When conducting strategy research and development, we like to think in terms of what the new strategy will add to our current portfolio of systems. In general, we are looking for one or more of the following factors:

– Additional alpha

– A reduction in volatility

– Exposure to different/more markets (diversification)

– Exposure at different times

We tend to favour strategies that provide the above but also have a robust investment thesis backing them (a repeatable, definable and explainable edge). This reduces our reliance on back testing and possible model overfitting.

One strategy we have recently introduced meets these criteria – introducing ‘Equity Flow’. The strategy offers the Frame Futures Fund additional exposure to a suite of equity index futures markets at specific times of the year where we believe we have an edge.

The investment thesis is simple: Large institutional managers (both active and passive) must adjust their portfolio exposure for inflows and outflows. These adjustments are more likely to happen at certain times of the year. When you combine the scale of the flows, they can be significant enough to move markets in the direction of the flow. By identifying when these periods are, we can take positions in the relevant markets in advance and therefore profit from the resulting market move.

So, how does the strategy look in a back test? With some additional measures to manage risk more actively, we have a strategy that wins approximately 63% of the time, returning 12% per annum with a maximum drawdown of -13%.

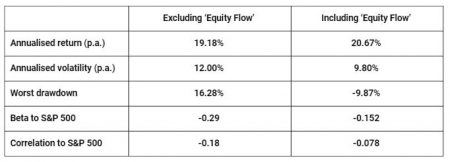

But this is only half the picture. What happens when we introduce the strategy into our current portfolio? Constructing an unleveraged, equally weighted portfolio of all our strategies (including ‘Equity Flow’) we analyse some ‘before’ and ‘after’ performance metrics.

The introduction of ‘Equity Flow’ has both generated additional alpha and reduced volatility. The increased equity market exposure means beta and correlation to the S&P 500 increase slightly.

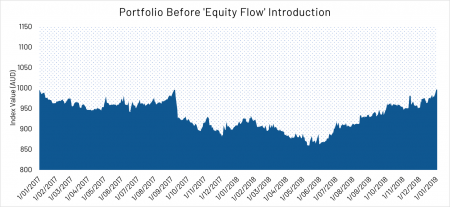

Another benefit is increased returns during periods where the portfolio was weak. Consider the prior portfolio’s performance between 01/01/2017 and 01/01/2019. It was approximately flat for the period with a maximum draw of -14.7%.

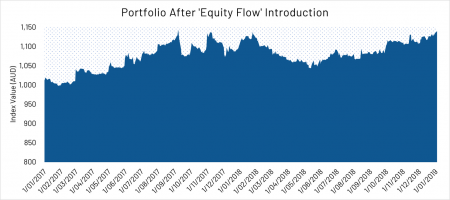

After introducing the ‘Equity Flow’ strategy, however, the portfolio returns 13.6% for the period with a max drawdown of -8.7%, considerably smoothing the returns for the period.

If you would like to discuss any of these points, please email me at hue@framefunds.com.au or call our office at 02 8668 4877.

Download the full report by clicking the image below.