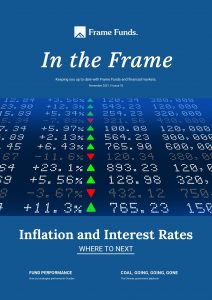

Computershare (ASX: CPU)

Computershare (ASX: CPU) is an Australian success story that from its’ roots as a technology start-up in the 1970s, has grown predominately through acquisition to become an ASX50 constituent.

CPU is a stock transfer & registry company that offers client services for corporate trust, stock transfer and employee share plans in over twenty countries.

The recent completion and integration of acquired Wells Fargo Corporate Trust Services for $1 billion (now called CCT), has accelerated CPU’s position in the US corporate trust market to a top-four player.

Besides their well-received full-year financials in August, in their FY22 outlook, the company is expecting margin income to increase 35.5% on its prior corresponding period (with CCT) and management EBIT to increase 3.7% (excl. CCT). This has culminated in a share price increase of 20.75% post their financial report.

Aside from the recent growth, report, and integration of CCT, we believe in its ability to generate further income and minimise integration expenses. This in combination with forecasted global rate increases, may support margin expansion.

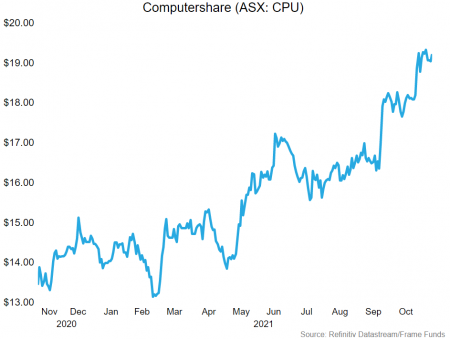

Cleanaway Waste Management (ASX: CWY)

Cleanaway Waste Management (ASX: CWY) is an Australian waste management company with significant market share domestically, as well as operations in the United Kingdom.

Specifically, their main operating segments include Solid Waste Services (59% of net revenue), Liquid Waste & Health Services (23% of net revenue) and Industrial Waste Services (14% of net revenue). Our view is the domestic resource recycling and energy segment to be an area for growth.

At their most recent AGM, CWY provided an update on current trading conditions. They noted they see trading activity levels return to more normalised levels. This is a far cry from the $4m per month cost of the NSW COVID lockdowns seen earlier this year. They expect container deposit schemes to lead the recovery.

Whist the impacts of COVID continue to linger, the company’s bottom line should continue to improve as they return to normal in their key trading markets. We expect an improvement in their EBITDA margin as they continue to focus on growth in domestic recycling and their energy waste operations.

Scentre Group (ASX: SCG)

Scentre Group (ASX: SCG) is the spin-off from Westfield Development Corporation in 2014. SCG comprises of both the retail real-estate assets and shopping centre ownership interests of around 42 Westfield shopping centres.

With that portfolio, they undertake ownership, development, design, construction, and marketing activities for its centres – effectively a REIT with a hands-on approach.

Scentre Group’s half-yearly financials was a major catalyst for their recent share price growth. Additionally, the 3Q21 operational update released on the 9th of November was a key insight into the business.

Naturally sales in NSW experienced a significant decline during the lockdown, with over 50% of their income originating from the state. Currently 95% of the portfolio is now open, which should allow SCG to return to a more normalised level of operation. Gross rent for the 10-month period to the 31st of October exhibited an increase of $604 million ($1.8 billion total) compared to their prior year.

We like the operational resilience of SCG, especially the way they handled their COVID-sensitive retail segment. Further to this, the redevelopment of Westfield Knox and its Mt Druitt development should accelerate earnings over the medium term as shoppers continue to return to their shopping centres.

Download the full report by clicking the image below.