO). Santos’s flagship assets are located in the Cooper Basin, Queensland, and the Barossa. Santos has guided CY2021 production of 84-91 mmboe, with upstream production costs of $8.00-$8.50boe. Santos has a strong balance sheet, and we are watching for potential M&A activity, however, we do not expect it to come in the near term. Santos is also a large-scale producer of LNG through its Darwin and Barossa projects. Despite a period of depressed LNG gas prices, management is optimistic about a recovery.

Does the sell-off in tech present any opportunities?

Rising yields have certainly ground the tech-heavy Nasdaq to a halt, with the index down considerably since its all-time highs set on the 16th of February. Domestic tech favourites have not avoided the sell-off, Afterpay (ASX:APT) is down over 30% since its February highs, Appen (ASX:APX) & Nuix (ASX:NXL) are down 65% and 50% respectively on the back of lacklustre reports and broker downgrades. We are cautious on high p/e growth stocks at the moment, as the volatility in yields is rife.

We stress the importance of not buying company’s whose share prices are in free fall as they can always go much further than expected. We prefer to identify a technical basing of the share price, accompanied by some positive fundamental or macro news before we scale into positions. One key point to think about is whether the companies in your portfolio have capital intensive business models. If they were unable to raise money for a couple of years, would their business survive?

The dot com bubble is a good example as to why having a concentrated portfolio in these capital-intensive growth stocks and high p/e names can be a recipe for disaster.