Weekly Update | July 07, 2023

If you’d like to watch, rather than read, please click the image below.

It has been another busy week in the Frame Funds offices, with trading and market research the focus.

Let’s hop straight into five of the biggest developments this week.

1. Swiss PMI m/m falls to 0.1%

The recent interest rates hikes are having a notable impact in restoring price stability in Switzerland. Inflation for the month of June fell significantly from the 0.3% reported in May, lower than the market consensus of 0.2%. The decrease in inflation was helped by a fall in transportation costs and price stability in energy prices.

2. Australia holds interest rates at 4.1%

After successive and sustained rates hikes, the RBA finally sat on its hands to hold interest rates at 4.1%, just as markets had anticipated. This came after tentative signs of thawing inflation in recent reports. The pause left markets uncertain as to whether it marked an end to the RBA’s aggressive tightening cycle or was a temporary hold.

3. US ADP Non-farm payroll surges to 491K

The US labour market is on a roll with no signs of letting off. The economy created 491K jobs in June, a remarkably larger number than the 267K created in May. The massive surge in job numbers was also a major shock to markets which forecasted a jobs number of 226K. This marks the largest payroll figure since July last year.

4. US ISM Services PMI rises to 53.9

The services sector expanded by 53.9% in June, making it the most active sector of the economy by far. It beat last month’s figure of 50.3% and was ahead of markets expectations of 51.3%. The Friday’s data release is a landmark for the sector that has shown growth in 36 of the last 37 reports.

5. US unemployment claims marginally rise to 248K

US unemployment claims remain fairly consistent after reporting 248K, a minor rise from the previous month’s number of 236K. This was an indicator that the labour market remains strong and resilient. This week’s number came in around market expectations of 247K. Once the again the report demonstrates the strength of the labour market, however, may also indicate that rate rises still have further to go.

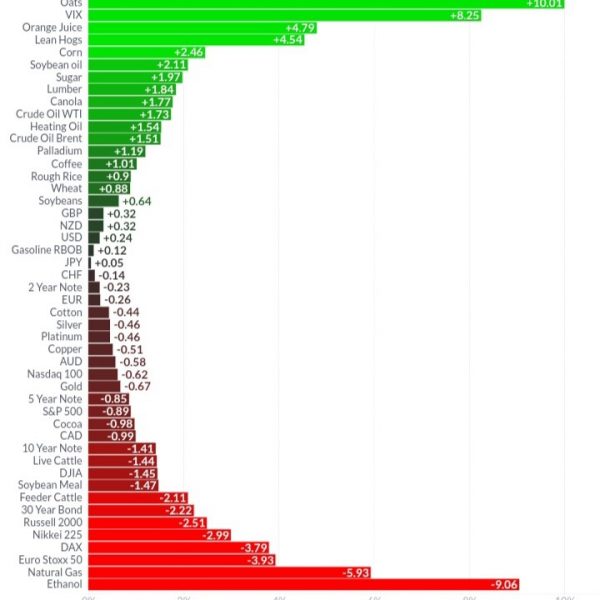

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

In a somewhat subdued week, oats, corn, soybean oil and orange juice traded higher. Continued uncertainty about growing conditions in the US related to oats, corn and soybean oil, while orange juice continued to gradually move higher, as the currency cyclone season has decimated orange farmlands on the East Coast of the US. The VIX rallied aggressively overnight, as equity markets sold off. European, Japanese and US small caps have had a poor week, with the Euro Stoxx 50, Nikkei and Russell 2000 index all down over -2.50%.

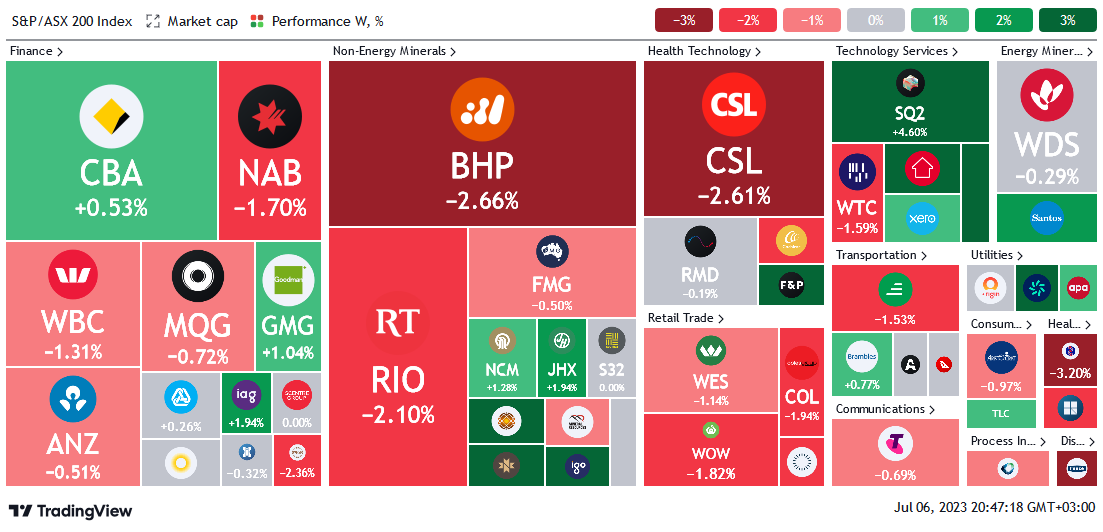

Here is the week’s heatmap for the largest companies in the ASX.

Another mixed week for the ASX, with the number of businesses declining, far outweighing the number rising. Continued concerns around the China slow down, and the path of interest rates, continue to weight on the ASX. Financials posted mixed results with NAB, WBC and MQG leading the selling while CBA and GMG, supporting the market. Miners continued to fall with BHP and RIO leading the way.

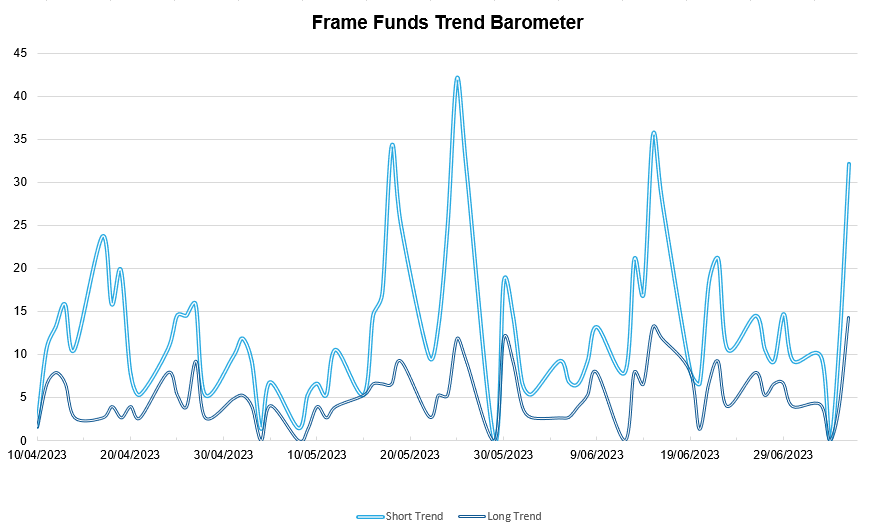

*Historically there is a positive correlation between the number of constituents experiencing both short and long-term trends and the performance of the strategy.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.