Weekly Update | March 8, 2024

Let’s hop straight into five of the biggest developments this week.

1. Switzerland’s CPI soared to 0.6% m/m

Inflation in Switzerland is more endemic and widespread than previously estimated. CPI data for February came in at 0.6%, a substantial rise from the previous 0.2% as well as overshooting the 0.5% market prediction. The inference is that the rise in energy prices is spearheading a resurgence of inflation in Switzerland and Europe in general.

2. US ISM services PMI fell to 52.6 in February

Activity in the crucial US service sector grew slower than economic projections in February. The ISM services PMI receded to 52.6 from the previous 53.4 as well as the 53.0 priced in by market participants. Despite being on a fourteen-month expansion run, the sector appears to be losing steam as high interest rates restrain spending.

3. Canada left interest rates unchanged at 5.00%

The BOC held back from adjusting its monetary policy in a fifth straight meeting, leave its 5.00% overnight rate intact. The decision is premised on the fact that inflationary risk remains high in Canada at a time when weaknesses in the labour market are beginning to emerge. The inference is that the central bank is adopting a wait and see stance to realize the full effects of the current policy framework.

4. Australia’s GDP growth ticked down to 0.2% q/q

Economic growth in Australia slowed in the final quarter of 2023 in line with economic forecasts. GDP data slackened marginally to 0.2 from the previous upward revised figure of 0.3%. This paints a grim picture of the extent to which high interest rates have restrained economic activity.

5. ECB held interest rates steady at 4.5%

The ECB held interest rates static at 4.5%, marking the fourth straight meeting that the central Bank is opting for nonintervention. This was in line with market expectations and points to a lack of any directional shift in monetary policy. The recent re-emergence of inflationary pressure across the EU due to energy vulnerability and price rises has seen the current record rates hold.

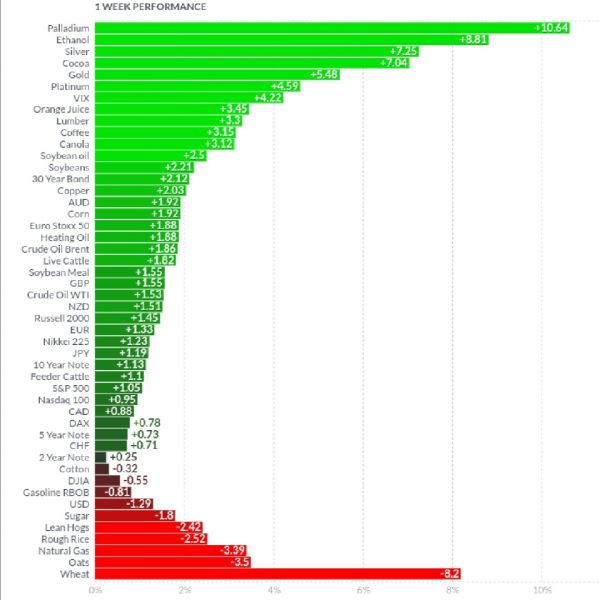

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Precious metals rallied significantly due to supply concerns. Palladium led the charge with a +10.64% rise after the worst labour standoff in recent history in South Africa. Silver, gold and platinum were equally boosted as supply shortfalls clashed with a surge in demand in China. The VIX was elevated on geopolitical risk after Houthi attacks in the Red Sea claimed their first fatalities. Cocoa, ethanol and coffee were up on seasonality as cold weather persisted. The energy complex extended gains on supply chain concerns as well as rising demand in the US to shore up falling inventories. Oats and wheat sold off on oversupply as the new season holds firm.

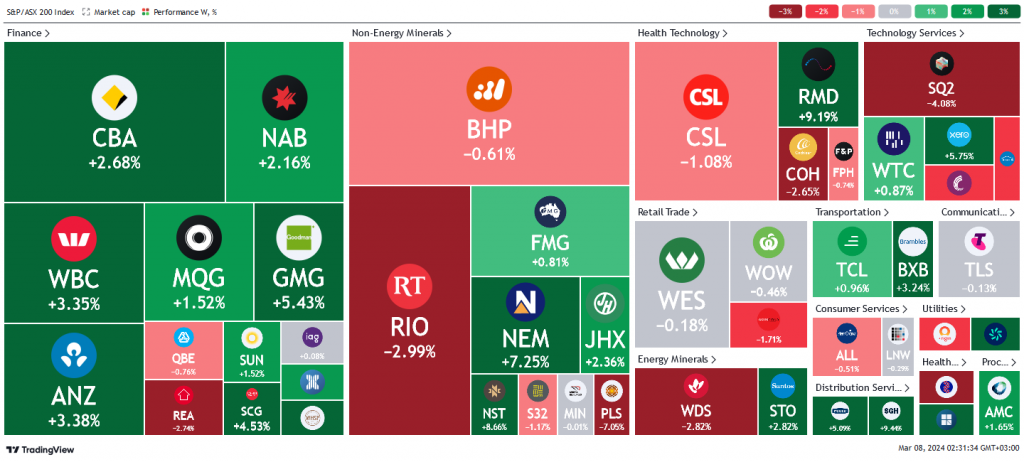

Here is the week’s heatmap for the largest companies in the ASX.

Yet another mixed week for the ASX albeit with bias to the upside. Financial stocks showed most bullish activity with most stocks in the green in reaction to weak growth data that negated prospects for another interest rates hike in the near term. QBE and REA stood out with relative weakness to close >-2.2% down. Energy miners were mixed greatly without clear-cut winners between bulls and bears. NEM and NST were in overdrive, netting +11.71% and 13.3% respectively. On the other hand, PLS was the biggest loser to close – 3.34% down. Healthcare tech, tech services and retailers posted mixed results with inherent variations while transporters and consumers were all green.

Yet another mixed week for the ASX albeit with bias to the upside. Financial stocks showed most bullish activity with most stocks in the green in reaction to weak growth data that negated prospects for another interest rates hike in the near term. QBE and REA stood out with relative weakness to close >-2.2% down. Energy miners were mixed greatly without clear-cut winners between bulls and bears. NEM and NST were in overdrive, netting +11.71% and 13.3% respectively. On the other hand, PLS was the biggest loser to close – 3.34% down. Healthcare tech, tech services and retailers posted mixed results with inherent variations while transporters and consumers were all green.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.